Australia’s rate of population growth continues to slow: Cameron Kusher

The Australian Bureau of Statistics (ABS) released demographic data for the December 2014 quarter yesterday. The data highlighted a continuing slowdown in the rate of national population growth, with the quarterly increase now lower than slump in population growth recorded during the GFC. In particular the mining states and territories are recording the biggest slowdown in population growth fueled by a slowdown in both interstate and overseas migration.

The data showed that throughout 2014 Australia added another 330,202 persons. Although this is still a relatively high rate of population growth, it is the lowest annual increase in population since the population increased by 327,637 persons over the 12 months to September 2011. Over the final quarter of the year the national population increased by 64,010 persons which was its lowest quarterly increase since June 2006 (52,834).

At a national level population growth is comprised of overseas migration (arrivals minus departures) and natural increase (births minus deaths), any interstate migration is neutral at a national level. Over the past year, the country experienced a natural increase of 146,067 persons and net overseas migration of 184,135 persons. The rate of annual natural increase is at its lowest level since December 2006 (139,793) and annual net overseas migration is at its lowest level since June 2011 (180,372). On a quarterly basis, natural increase was recorded at 36,517 persons (its lowest level since December 2006) and net overseas migration was recorded at 46,034 persons (its lowest level since June 2011).

With the national population increasing by 330,202 persons over the past year, the majority of population growth has taken place in the largest states. NSW (31.2%) and Vic (30.7%) accounted for a combined 61.9% of national population growth. If you add Qld (19.4%) and WA (12.1%) the four largest states accounted for 93.5% of national population growth over the year.

As far as the rate of population growth goes, for the first time since September 2006 WA is no longer the state with the most rapid rate of population growth with Vic taking over the mantle. Vic’s population increased by 1.8% over the year followed by: WA (1.6%), NSW and Qld (both 1.4%), ACT (1.1%), SA (0.9%), NT (0.4%) and Tas (0.3%). Qld, WA and NT in particular are seeing the impact of the mining downturn with fewer workers required in these states as the pipeline of major infrastructure projects winds down translating into slower population growth. Two years ago these states were recording annual population growth of 2.0% in Qld, 3.7% in WA and 2.8% in NT.

Net overseas migration has been slowing at a national level and as the above chart shows, all states are experiencing a fall in net overseas migration. The full brunt of the slowdown in net overseas migration is once again being felt by the resource states. Annual net overseas migration is -30.9% lower in Qld, -47.6% lower in WA and -56.0% lower in NT. All other states except for NSW (+1.9%) and ACT (+4.1%) have recorded a fall in net overseas migration over the year, but nowhere near the extent of the mining states and territories. The declines in these states were recorded at -4.2% in Vic, -9.0% in SA and -2.9% in Tas. The data also highlights that overseas migrants have a clear preference to settle in the larger states. Over the past year, 37.9% of net migration occurred in NSW with a further 30.4% in Vic, 13.2% in Qld and 10.3% in WA.

At a national level net interstate migration has no impact however, it does have a significant impact across individual states. Over the 12 months to December 2014, there were 335,256 interstate movements across the Australian states. Historically Qld has attracted as high number of interstate migrants however; net interstate migration to the state has slowed sharply over recent years. Across the states, Vic now attracts the most net interstate migrants (9,336) followed by Qld (5,598) and these are the only two states that have recorded a net gain in interstate migration over the year. Vic’s net gain from interstate migration is a record high while migration to Qld is at its lowest level on record. The net outflow of residents from the remaining states was recorded at: -5,572 persons in NSW, -2,744 in SA, -400 in WA, -1,278 in Tas, -3,392 in NT and -1,548 in ACT. Despite the net outflow, the net number of residents leaving NSW is at a record low. On the other hand the loss of residents from WA is the largest since September 2003 and the outflow from NT is the largest on record.

In terms of natural increase the states with the largest overall populations also have the greatest natural increase. There has been a sharp decline in natural increase in NSW over the past few years while natural increase is trending higher in WA. The state-by-state shares of natural increase are: 26.5% in NSW, 24.8% in Vic, 23.5% in Qld, 4.9% in SA, 14.8% in WA, 1.0% in Tas, 2.0% in NT and 2.6% in ACT.

The demographic data highlights challenges for the Australian economy and individual states. Gross domestic product has been slowing and is much lower on a per capita basis. With population growth slowing and set to slow further in coming quarters (as foreshadowed in the monthly overseas arrivals and departures data) this poses a challenge for the national economy. The resource states in particular are being impacted as they are attracting fewer migrants from both interstate and overseas. Conversely, NSW and Vic (which are a proxy for Sydney and Melbourne) are the places that both domestic and international migrants want to head to.

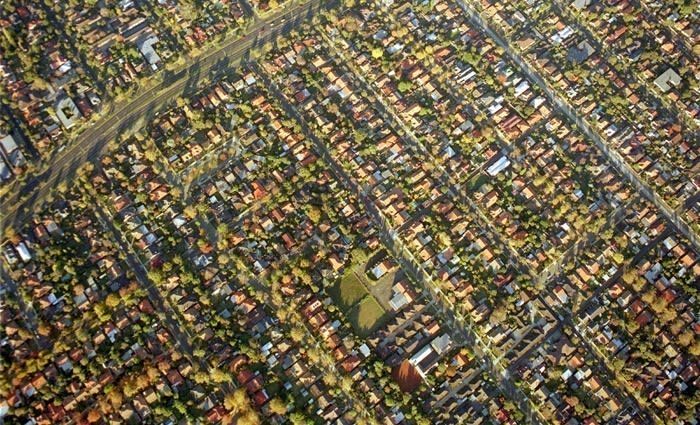

This in turn fuels demand for housing, creates the need for more jobs and requires more spending on infrastructure. To-date it doesn’t look as if the sharp rises in home values in Sydney and to a lesser degree Melbourne over recent years is stopping migrants heading to these areas. You would have to think that at some point this will change but no one has a crystal ball to know exactly when that inflection point will occur. Particularly given how low the cost of debt currently is with interest rates so low, furthermore rental pressures are easing given already high new housing construction and a record high pipeline of approvals to potentially follow.

Cameron Kusher is RP Data’s senior research analyst. Follow Cameron on Twitter here.