NSW leads national building boom: CommSec's Savanth Sebastian

GUEST OBSERVER

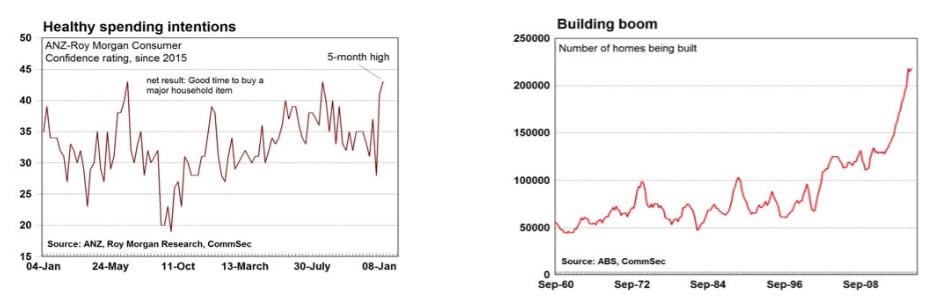

Consumer confidence: The Westpac/Melbourne Institute survey of consumer sentiment rose by 0.1 percent in January to 97.4. The confidence index is up 0.1 percent on a year ago.

Dwelling starts: Starts fell by 2.8 percent in the September quarter after falling by 7.2 percent in the June quarter. Building work done fell by 5.5 percent in the quarter to be up 1.4 percent on the year.

As at the September quarter, a record 218,297 homes were being built, up 12.1 per cent on a year ago.

In the year to September, dwelling starts were at record highs in NSW (70,326) and 79 percent above the decade average. In Queensland starts were at 21-year highs (49,939) and 36 percent above decade averages.

The consumer confidence figures have implications for finance providers, retailers, and companies dependent on consumer and business spending. Building & building material companies are affected by dwelling starts including Boral, James Hardie, Adelaide Brighton, Brickworks, AV Jennings Limited, Devine Limited and Beacon Lighting.

What does it all mean?

The latest monthly reading on consumer sentiment suggests consumers are non-plussed about life. But the more timely Roy Morgan weekly survey suggest consumers are super chipper about the current environment. In addition the monthly consumer sentiment reading suggests that sentiment lifted by between 1.9 percent and 7.4 percent across the major capital cities, yet the overall reading only lifted by a sedate 0.1 percent.

So just how are consumers faring? The outcome is likely to be somewhere in the middle. Consumers are modestly upbeat and more importantly household finances remain in good shape. Interestingly the weekly and monthly consumer sentiment readings seem to agree on one key point - the measure on whether it is a good time to purchase a major household item? Well, it seems there is no time like the present, with both readings recording a four or five-month high.

Looking forward, a potential dampener to sentiment is likely to be the lift in petrol prices. However the stronger Australian dollar should help to offset that in coming weeks. The ongoing strength in sharemarkets should provide a degree of support to household confidence. Interestingly the measure of whether it was a good time to buy a major household item remains upbeat despite the latest fall.

What do the figures show?

Consumer confidence

The Westpac/Melbourne Institute index of consumer confidence rose by 0.1 percent in January to 97.4. The confidence index is up 0.1 percent on a year ago.

The current conditions index fell by 0.5 percent while the expectations index rose by 0.5 percent.

Three of the five components of the index rose in January:

- The estimate of family finances compared with a year ago was down by 7.6 percent;

- The estimate of family finances over the next year was up by 0.3 percent;

- Economic conditions over the next 12 months was up by 2.5 percent;

- Economic conditions over the next 5 years was down by 1.4 percent;

- The measure on whether it was a good time to buy a major household item was up by 4.9 percent.

Gender & demographics: Men (index reading of 102.9, up 5.2 percent) were still more optimistic than Women (99.6, up 2.8 percent). The sentiment index for young people fell by 0.6 percent to 119.3 in January. Across the other demographics: 25-44 years (index 99.3, down by 1.3 percent); 45 years plus (index 98.3, up by 9.5 percent).

Housing outlook: A good time to buy a dwelling? The index was down 2 percent in the month to 100.9 and was down by 10.7 percent over the year.

States: NSW (103.8, up by 2.7 percent); Victoria (index 103.7, up 5.7 percent); Queensland (99.6, up 3.2 percent); Western Australia (95.2, up 7.4 per cent); South Australia (92.8, up 1.9 percent).

Dwelling starts

Dwelling starts (commencements) fell by 2.8 percent in the September quarter after falling by 7.2 percent in the June quarter. House approvals fell by 1.8 per cent and apartments fell by 0.7 percent. Work started on 229,295 new dwellings over the year to September, easing further from the record high of 232,018 dwellings in the year to March.

Across Australia, starts in the September quarter fell in six states/territories: NSW (up by 5.8 percent); Victoria (down by 9.6 percent); Queensland (up by 6.3 percent); South Australia (down by 20 percent); Western Australia (down by 13.6 percent); Tasmania (down by 0.6 percent); Northern Territory (down by 7.6 percent); and the ACT (down 39.6 percent).

In the year to September, dwelling starts were higher than the decade average in all the states & territories except for South Australia (down 1 percent), Western Australia (down 3.5 percent), Tasmania (down 15 percent) and Northern Territory (down 12.6 percent). Starts were at record highs in NSW (70,326) and 79 percent above the decade average. In Queensland starts were at 21 year highs (49,939) and 36 percent above decade averages.

What is the importance of the economic data?

Westpac and the Melbourne Institute release the Index of Consumer Sentiment each month. According to Melbourne Institute: “The survey of consumer sentiment was first undertaken in 1973 and was conducted on a quarterly basis until 1976, a six-weekly basis from 1976 to 1986, and has been conducted monthly ever since.” Confident consumers may be more inclined to spend, especially on major items.

The Australian Bureau of Statistics releases data on dwelling commencements (starts) each quarter. The figures provide guidance on future construction activity. If construction begins on new houses or apartments, it signifies work for building trades.

What are the implications for interest rates and investors?

There are a few headwinds for consumer confidence. No doubt the lift in oil prices and the resulting lift in petrol prices does have a direct impact on household budgets. In addition, the ongoing rebalancing of the Australian economy away from mining to housing and uncertainty about future housing supply in Sydney, Melbourne and Brisbane will occupy policymaker discussions in coming months. Overall the Reserve Bank is comfortably on the sidelines looking to see how the economy evolves over the early part of 2017.

Savanth Sebastian is an economist for CommSec.