Million dollar sales reach record levels: Cameron Kusher

GUEST OBSERVER

The cost of housing continued to rise across most parts of the country over the past 12 months.

Bracket creep should come as no surprise in markets like Sydney and Melbourne where dwelling values have increased by 77% and 61% respectively over the past five years.

While Sydney and Melbourne dominated as the two capitals with the highest proportion of sales at at least $1 million, most other capital cities and regional areas also enjoyed a proportional lift in home sales over the million dollar mark.

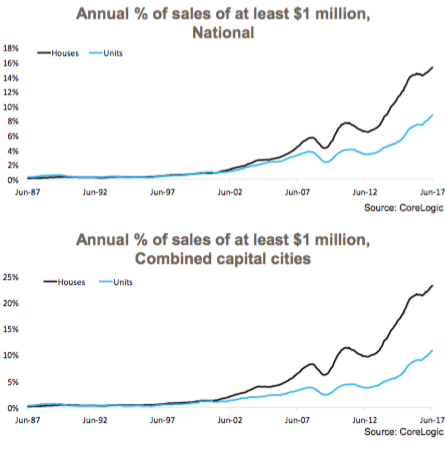

The CoreLogic analysis confirmed that over the 12 months to June 2017, 15.4% of all house sales and 8.8% of all unit sales nationally were at a price of at least $1 million. By comparison, 12 months earlier 14.4% of all house sales and 7.5% of all unit sales were at least $1 million in value.

The latest data shows that instances of dwellings selling for at least $1 million is much more prevalent across the combined capital cities. Over the 12 months to June 2017, 23.2% of all houses and 10.8% of all units sold in capital cities were sold for at least $1 million. The proportion of sales of at least $1 million has increased over the year from 21.5% of houses and 9.1% of units.

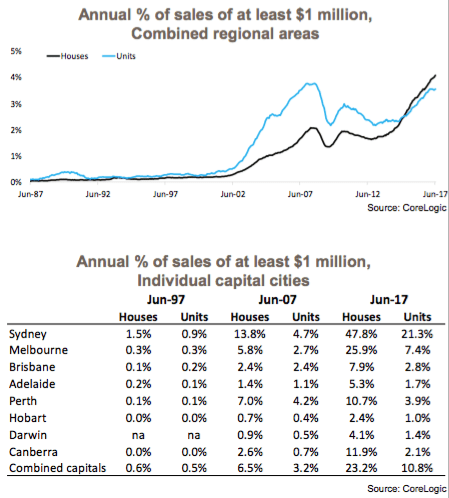

While regional housing markets generally have lower housing costs than capital cities, the proportion of sales occurring for at least $1 million is also increasing in these areas. Across the combined regional areas the proportion of houses selling for at least $1 million has increased from 3.5% in June 2016 to 4.1% in June 2017. Meanwhile, the proportion of units selling for at least $1 million has increased to 3.5% of all sales in June 2017, up from 3.2% a year earlier.

Delving into the individual capital cities, and not surprising, Sydney and Melbourne have had substantially more properties sell for at least $1 million over the past year than any other capital cities.

Over the past year, 47.8% of all houses and 21.3% of all units sold in Sydney transacted for at least $1 million. By comparison, 10 years earlier just 13.8% of houses and 4.7% of units transacted from at least $1 million over the year.

In Melbourne, more than a quarter (25.9%) of house sales and 7.4% of unit sales were at least $1 million in value. By comparison, ten years earlier 5.8% of house sales and 2.7% of unit sales over the year were at least $1 million.

In all of the other capital cities the proportion of houses selling for at least $1 million is higher than it was a decade ago. More than 10% of house sales over the past year in Perth and Canberra were at least $1 million in value. Perth is also the only city to have recorded a lower proportion of unit sales of at least $1 million over the 12 months to June 2017 compared to a decade earlier.

With dwelling values continuing to climb, we anticipate that in another 12 months we’ll see an even higher proportion of sales sitting at or above $1 million.

The flip-side to this is that the ongoing increase in the proportion of residential properties selling in excess of $1 million highlights the ongoing deterioration in the availability of housing affordability.

Although the Federal Government attempted to address housing affordability in the Budget this year, it is clear that in order to improve housing affordability there is much more work to be done on both supply and demand drivers of the market.

Cameron Kusher is research analyst for CoreLogic. You can contact him here.