Property sentiment strengthens, despite higher rate expectations: ANZ Research

GUEST OBSERVER

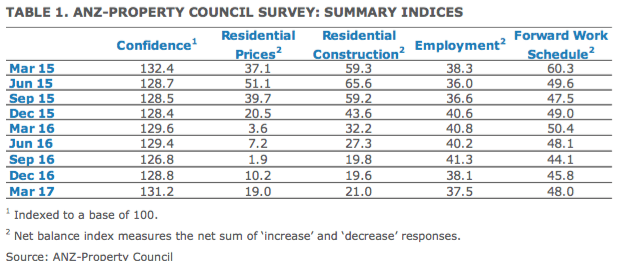

Respondents to the ANZ-Property Council Survey report a more optimistic outlook for the property sector in 2017.

Confidence rose to a two-year high, supported by stronger expectations of economic growth, capital values, and forward work schedules.

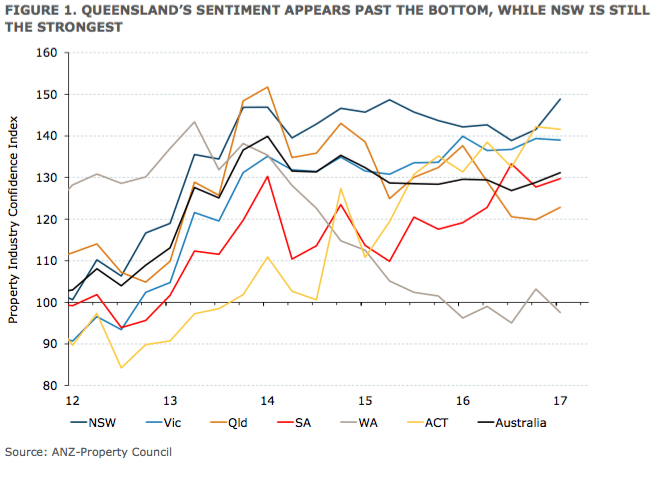

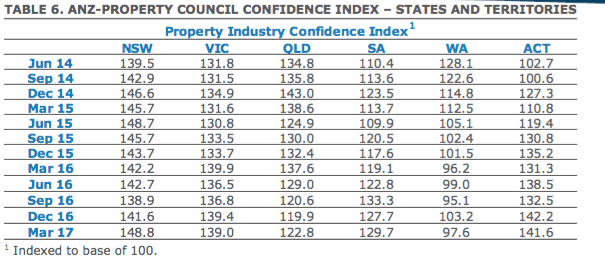

Sentiment is still strongest in New South Wales, while the outlook for Queensland’s property market looks to have bottomed, and is embarking on a tentative recovery.

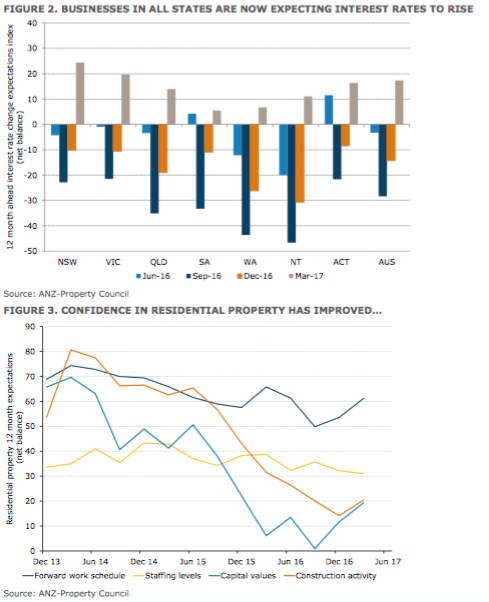

Firms nationwide now expect interest rates to rise over the next 12 months. This likely reflects a combination of the RBA cutting cycle reaching an end, and recent increases in bond yields and retail interest rates – especially in the housing market.

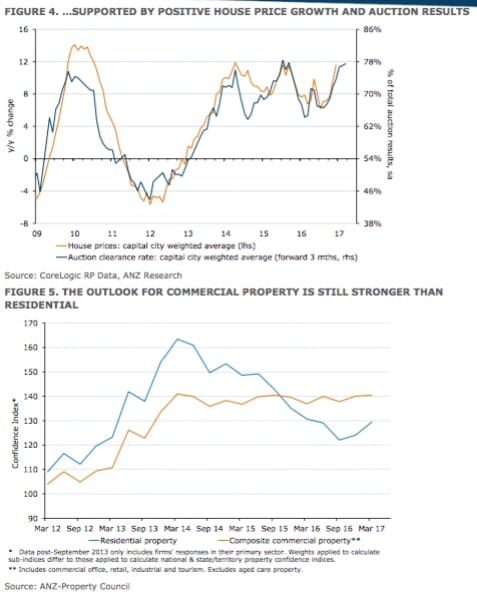

Confidence in residential property rose significantly, in line with other positive data flow on the housing market in recent months, including price growth, auction results, and investor finance.

Commercial property sentiment remains elevated, especially in the tourism sector. The improvement in the outlook for commercial offices is also encouraging.

ANZ chief economist Richard Yetsenga said the first quarter ANZ-Property Council Survey shows a further increase in sentiment in the property sector, despite the sharp slowdown in economic growth prior to the survey.

"Nonetheless, we believe growth will continue to pick up through 2017, with most of the Q3 weakness proving to be only temporary," he said.

"Our solid outlook for the Australian economy in 2017 is broadly consistent with the strong tone to this quarter’s survey. Sentiment in New South Wales’, Victoria’s, and the ACT’s property markets sits around record levels, in line with the transition away from mining-led growth. A stronger non-mining economy means that we believe the RBA’s easing cycle is over, and we expect rates will remain on hold this year.

A noteworthy feature of this quarter’s survey is that businesses nationwide now expect interest rates to increase over the coming year. This reflects both the RBA being at the end of their easing cycle, as well as tighter funding conditions. But as of yet, there is little sign that the likelihood of higher funding costs is having an adverse impact on the property sector.”

The March quarter survey showed that firms are considerably more optimistic around the outlook for the property sector. Confidence reached a 2-year high, with 31 percent of respondents expecting conditions in the property market to improve over the next 12 months.

The outlook remains quite mixed across the states, with New South Wales still leading the way (Figure 1), while Western Australia continues to feel the negative effects of declining mining investment. Encouragingly, sentiment in Queensland appears to be showing some signs of a base.

Queensland tends to get lumped with Western Australia as a ‘mining state’, but the transition to growth outside the mining sector appears much more advanced in the eastern state. Recent GDP data show that Queensland’s business investment has increased for the past two quarters, and in annual terms is much less of a drag on the state economy compared to 12 months ago.

Consistent with this result, ANZ-Property Council respondents in Queensland are reporting a more positive state economic outlook and generally rising capital values over the next year.

One trend that is consistent across the states is the expectation that interest rates will rise over the next 12 months. This is a significant turnaround from just 6 months ago, when respondents in all states expected rates to move lower (Figure 2).

We believe this changed outlook reflects two influences. First, it is increasingly likely that the RBA is now at the end of its easing cycle, after having cut rates again in August. Second, bond yields have been rising for the past few months, and even more recently housing investors have seen their interest rates increase. All in all, it appears highly unlikely that today’s record low interest rates will continue to fall.

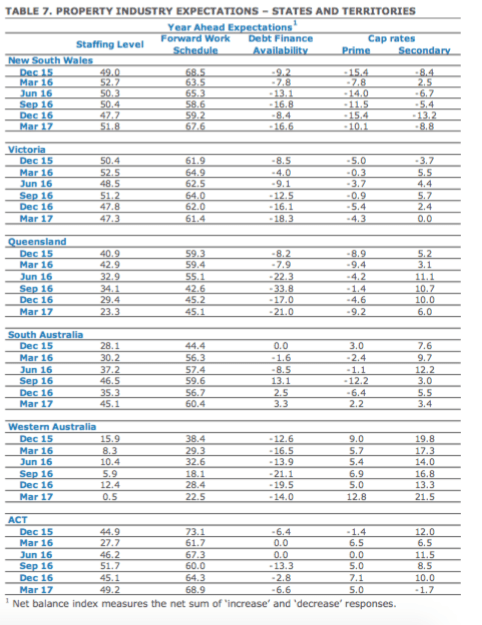

Much of the improved outlook for the property market came from the residential segment, supported by improved expectations of capital price growth, forward work schedules, and construction activity (Figure 3). The stronger price growth expectations are largely in line with recent results in the housing market. House prices have returned to double-digit annual growth rates across Sydney and Melbourne, while auction clearance rates have steadily increased and now sit only a fraction lower than last year’s peak (Figure 4). Coupled with the returning presence of investors, it appears that demand for housing is reasonably steady at an elevated level.

The recent improvement in work schedules and construction activity expectations is also a positive. While we expect dwelling investment to fall slightly through the second half of 2017 given the recent decline in building approvals, a significant backlog of work is likely to see construction remain around historically high levels.

Sentiment in the commercial property segment is still stronger than in residential property (Figure 5). The March quarter survey saw the outlook for commercial property rise to the second-highest level on record, driven by an ongoing improvement in commercial office sentiment, and still-elevated levels of confidence in the tourism industry.

Net confidence in the commercial offices segment has been steadily rising for nearly two years, reflecting an improving outlook for price growth and construction activity. This result is in line with ongoing absorption of office space as white-collar employment continues to rise across the major capital cities.

The outlook for the tourism industry remains very strong despite a small decline in the March quarter. A net 64% of respondents expect tourism-related construction activity will rise over the next 12 months, 52 percent believe their company’s forward work schedule will rise, and 39% forecast capital values to rise. This positive outlook is consistent with data showing the ongoing strength in Australia’s services exports, which includes tourism (Figure 6).

Importantly, the resilience of the AUD over the past year does not appear to have had a dampening effect on tourist inflows and expenditure. This suggests the strength of the tourism sector is not solely dependent on the currency, and is supported by other factors such as the rapid wealth expansion of the Chinese middle class. This broadening of demand bodes well for the growth prospects of an increasingly key component of Australia’s economy.

Daniel Gradwell is economist, ANZ and Richard Yetsenga is chief economist They can be contacted here.