Residential building starts to plunge 31 percent in three years: BIS Oxford Economics

Australia’s building market, a main driver of growth, is expected to decline over the next three years led by a drop in residential starts, says a new report by BIS Oxford Economics.

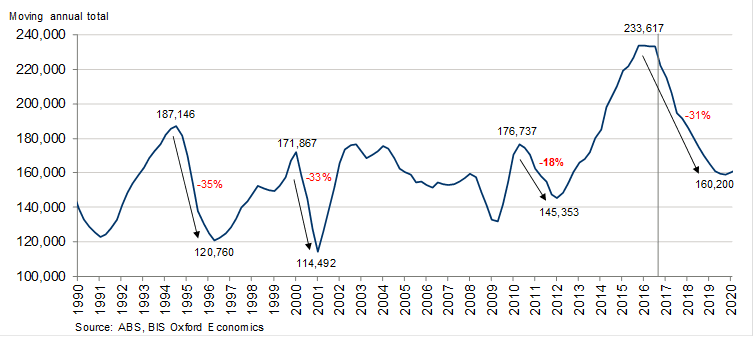

Residential starts are expected to fall 31 percent as key markets move into oversupply, according to the Building in Australia 2017-32 report.

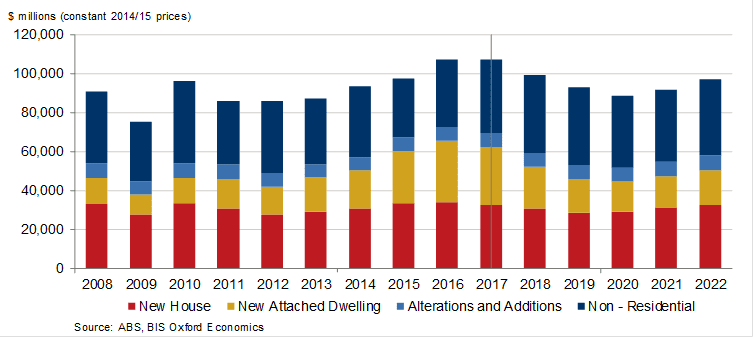

Further, the BIS report says that the value of national building commencements peaked in 2015/16 at $107.3 billion (in constant 2014/15 prices), up 22 percent in real terms since the end of the resources investment boom in 2012/13.

While a similar value of commencements is estimated for 2016/17, the report forecasts a cumulative 17 percent decline in the real value of commencements over the three years to 2019/20.

The report comes close on the heels of another BIS report that the muted retail industry will continue to struggle in the face of tough economic conditions and investment risks in the sector are higher.

FIGURE 1: VALUE OF TOTAL BUILDING COMMENCEMENTS

CONSTANT 2014/15 PRICES, $MILLIONS

A soft economy, weak household income growth and subdued consumer spending will continue for some years, while Amazon’s entry will only add to the challenges to Australian retailers and shopping centres, says Retail Property Market 2017 to 2027.

“The record breaking residential building boom is already turning, offsetting growth in starts for non-residential building through 2016/17,” said Adrian Hart, associate director of Construction, Maintenance and Mining at BIS Oxford Economics.

Residential building starts will decline sharply in the next two years, particularly in the investor-driven apartments segment, as supply catches up to underlying demand.

BIS expects the total residential market to fall by around 31 percent over the next three years.

The decline will be even sharper for the number of private high density apartments getting underway nationally, being close to 50 percent.

FIGURE 2: NUMBER OF DWELLING COMMENCEMENTS

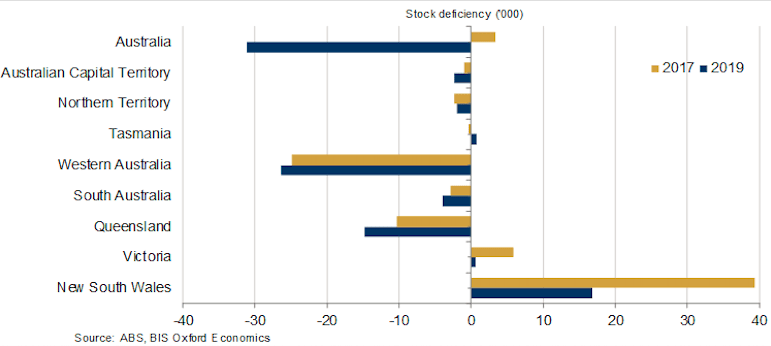

Figure 3: Dwelling Stock Deficiency, Thousands

“Overall the slump will be similar in percentage terms to the residential downturns in the mid-1990s and the introduction of the GST in 2000/01,” the report said.

The economic forecaster’s outlook for residential building activity is more bearish than that included in the 2017/18 Commonwealth Budget, as well as last week’s RBI statement during its rate decision announcement.

The central bank has kept rates at a record low of 1.50 percent for a year now.

In the statement, Reserve Bank Governor Philip Lowe said the “current high level of residential construction is forecast to be maintained for some time, before gradually easing”.

“It may not be as rosy as all that,” said Robert Mellor, managing director at BIS Oxford Economics.

“Our dwelling demand/supply analysis indicates that all states with the exception of Victoria and New South Wales are either in balance or oversupply,” said Hart.

Dwelling completions are ahead of underlying demand over the next two years, implying a national residential stock surplus by 2018/19 despite New South Wales still being undersupplied.

“While high density dwellings do take longer to complete than traditional detached dwellings, when the end comes it will be very swift,” said Mellor.

“The high proportion of investor activity is another risk factor as investor sentiment can turn quickly. Overall, we expect 2017/18 will be the peak in high density residential completions, but that part of the market will slump around 50 percent in the subsequent two years. By contrast, a milder decline is forecast for detached houses. The saving grace is that the floor in residential commencements is likely to be higher than in previous busts.”

Commercial property, however is a different story.

The Building in Australia report forecasts the value of non-residential building commencements to rise further in 2017/18 – following a cumulative increase of 25 percent over the past two years.

“Improved economic conditions along the eastern seaboard are driving new commercial and industrial developments, particularly in New South Wales and Victoria,” said Hart.

“Offices, retail and accommodation commencements have been very strong, although the latter two segments will run out of puff in coming years given the project pipeline and fundamental demand drivers. By contrast, education and health segments are poised for further growth in commencements given a range of large tertiary education and hospital projects about to get underway.”

However, the total value of non-residential building commencements is expected to ease later this decade, joining the downturn in residential starts.

“Except for a few sub-segments, the current upswing in non-residential building commencements is unlikely to be sustained over the next few years,” said Hart.

Weaker prospects for growth in retail sales will see a narrower pipeline for retail projects, while a tripling in accommodation starts since 2012/13 may also push activity in this segment over the top, resulting in a correction, added Hart.

Barring offices, transport buildings (eg. railway stations and airport terminals), health and education, most other non-residential building segments are expected to experience flat or declining commencements activity over the remainder of the decade.

BIS said the looming downturn in building commencements would be a strong challenge to achieving the three per cent growth targets for the Australian economy outlined in the 2017/18 Federal Budget.

“The strong growth in building commencements since 2012/13 provided a welcome boost for the Australian economy at a time when resources-related investment and construction activity fell heavily,” said Hart.

“But with residential building activity in particular now set for a sharp decline – along with its multiplier impacts on industries such as construction, manufacturing and retail – the Australian economy will need new investment drivers to support growth and employment.”