House price growth forecast for 2018 across Australia: SQM

Australia’s housing market will likely record moderated dwelling price rises in 2018, with Melbourne again being the top mainland performer, according to SQM housing expert Louis Christopher in his end of year review.

In 2018, Mr Christopher expects national house prices to rise between four and eight percent.

It will be led on the mainland by Melbourne with a gain of seven to 12 per cent.

Hobart will be even stronger at eight to 13 per cent.

SQM tips Canberra will show five to nine per cent price growth.

Sydney house prices are forecast to rise four to eight per cent.

Perth will tick over into mildly positive territory, with small gains tipped in Adelaide and Brisbane.

His SQM tips are unamended from his full October annual report.

His tips of between 4 percent to 8 percent in 2018 represent a fall from a growth rate of what has been around 4.2 percent national growth over the past 12 months with a national median price of $549,000, well below the 5.8 percent rise in values in 2016 and 9.2 percent gain in 2015.

Melbourne’s property market will lose some momentum, according to predictions in Christopher’s Housing Boom and Bust Report.

Offsetting a slowdown in Melbourne and Sydney will be first-year property market recoveries for Perth and Darwin and the ongoing boom in Hobart’s property market, which is set to record the highest level of price growth of any capital city at between 8 percent to 13 percent, Christopher said.

Click here to enlarge.

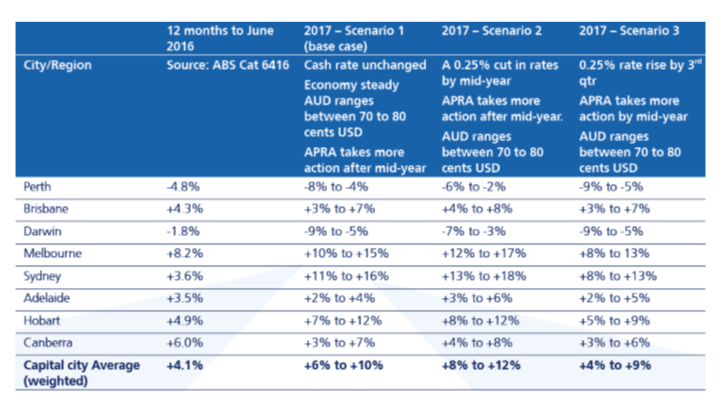

SQM Research tipped 2017 capital city house price growth to have been between six to 12 per cent - with Corelogic daily index showing a 4 percent rise across its five capital city index for 2017.

The SQM Research boss acknowledges his 2017 forecast for Sydney house prices to surge 11 to 16 per cent was an over-estimate, according to The Australian Financial Review, given APRA moved earlier that Christopher anticipated.

"The Sydney market was picking steam earlier this year. But APRA acted earlier than we forecasted. Our forecast assumed they would step in the market sometime in the third quarter," he said.

Christopher acknowledged the APRA move was "prudent."

"At the end of the year the market was flat with a number of areas recording some price falls," he told a Harris Partners Talking property vimeo.

It was March when the Australian Prudential Regulation Authority announced all deposit-taking institutions were to cut back on origination of interest-only loans to a maximum 30 per cent of total lending.

"Sydney was an overvalued market to begin with so was more susceptible," Christopher advised as to why Sydney bore the brunt of the turndown.

SQM's 2017 Boom and Bust Report scenario forecasted an acceleration of dwelling price rises in Sydney and Melbourne with Sydney dwelling prices forecasted to rise 11 percent to 16 percent for the 2017 calendar year, while Melbourne was forecasted to rise by 10 percent to 15 percent.