NAB survey indicates pullback in foreign buyers: CoreLogic's Cameron Kusher

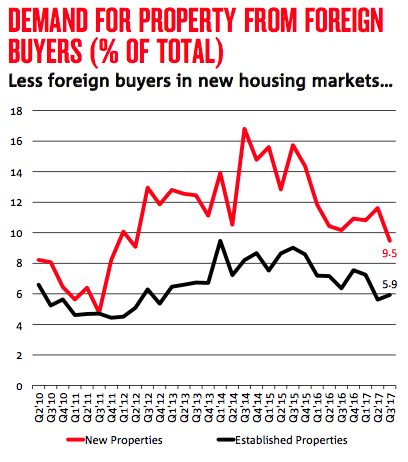

Regulatory moves to tighten lending to foreign buyers seem to be working, with their share in new property markets falling to a five-year low 9.5%, according to a NAB index.

However, the share of foreign buyers edged up to 5.9% in established markets, albeit still near four-year lows.

The figures are part of NAB’s Residential Property Survey for the quarter ended September.

The data was cited by CoreLogic’s head of research Cameron Kusher.

“NAB's quarterly residential property survey indicates that there has been a big pullback in foreign demand for residential property,” Kusher tweeted.

NAB’s note had said that “we have maintained our view for more muted market performance going forward, particularly following our revised expectations for RBA rate hikes which have been brought forward to mid-2018 (from H2 2019)”.

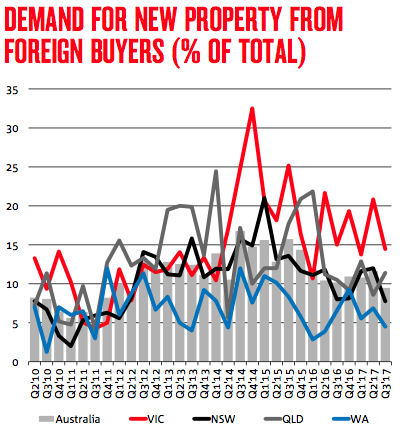

Victoria had the lowest foreign buying activity in new property markets, where the share of sales to foreign buyers fell to 14.4% (20.8% in Q2).

Foreign buyers were also noticeably less prevalent in NSW, where their market share fell to 7.8% - its lowest level since Q1 2012 and down from 12.0% in Q2. The proportion of foreign buyers in new property markets also fell in WA to 4.5% (6.9% in Q2). In contrast, foreign buyers increased their market share in Queensland to 11.4% (8.6% in Q2) despite the introduction of a foreign investor land tax surcharge in July 2017.

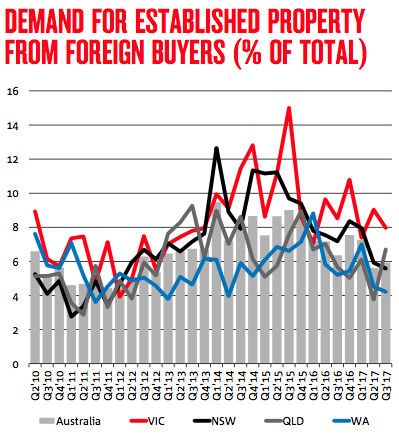

In established housing markets, the overall share of foreign buyers rose a little from 5.6% to 5.9% in Q3, but remained anchored at near 5-year lows.

Foreign buyers accounted for a smaller share of sales in Victoria (8.0% in Q3 vs. 9.0% in Q2), NSW (5.6% vs. 5.9%) and WA (4.2% vs. 4.5%).

In Queensland, however, they accounted for 6.7% of established property sales, up from 3.8% in Q2.