"Stunning" August jobs data as employment rose 111,000: CommSec

EXPERT OBSERVER

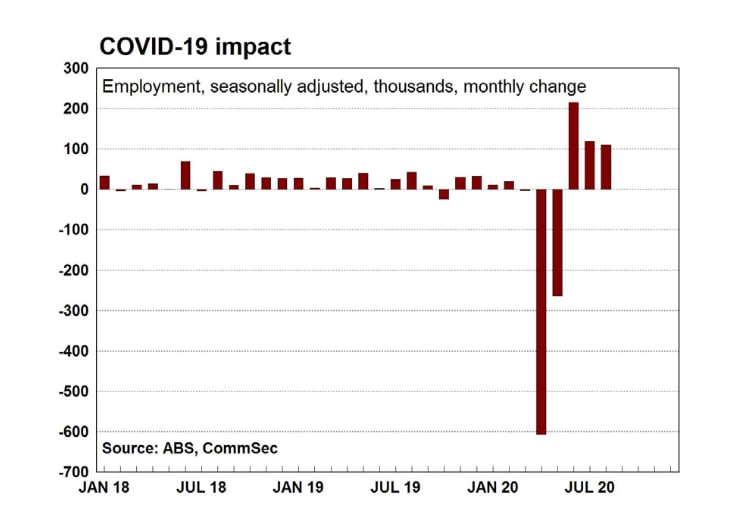

Employment rose by 111,000 in August (survey forecast: -35,000) after rising by an upwardly-revised 119,200 jobs in July (previously reported as an 114,700 increase in jobs). Full-time jobs rose by 36,200 and part-time jobs rose by 74,800.

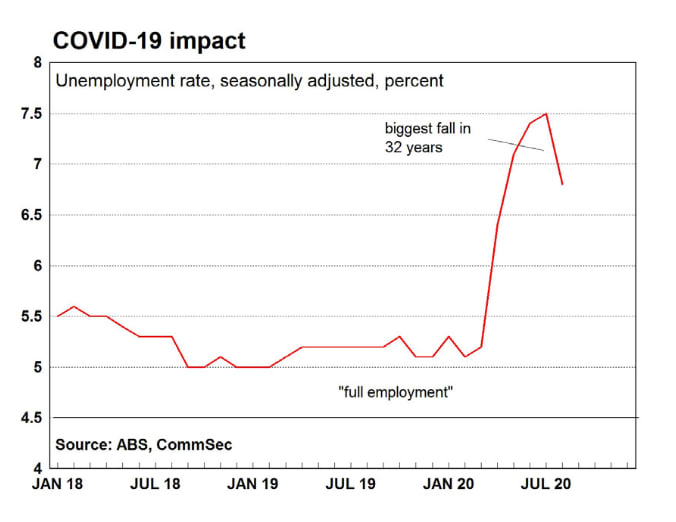

The unemployment rate fell from a 22-year high of 7.5 per cent to 6.8 per cent in August (survey forecast: 7.7 per cent). It was the biggest monthly fall in the jobless rate in 32 years (July 1988).

Hours worked rose from 1.682 million hours to 1.683 million hours (up 0.1 per cent) but were down 5.1 per cent over the year.

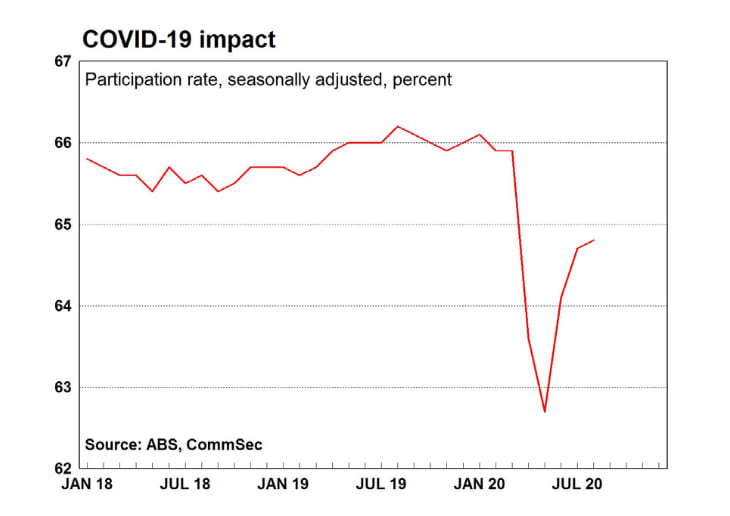

The participation rate rose from 64.7 per cent to 64.8 per cent in August.

In August, the underutilisation rate fell from 18.7 per cent to 18.0 per cent. The underemployment rate was broadly steady at 11.2 per cent.

Unemployment across states in August: NSW 6.7 per cent (July 7.2 per cent); Victoria 7.1 per cent (6.8 per cent); Queensland 7.5 per cent (8.8 per cent); South Australia 7.9 per cent (7.9 per cent); Western Australia 7.0 per cent (8.3 per cent); Tasmania 6.3 per cent (6.0 per cent); Northern Territory 4.2 per cent (7.5 per cent); ACT 4.2 per cent (4.6 per cent).

In August 2020, all states and territories recorded increases in the number of employed people except for Victoria. The number of employed people in Victoria decreased by 42,400. In contrast, New South Wales recorded an increase of 51,500 employed people and there was an increase of 32,200 employed people in Western Australia.

Over the three months to August 2020, all states and territories recorded increases in the number of employed people, led by gains in NSW (+188,100), followed by Queensland (+90,300), Western Australia (+73,400), South Australia (+33,400), Tasmania (+15,800), ACT (+11,900), Victoria (+9,500) and Northern Territory (+2,800).

A raft of companies is affected by the employment data but especially those dependent on consumer spending.

What does it all mean?

There is no doubt that this is a stunning set of job figures – especially considering that nation’s second largest economy was in lockdown throughout the month. More people were looking for jobs in August, more people found jobs, and more employees reconnected to their workplaces. The jobless rate fell sharply and a six-digit gain in jobs was recorded.

More than 86,000 unemployed people found work. The cherry on top was a drop in the youth jobless rate from 16.3 per cent to 14.3 per cent. The job programs are clearly working as intended.

JobKeeper and JobSeeker have been instrumental in supporting the job market, spending and the broader economy. But the programs have made it more difficult in working out what is going on, specifically in the job market. But these are extraordinary times and the job programs are similarly remarkable.

There will still be bumps on the road ahead. But the federal, state and territory governments, Reserve Bank, unions and businesses can all claim credit for today’s stunning job figures.

However the hope is that the unemployment rate will now peak well below official forecasts of near 10 per cent. In fact, for this to occur at least 400,000 jobs would have to be shed by year-end – unlikely with Victoria’s restrictions being eased. And the aim has to be to be quickly get people back in jobs because the longer that people are out of work, the less employable they become.

The data shows a return to work of sole traders but fewer job gains for employees. That makes sense in that the economy is still only gradually re-opening. But it is an encouraging trend.

Australia may be technically in recession like most of the globe, but it continues to be a non-typical recession. Consumer spending continues to rise as Kogan confirmed yesterday. Home prices are rising in many parts of the country.

Home sales are lifting, underpinned by HomeBuilder. And infrastructure projects support commercial and engineering construction sectors. Despite tensions with China, our largest trading partner is hoovering up record volumes of iron ore and gold exports are expected to hit record highs, courtesy of pandemic demand.

The latest job data coincides with more data on job ads from SEEK, showing (ex-Victoria) another 1.8 per cent lift in vacancies in August.

What do the figures show?

Labour force – August

Employment rose by 111,000 in August (survey forecast: -35,000) after rising by an upwardly-revised 119,200 jobs in July (previously reported as an 114,700 increase in jobs). Full-time jobs rose by 36,200 and part-time jobs rose by 74,800.

The unemployment rate fell from a 22-year high of 7.5 per cent to 6.8 per cent in August (survey forecast: 7.7 per cent).

Hours worked rose from 1.682 million hours to 1.683 million hours (up 0.1 per cent) but were down 5.1 per cent over the year.

The ABS noted: "Employment rose almost 1 per cent but hours worked rose by a more modest 0.1 per cent. Hours fell by 4.8 per cent in Victoria, compared to a 1.8 per cent increase across the rest of Australia.”

The weaker increase in hours worked has also been reflected in the strength of the increase in part-time employment between May and August, which has been almost eight times greater than the increase in full-time employment.”

The participation rate rose from 64.7 per cent to 64.8 per cent in August.

In August, the underutilisation rate fell from 18.7 per cent to 18.0 per cent. The underemployment rate was broadly steady at 11.2 per cent.

Unemployment across states and territories in August: NSW 6.7 per cent (July 7.2 per cent); Victoria 7.1 per cent (6.8 per cent); Queensland 7.5 per cent (8.8 per cent); South Australia 7.9 per cent (7.9 per cent); Western Australia 7.0 per cent (8.3 per cent); Tasmania 6.3 per cent (6.0 per cent); Northern Territory 4.2 per cent (7.5 per cent); ACT 4.2 per cent (4.6 per cent).

In August 2020, all states and territories recorded increases in the number of employed people except for Victoria. The number of employed people in Victoria decreased by 42,400. In contrast, New South Wales recorded an increase of 51,500 employed people and there was an increase of 32,200 employed people in Western Australia.

Over the three months to August 2020, all states and territories recorded increases in the number of employed people, led by gains in NSW (+188,100), followed by Queensland (+90,300), Western Australia (+73,400), South Australia (+33,400), Tasmania (+15,800), ACT (+11,900), Victoria (+9,500) and Northern Territory (+2,800).

ABS: “The participation rate for 15-24 year olds (who are often referred to as the "youth" group in the labour market) decreased 0.3 pts to 65.7% in August 2020. Employment for 15-24 year olds increased by 28,800 people (1.6%). The unemployment rate for this group decreased by 2.0 pts to 14.3%.”

The ABS highlighted the gains in jobs by sole traders: “In original terms, there was a 44,500 net increase in employment between July and August. This growth in original employment can be attributed to an increase in the number of owner managers (self-employed people) without employees, most of whom working in an unincorporated enterprise (e.g. a sole trader), which increased by 50,200 (Chart 1). In contrast, there was minimal growth in the number of employees (up 2,600).”

What are the implications for investors?

Australia continues to do well. The ABS notes that the US jobless rate was 8.4 per cent in July and the jobless rate was 10.2 per cent in Canada. Estimates for Australia on a similar basis were 7.3 per cent and 7.9 per cent.

The “effective” rate of unemployment is estimated at 9.3 per cent, so there are no grounds for complacency.

The resilience of the Aussie job market continues to provide support for retailers and the housing market. While challenges lie ahead, many retailers have adapted well to the new environment, especially the focus on online sales.

Aussies need to collectively take a deep breath ahead of the wind down of JobKeeper and JobSeeker schemes over the next six months. The hope is that stronger operating conditions and reduced support payments will encourage workers to re-join the job market. Today’s virus case numbers in Victoria also offer reasons to be positive.

As noted Australia continues to do well, but challenges lie ahead. Note other data today showed the New Zealand economy contracting by 12.2 per cent in the June quarter – much more than 7 per cent Aussie decline. Getting the right balance between health and economic issues will be critical in the months ahead. NSW is showing the way with the most jobs created or reinstated in the past three months while keeping its borders open for business and implementing effective virus testing and tracing to keep the virus in check.

CRAIG JAMES is the chief economist at CommSec.