APRA shrugged? Investments loans up 21 percent: Pete Wargent

Pete WargentJanuary 17, 2017

If it seemed that the big capital city housing markets were strengthening into Christmas then so it was, with a massive 4.9 percent jump in investment loans to a 17-month high of $13.3 billion, up 21.4 percent from a year ago in seasonally adjusted terms.

It never pays to get too excited about month to month changes, but even with the ABS drilling its trend line through the figures it's clear than investors were resurgent.

Total housing finance increased by 2.2 percent in the month to a strong $32.7 billion.

Ex-refinancing, the number of owner-occupier loans picked up in the month, but the real story is the huge flip back to investment loans.

Average loan sizes are now clearly trending up again, having been knocked back by the first salvo of macroprudential measures to curb investor lending.

In the owner-occupier markets, Melbourne and to some extent Queensland are seeing strong mortgage volumes for owner-occupiers.

The number of first homebuyer loans jumped from 7,302 to 8,281 in November in original terms, but overall it's a tough environment for first homebuyers in Sydney (which in part accounts for why so many are turning to investment property as a first purchase).

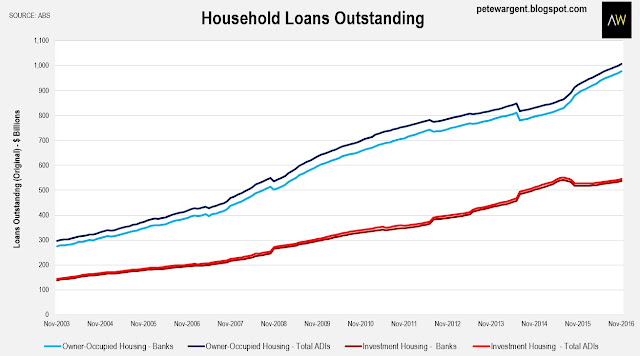

The wrap - $1 trillion of home loans

Investment loans increased for the sixth time in seven months, and this one was a big leap, taking the year-on-year increase to above 21 per cent, the highest such percentage increase since the peak of the Sydney boom in Q2 2015.

In part thanks to net loan reclassifications and some cases of 'switching' of loan purpose, the stock of outstanding investor loans increased by only 3 per cent over the year to November.

Owner-occupier loans outstanding on the other hand surged by more than 9 per cent to pass $1 trillion.

Regardless of the blurred classification of outstanding credit, the key takeaway is that investors were pouring back into the market in late 2016, particularly in Sydney and Melbourne,

I'll look as those investment loans in more detail and by state.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.