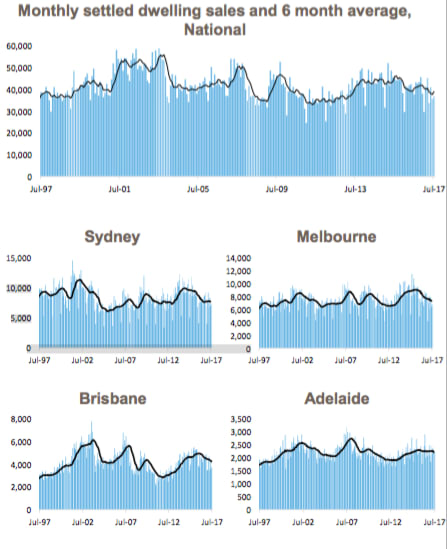

Number of dwelling sales starting to trend higher

GUEST OBSERVER

At a national level, the six month average trend shows that the number of dwelling sales is starting to trend slightly higher.

Of note is that settled sales peaked all the way back in July 2003, a time at which the population was around 4.7 million lower than it is currently.

While the national population increased by almost 4.7 million persons between June 2003 and December 2016, a commensurate lift in transactions has not occurred.

This is likely due to a number of reasons including the impost of stamp duty which discourages transactions, higher prices which lead to greater commission on sales and no real incentives for people to downsize homes when their children leave or they reach retirement.

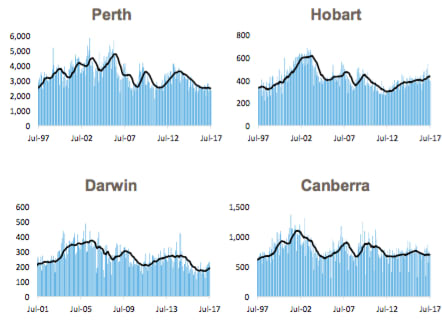

Across the individual capital cities the number of sales and the transaction trends are somewhat mixed.

Sydney – annual sales volumes are -0.9% lower year on year however, they have been trending higher from a recent low in April 2017.

Melbourne – transaction volumes are slightly higher than their recent low however, annual settled sales are -7.6% lower than they were over the 12 months to July 2016.

Brisbane – annual sales volumes are -9.7% lower over the past year and the number of transactions is clearly continuing to trend lower across the city.

Adelaide – over the past year, the number of sales throughout the city was only -0.9% lower than over the previous year and the trend data indicates fairly stable transaction volumes.

Perth – settled sales are substantially lower than their peak and annual sales have fallen by a further -1.1% over the past year however, monthly data points to a recent stabilisation in transaction activity.

Hobart - the city has seen a substantial lift in transactions over the past 12 months with annual sales 10.9% higher over the past year.

Darwin – on an annual basis, sales volumes have increased by 10.7% and they have shifted higher off an historic low base.

Canberra – settled sales are slightly lower over the year, down -1.4% however, there has been a moderate lift in transactions recently.

The settled sales insights highlights that although some regions are seeing transactions rise they remain well down on historic high levels.

The relatively lower volume of transactions across markets experiencing positive population growth highlights the ongoing inefficiencies in the housing market which discourage transactions.

These inefficiencies (detailed earlier) also have an economic impact as the high cost of exiting and entering the housing market is likely to impact on labour mobility as home owners may choose not to move for employment because of these high costs.

Note: Property transaction are an important component of the housing market, particularly for participants such as real estate agents and mortgage brokers that rely on turnover for their commission. Furthermore, transactions are an important source of stamp duty revenue for state governments.

It is important to note the way in which property transactions are recorded. All data is based on settled sales which means off-the- plan sales are counted once the property settles. Upon settlement, which can be several years after the contract date, off-the-plan sales are recorded at their contract date which means recent years of sales will be subject to revision.

Cameron Kusher is research analyst for CoreLogic. You can contact him here.