Federal budget to keep focus on jobs: CommSec's Craig James

EXPERT OBSERVER

What does it all mean?

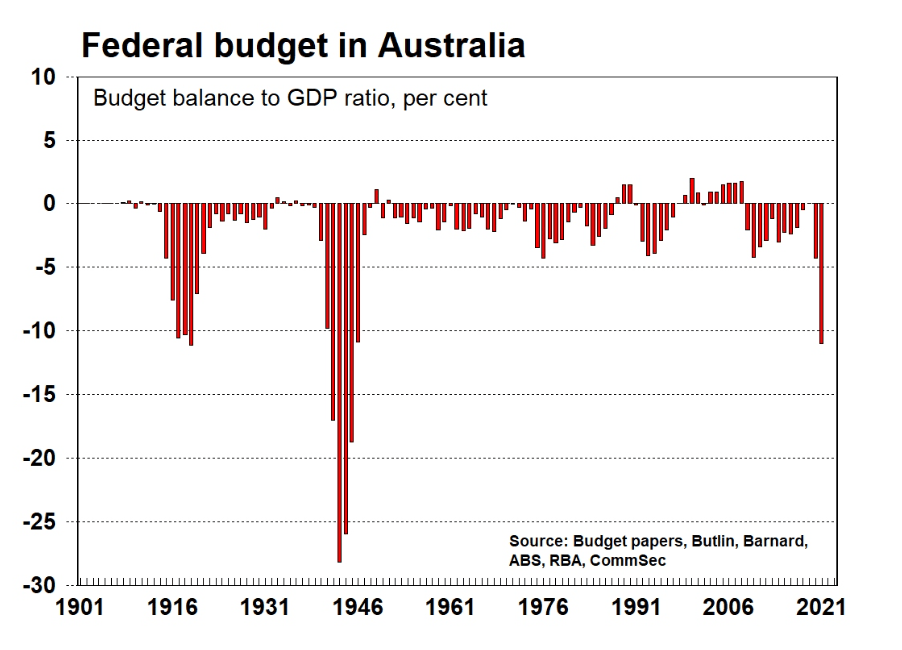

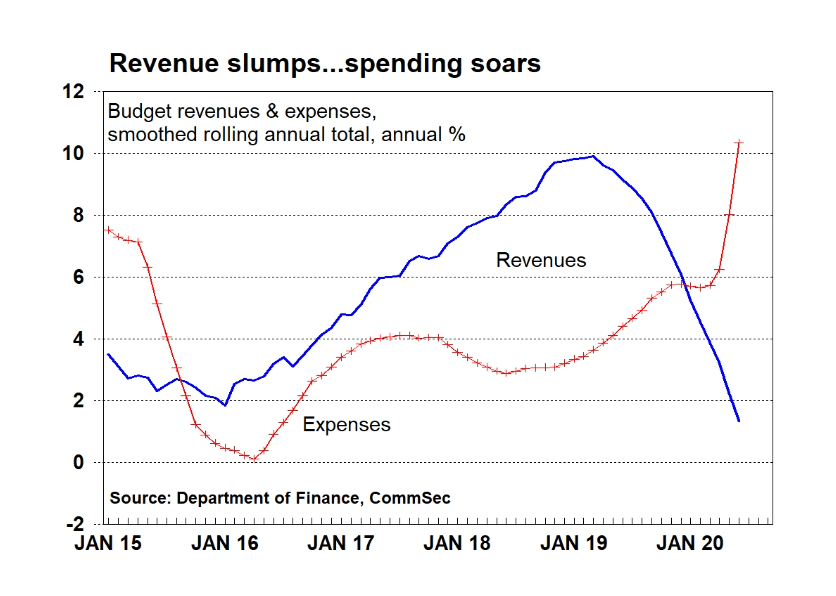

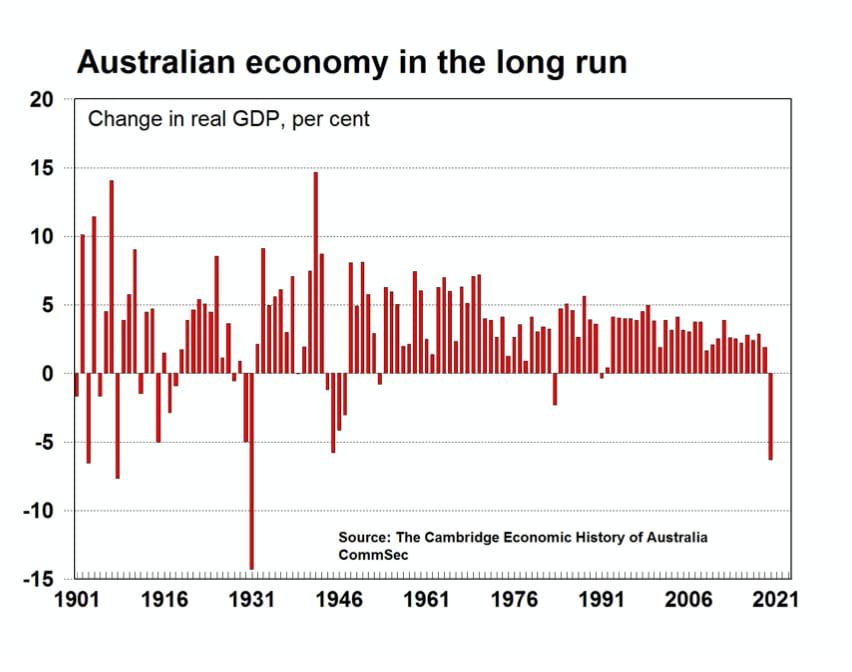

The Federal Government has had one mantra over the COVID-19 environment: to keep business in business and keep people in jobs. And despite the budget headed for the biggest deficit in 75 years, that mantra will continue to echo in the upcoming budget. A deficit of around $220 billion or 11 per cent of GDP is expected this year (2020/21).

Based on usual leaks, pre-announcements and speculation, the budget will be focussed on jobs. Other key measures include tax cuts, cash handouts for payments, significant spending on infrastructure, a new apprenticeship & trainee program, investment in manufacturing and a Digital Business Plan.

One on-going issue will be wage subsidy schemes. There is growing debate on how the schemes should be structured. Some are concerned that jobseekers will be pushed into poverty if the programs are wound back too quickly. But others are concerned that the programs are too generous – and if kept in place too long it will lead to jobseekers staying out the job market and thus becoming less employable over time. The latter situation has been a constant feature of past recessions.

Budget speculation: What do we know so far?

Ahead of each budget, AAP newswires compiles the ultimate guide. And this year is no different. Paul Osborne from AAP has compiled the following report.

Also Newscorp press yesterday reported that tax cuts could be brought forward to begin July 2020.

Today, the Government announced that half the salary of new apprentices and trainees in any industry will be paid for by the federal government for one year under a wage scheme to create jobs. The scheme is reported to cost $1.2 billion to employ 100,000 new workers and will begin Monday October 5.

Media is also reporting a focus in the budget on boosting female employment.

The AAP report from Paul Osborne:

THE BIG PICTURE

Prime Minister Scott Morrison and Treasurer Josh Frydenberg say it will be a "jobs budget" with the aim of driving the recovery out of the first recession since the 1990s

Estimated budget deficit of $200 billion

Debt edging upwards of $800 billion

Expected $140 billion in stimulus over four years

INFRASTRUCTURE

Funding to expand two NSW dams, Wyangala and Dungowan.

$53 million funding for gas infrastructure as part of a national plan

$211 million for domestic fuel security facilities

More flexible rules for the Northern Australia Infrastructure Facility to invest

HIP-POCKETS

Possible bringing forward of personal tax cuts due to start in 2022

2.5 million pensioners to get extra help to make up for an inflation-related rise not going ahead

HomeBuilder package likely to be extended

No changes to the JobSeeker dole payments. Government wants more data on economic conditions before deciding.

BUSINESS

$112 million in fringe benefits tax changes to ease burden on small business

Consideration of a business investment allowance

Wage incentive for small and medium-sized businesses to take on new workers

$1.5 billion manufacturing strategy

$800 million aimed at helping individuals and businesses work online

$53 million funding for television and film production and new content rules

Possible rule changes around "loss carry-back" for businesses

HEALTH

Extension of telehealth and e-prescription services

Extra funding for aged care, ahead of the receipt of the royal commission report

New strategy to get young people out of residential aged care

$9 million for research into cancer in children and young adults

REGIONS

$100 million for new Regional Recovery Partnerships (projects in areas hit by drought, bushfires and coronavirus)

$30 million for the Regional Connectivity Program (local telecommunications projects)

$50 million Regional Tourism Recovery initiative (assist businesses in regions heavily reliant on international tourism)

$200 million for an additional round of the Building Better Regions Fund

$50 million extra in rebates for farmers seeking to put in bores and dams

EDUCATION

Extra $326 million to provide 12,000 more university places for domestic students

WELFARE

$7.6 million for parents experiencing stillborn babies or the death of a child under 12 months of age

700 new safe places for women and children escaping domestic violence under $60 million "safe places" initiative

ENVIRONMENT

$61.7 million for nature-based tourism.

What are the implications for investors?

Stimulus is expected to continue. Governments and central banks will continue to do all that it takes to get the economy back to a sense of normalcy. Interest rates will stay low for three years. And the government won’t start crafting plans to wind back deficits and debts until the jobless rate is comfortably below 6 per cent.

Investors can largely ignore economic and budget forecasts longer than a year away. So much can change in a short space of time in the pandemic recession.

The budget will be judged on the ability to create and sustain jobs and keep business in business, rather than being judged on meeting specific fiscal and economic forecasts.

Retailers, building & construction trades, manufacturing, pensioners, young people and middle-income workers look to be the main winners from the budget.

CRAIG JAMES is the chief economist at CommSec.