More to Tasmania than Hobart as Launceston also thrives: Terry Ryder

Most property-watchers are aware of the Tasmanian property boom, with attention focused on Hobart as the national leader for capital city price growth, for suburbs with the shortest time-on-market and for the nation’s lowest vacancy rates.

But there’s more to the Tassie story than Hobart. The second city Launceston is also thriving.

Launceston has seen good price growth in the last 12 months, with double-digit increases in the median house prices of several suburbs. This market also features vacancies below 2% and strong rental yields above 5.5%.

And the future looks strong, starting with the underlying economy – always pivotal in the fortunes of property markets.

The Launceston City Deal, financially supported by all three levels of Government, has secured Launceston’s future as a “University Town”.

Under the plan, Launceston will be the recipient of serious spending on infrastructure for industries such as education, construction, the Defence Force, transport and forestry. Launceston General Hospital is being upgraded, new industrial estates are emerging and new housing estates are opening up.

In the 2016 Census, the population of Launceston was 81,000. Other reports suggest around 100,000 live in and around Launceston.

It is one of Australia’s oldest cities and is home to many historic buildings, including the General Post Office. It’s the commercial hub for northern Tasmania’s agricultural and pastoral activities which, in recent years, have evolved from the growing of apples to viticulture.

Wool is also an important industry while $130 million has been spent on the Meander Dam and irrigation infrastructure to support the agricultural sector.

Launceston has a diverse range of industries, including manufacturing, minerals and resources, commercial shipping, tourism and educational facilities.

Human pharmaceuticals manufacturing earns the region about $130 million each year. Tasmanian Alkaloids, located near Westbury, is the largest exporter of opiates from which codeine and morphine are derived. The company employs 200 local people.

Premium beer drinkers will be familiar with the name James Boag. The Brewery employs around 150 and produces 76,000,000 litres of beer annually.

Manufacturing makes the largest contribution to the local economy, earning over $1 billion per year. George Town Seafoods announced in April 2016 that it will double production at its processing facility. The business employs 70 people in peak production periods.

The Bell Bay Aluminium smelter, about 45km from Launceston, is one of the state’s biggest employers claiming 1,500 direct and indirect jobs.

Tourism employs 2,500 and is worth $340 million a year to the local economy. Around 1.29 million passengers used Launceston airport in 2015, and following a redevelopment completed in mid- 2016, the airport expects to cater for two million passengers each year by 2030.

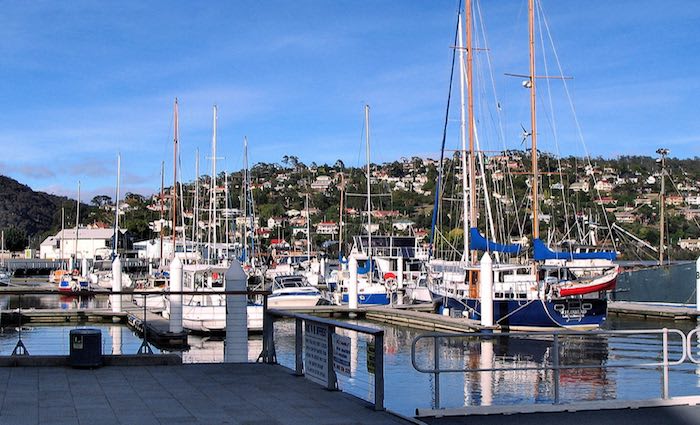

Numerous wineries operate along the Tamar Valley which produces about 40% of Tasmania’s premium wines. Another main attraction is Cataract Gorge, home to the longest single span chairlift in the world while Launceston is often called the ‘Garden City’ because of its many parklands.

Launceston Airport offers regular flights to Melbourne (where travellers can connect with international flights), Sydney and Brisbane.

Launceston is now one of the leading property markets in regional Australia, attracting mainland investors. The city features prominently in The Price Predictor Index published by hotspotting.com.au, as it has several suburbs with growing sales activity, while the nearby West Tamar LGA also has growth markets.

Affordable Invermay (median house price $248,000) typifies the growth in this region, the number of annual sales leaping from 64 in 2017 to 99 early in 2018.

The increased sales activity has delivered a median price rise of 8% in the last 12 months.

On the other side of the North Esk River, the inner- city of Launceston has seen the median house price grow 23%, resulting in a median price of $449,000.

The median house price in Newstead, another inner- city suburb with 121 annual sales, has risen 13% to $365,000, while Norwood is up 13% to $348,000. Further out, the median house price in Hadspen is $315,000 following a 14% rise in 12 months.

Interstate buyers have become common, attracted by the state’s affordability, combined with positive developments in the city.

Agents have reported that about 30% of buyers in Launceston hail from Sydney - and many intend to move to Launceston rather than buying for investment purposes.

Terry Ryder is the founder of hotspotting.com.au

twitter.com/hotspotting