My basic investment philosophy

Someone asked me last week if I am "bullish on property?".

It's a bit of wild concept if you think about it.

At the last count there are around 9,300,700 dwellings in Australia, and the vast majority of them I wouldn't invest in.

There are a huge number of areas that I would consider to be extremely risky, in fact, including a whole range of mining towns and regional centres, and even some larger cities with weak population growth and job markets.

My position always been that if you can demonstrate a certain level of skill and invest in the right suburbs and property types you can make a lot of money, but I wouldn't say that makes me bullish on housing per se.

In Britain, London and its surrounds has been the only area worthy of investing for my money over all the years.

In Australia, I generally stick to certain suburbs in Sydney.

In 2007, that meant a number of key suburbs in the inner west, and even then only certain types of property.

Last year we were buying on the lower north shore, but again only in a handful of suburbs and certain types of property.

At the weekend, the lower north recorded another blistering auction clearance rate of 92%.

I wouldn't get too bogged down in the weekly conspiracy theories about under-reporting: just look at the actual results reported in suburbs like Kirribilli, Wollstonecraft, Cremorne and Neutral Bay.

The lower north shore is now absolutely flying!

We expect to see Milsons Point and Waverton outperforming in 2014 too.

We try to avoid buying in heated markets, however, so we may leave the hordes to the auction frenzies at ever-higher prices now, and look elsewhere.

Next on our hit-list will include three suburbs in particular to the west and south-west, a little further out than the traditional capital growth hotspots, in order to catch the ripple effect of capital growth which is repeated in most property market cycles.

March property prices

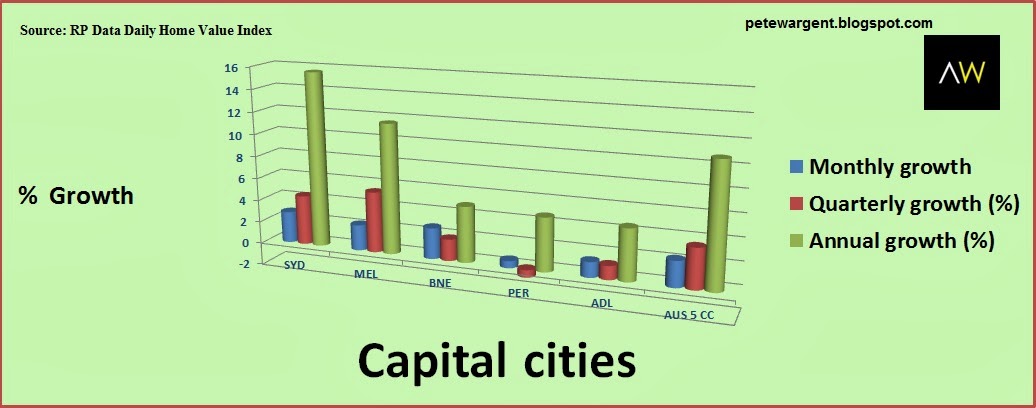

RP Data will released its property price results for the month of March, which unsurprisingly will continue to report very strong gains in Australian capital cities (+2.3%) for the 10th month in a row.

Leading the way, of course, were Sydney (+2.8%) and Melbourne (+2.3%), although in fact gains were recorded everywhere in March.

Over the past 12 months, the best performing capital city has continued to be Sydney, and the worst, perhaps not surprisingly given its weak jobs market and low population growth, Adelaide.

Philosophy

Like most people, my investment philosophy has changed a bit over time, but the basic principles remain the same.

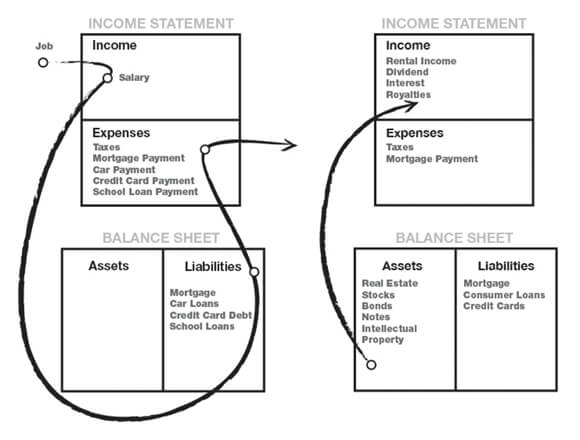

About a decade and a half ago, Robert Kiyosaki wrote a book, Rich Dad Poor Dad, which showed a diagram something like the one below which demonstrates the difference between the typical financial profile of a salary earner (lots of expenses, lots of liabilities) and that of an investor (fewer expenses and lots of income-producing assets).

My basic philosophy is to think of investment as being like a snowball, compounding and growing its income and capital appreciation year after year, for as long as I live.

Spending less than you earn and investing the difference was a real "aha!" or "light bulb" moment for millions of people around the globe. Kiyosaki sold 26 million copies of that book alone and went on to build a substantial business empire from this one very simple core idea.

Concept: Robert Kiyosaki

Kiyosaki's point was that investors should try to avoid getting into bad debts (credit cards, car loans, school loans etc) and instead load up the asset column with your business, real estate and stocks.

My one simple big idea

Like many people I've experimented with a few different approaches, including trading or buying speculative stocks. These days I have stripped back my investment philosophy to keep it as simple as humanly possible. My one simple ideas as it relates to my investment philosophy is this:

I want every single dollar I invest to still be going out to work for me if I live to be 110 years old.

That's my basic philosophy, to think of investment as being like a snowball, compounding and growing its income and capital appreciation year after year, for as long as I live.

What to invest in?

So what assets to invest in to achieve that goal?

You can spend a lot of time analysing companies and still get it wrong. The simplest method for most average investors might be to pick out some diversified Listed Investment Companies (LICs) which have a proven track record of increasing their profits and dividends for decade after decade after decade.

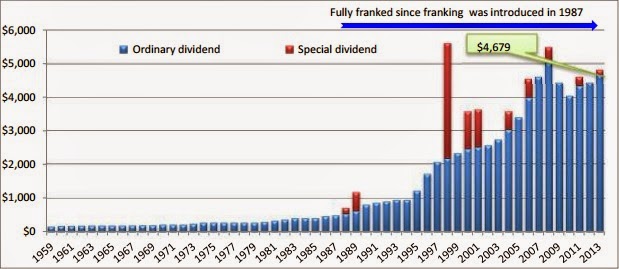

I don't recommend individual stocks for others to invest in. You have to pick companies which suit your own risk profile. But this is the kind of chart that I look for:

Source: WHF Annual Report 2013

If a company can achieve this type of result with its bottom line profits with its and franked dividend payments then the share price will likely take care of itself over time. Through investing in these types of diversified companies your dollars can go to work for you from now until... forever.

You don't even need to know what the wires do, although of course, you can lift the cover plate and see what the inner workings are up to if you so desire.

Source: ARG Annual Report 2013

Companies may in theory be perpetual but, surprisingly, many of them come and go. How much more re-assuring it is to be invested in a company which holds 100-120 top companies and trusts? Even if one of the companies held experiences a huge corporate fraud or failure, the investor should not be hurt too much. I covered in more detail why I like LICs here.

Real estate

I apply very similar principles in property investment. I want to invest in cities which will still be thriving if I live to be 110 years old. That means that for the core of my portfolio, I tend to steer away from small regional cities or one-industry towns.

It's no coincidence that my company has offices in London and Sydney, by the way, for those are two cities with tremendously strong fundamentals for the long-term.

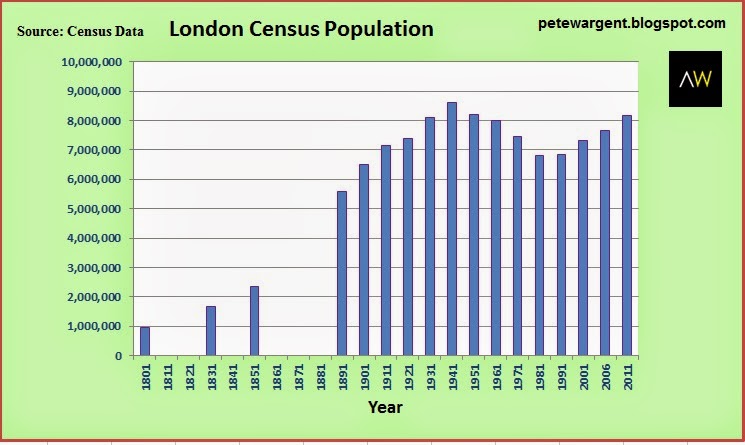

Knight Frank reported yesterday that London prices are up by 68% in the last five years since March 2009. How on earth, and why on earth, is that happening?

It's partly because of desperately inadequate construction. Parts of the market are desperately undersupplied and the activity in the market resembles a feeding frenzy at the moment.

It's also because in recent times, there has been a tremendous shift of funds towards residential real estate as a store of wealth, but only in certain key global cities. It's fairly obvious why prices have been growing when you consider this chart.

Centuries ago we had wars, plagues and even a Great Fire, and from the Second World War through to 1991 the city population declined for five consecutive decades as the city de-industrialised and went through a process of slum clearance and suburbanisation.

Since 1991, London has been busy establishing itself as a major financial centre, and international migration combined with an economic boom has seen the population explode from 6.4 million to above 8.1 million. London's population has been increasing at twice the speed of that of the rest of the UK and is expected to surpass 9 million by the end of this decade.

Importantly, the population in inner London has often been expanding at the same percentage rate as that of the Greater City of London, despite the limited availability of land. I don't worry too much what the talking heads in the press consider likely to happen this year or next. I just know that over the decades, London property will continue to represent an absolute no-brainer.

As a newer city, Sydney has not been through such a rollercoaster ride: the population trend is simply up, up, up and away.

The below is a dated population projection from the Bureau of Statistics. More recent data suggests that the estimates have been under-cooked and that Sydney's population could rise much more rapidly still than this (click chart) to around 8 million by 2050, instead following the trajectory of the red line (click chart).

So much energy is diverted towards what might happen to prices in the next 12 months, but as an investor, inactivity can actually be your greatest friend.

As for the flow of international funds, well let's be blunt: this will have very little (if any impact) on regional centres. The impact will be felt most keenly in inner Sydney where land is scarce, and inner Melbourne.

Through owning properties in suburbs where the supply is fixed you can be assured that your dollars you invested in investment properties will still be out there working for you for decades and decades to come. And more comforting still, the nature of compound growth means that they gains just get better and better over time.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His new book 'Four Green Houses and a Red Hotel' is out now.