July conditions elevated, confidence lifts: Andrew Hanlan

GUEST OBSERVER

The NAB business survey reported that business conditions remained elevated in July and that business confidence increased. The survey was conducted from July 25 to 31.

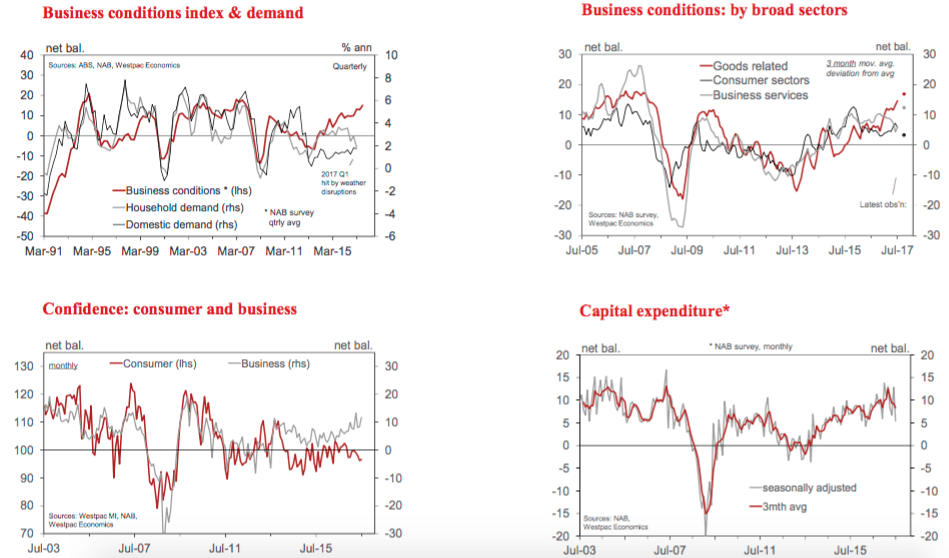

In July, the conditions index rose 1pt to +15. This is well above the long-run average for this series, of +1 (dating from 1989), but below the highs of 2007 ahead of the GFC.

The components of business conditions for July were: trading conditions down 1pt to +20; profitability up 4pts to +18; and employment conditions held onto earlier gains, steady at +7.

Business confidence moved higher, up 4pts to +12. Business confidence has improved since 2016, mirroring the global trend, and is at above average levels, although it continues to trail actual conditions.

How to interpret the survey?

The elevated level of the business conditions index is overstating actual conditions across the broader economy, as it has tended to do since the GFC.

Directionally, the survey suggests that the Australian economy is experiencing a trend improvement in underlying conditions after the slowdown in mid-2016, associated with the July Federal election.

The official data was mixed early in 2017, impacted by weather disruptions. More recently, partial indicators have improved (retail sales, exports, jobs), lending support to our view that the economy will rebound in 2017 from these temporary disruptions, although consumer spending is likely to be constrained by weak wages growth.

On employment growth, the previously weak official data has fallen into line with the positive signal from the private business surveys, meeting our expectations. The survey suggests that the recent trend improvement in employment will be sustained in coming months.

On investment, the outlook is less certain, with the survey’s capex measure pulling back in July.

By industry, a strengthening of conditions in 2017 relative to 2016H2 is evident in: construction; manufacturing; and mining. Construction has strengthened on an upswing in public investment; a lift in commercial building; elevated home building activity (ahead of a 2018 downturn); and the waning of the mining investment drag. Mining is enjoying better cash flows associated with higher commodity prices. Manufacturing is benefitting from strength in construction, mining, agriculture and the lower AUD. Positive spillover effects are also evident in wholesale and in transport & utilities.

Retail conditions reportedly dipped in July, possibly in part due to a mild winter, with Sydney experiencing its 2nd warmest July on record. Official data reports that real retail sales jumped in Q2, up 1.5%, after a weather disrupted 0.2% gain in Q1. The uncertainty is around the strength of consumer spending over the second half of 2017 and beyond.

By state, business conditions for July are positive in all states, with the exception of WA. Trend conditions are most favourable in the major non-mining state of NSW and Victoria. In NSW conditions jumped in July, to +22, possibly in part due to unseasonably mild and dry weather conditions. Looking through month to month volatility, the improvement in overall conditions between 2016H2 and 2017H1 is largely driven by the mining states of WA and Qld, as well as SA.

Andrew Hanlan is senior economist for Westpac and can be contacted here.