Hobart Australia's best performer on Knight Frank's Q2 global index

Hobart was Australia's best performing city for residential price growth in Q2 2020, Knight Frank's Global Residential Cities Index Q2 2020 has found.

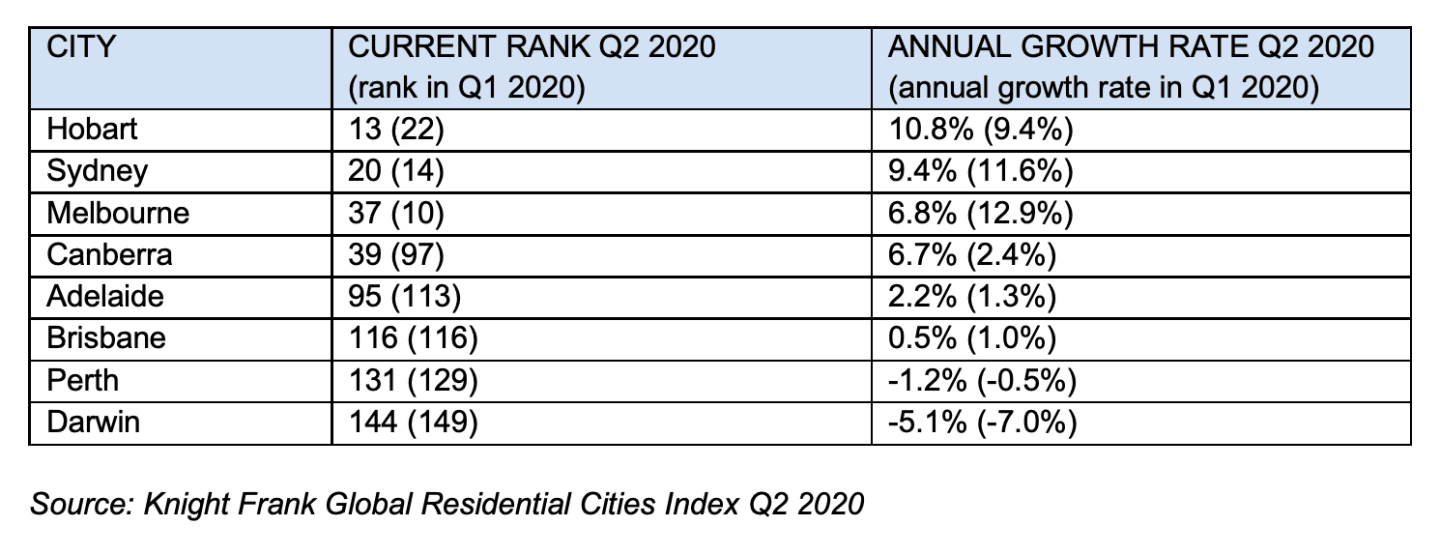

It led the way with a 10.8 per cent growth, 13th on Knight Frank's global list of 150 cities, up from 22nd in the Q1 report.

Sydney, Australia's most expensive capital, wasn't too far behind with price growth of 9.4 per cent, which saw it rank 20th on the list, down from 14th.

Melbourne was next, in 37th, well down from its top 10 rank in Q1.

The Victorian capital's residential property still grew 6.8 per cent, sharply followed by Canberra 39th with a growth of 6.7 per cent.

All four of the capitals record growth around double the average growth rate or higher.

Michelle Ciesielski, Knight Frank's head of residential research, said the volume of residential sales in Australia has reduced by close to 34 per cent during COVID-19, although noted that there has only been a shallow number of listings on the market with little evidence of distressed sales.

“Price growth has been impacted across Australia, but dwelling values only fell by two per cent in the second quarter of 2020, faring much better at this point than first anticipated", Ciesielski said.

“In the short term we expect further falls in housing prices to be cushioned by the ongoing low number of listings and a decreased number of new properties due for completion, with the proposed relaxation of responsible lending in early 2021 to shield against economic headwinds.

“We anticipate there will be a lot of change in the global index going forward, depending on sentiment around the world, and if we see second surges of the pandemic, which could also impact demand and price growth.”

Shayne Harris, Knight Frank’s head of residential in Australia, said Hobart has recorded the highest price growth in Australia for several reasons, namely the relative value and lifestyle contuing to be appealing, as well as the states rapid response rate to COVID and ability to shut borders.

“Tasmania has seen increased popularity by those seeking a regional tree-change, especially now when we have officially seen the success in the adaptability of many white-collar workers working from their homes", Harris says.

“Sydney continues to be underpinned by a severe shortage of stock for sale by both auction and private treaty and this has been reflected by the high clearance rates recorded.

“In the past couple of months difficulties around obtaining finance has drawn out many Sydney sale transactions and this still remains a hurdle, but in the past few weeks, I’ve been taken back with the increasing number of registered bidders at auctions.

“In some instances, we are once again seeing first home buyers being outpriced by downsizers and this is most likely to continue given their lower reliance on steady employment and a reasonable performing stock market.”

Overall the Knight Frank Global Residential Cities Index increased by 3.4% in the 12 months to the end of June, with the annual rate of growth declining marginally from 3.6% in March.