More SUVs sold than cars: Craig James

GUEST OBSERVER

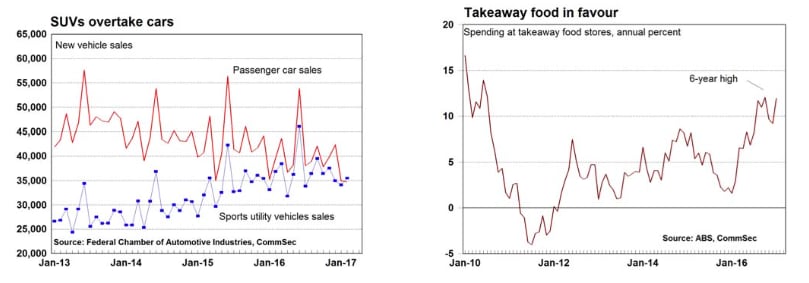

In February, more new sports utility vehicles (SUVs) or four-wheel drive vehicles were sold than passenger cars for the first time.

Yes, SUVs have overtaken cars and the gap is likely to grow over time. Buyers are liking the riding position, versatility and fit-out of SUVs and there are now a variety of model sizes to suit all preferences.

There is a bit of conjecture about which country holds the record for the longest economic expansion. The latest OECD data suggests that Australia already holds the record. The Netherlands had an expansion of 86 quarters (December quarter 1981 to March quarter 2003) while Australia has notched up 102 quarters (September quarter 1991 to December quarter 2016).

The Reserve Bank is unlikely to settle the matter, downplaying the importance of whether Australia has the world’s longest expansion. Still, the bottom line is that the economy is doing well and has done so for quite some time.

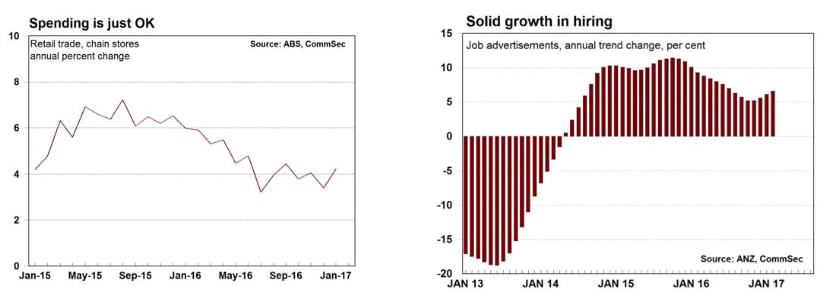

Consumers are spending, not splurging. But the pace of sales is certainly sustainable. The lift in spending in January of 0.4 per cent matched the average pace over the past six months and this exceeds both the 5-year and decade-average sales growth of 0.3 per cent a month.

Spending at takeaway food stores continues to be remarkable – up 1.6 percent in January and up 11.9 percent on a year ago. Competition is strong, keeping prices down, and that is causing people to sample the wares of the large range of food outlets. Ann increased range of “healthy choices” is also causing people to try the new offerings.

Job advertisements have been choppy in recent months while employers work out what their labour requirements are likely to be over 2017. Despite a dip in the seasonally adjusted number of job ads, trend growth is still rising and in fact annual trend growth is the best in seven months. The jobless rate looks set to hold between 5.5-6.0 percent.

National retail petrol prices have eased around 6 cents a litre from recent highs, in line with wholesale prices and Asian import prices. The wholesale price is near 116 cents a litre and that should be a guide for motorists to the cheapest prices that may be offered by retailers – usually at the peak of the discounting cycle in southern and eastern capital cities.

What do the figures show?

Retail trade

Retail trade rose by 0.4 percent in January after falling by 0.1 percent in December. Annual sales growth lifted from 3.0 percent to 3.1 percent (5-year average gain was 4.0 percent)

Non-food retailing rose by 0.6 per cent in January after falling by 0.5 per cent in December. Non-food retail spending is now up 2.9 per cent on a year ago.

Spending rose the most at Electrical and electronic goods retailing (up 2.4 per cent) from Takeaway food services (up 1.6 per cent). Spending fell most at Pharmaceutical, cosmetic and toiletry goods retailing (down 1.4 per cent) from Department stores and Newspaper & book retailing (both down 0.5 per cent).

Spending at takeaway food services was up 11.9 per cent on a year ago.

Sales by chain-store retailers and other large retailers rose by 0.8 per cent In January after falling 0.1 per cent in December. Sales are up 4.2 per cent over the year (5-year average gain was 5.2 per cent).

Sales rose in six of the eight states and territories: NSW (+0.2 per cent), Victoria (+1.1 per cent), Queensland (unchanged), South Australia (+0.6 per cent), Western Australia (+0.3 per cent), Tasmania (+0.4 per cent), Northern Territory (-0.8 per cent), ACT (+1.2 per cent). Job Advertisements

Job advertisements fell 0.7 per cent in February from 5-year highs to 165,643 ads. Advertisements have been volatile in the past four months. In trend terms, ads rose by 0.4 per cent in the month to be up 6.6 per cent over the year.

New vehicle sales

There were 89,025 new vehicle sales in February, down 7.7 per cent on a year ago (one less selling day in 2017 than 2016). Sports Utility Vehicles (SUV) totalled 35,497 sales during February to record a 39.9 per cent share of total industry sales. Passenger cars totalled 34,740 for a 39.0 per cent share. Light commercials were the third largest segment with an 18.5 per cent share.

State data compared with a year ago: “In percentage terms, Western Australia showed the most marked fall. Its market dropped by 13.7 per cent, or 1,199 vehicle sales, followed by the Northern Territory (-10.7 per cent), South Australia (-10.6 per cent), New South Wales (-7.4 per cent), Victoria (-7.0 per cent) and Queensland (-6.6 per cent). Tasmania (+1.1 per cent) and the ACT (+0.3 per cent) were the only two markets to show an increase.”

Petrol price

According to the Australian Institute of Petroleum, the national average Australian price of unleaded petrol fell by 2.9 cents to 128.7 cents a litre in the past week. The metropolitan petrol price fell by 3.9 cents to 126.5 cents per litre while the regional price fell by 0.8 cents to 133.2 cents per litre.

Average unleaded petrol prices across states and territories over the past week were: Sydney (down by 3.9 cents to 131.5 c/l), Melbourne (down by 2.1 cents to 120.8 c/l), Brisbane (down by 1.9 cents to 123.2 c/l), Adelaide (down by 12.1 cents to 123.7 c/l), Perth (down by 1.0 cents to 130.6 c/l), Darwin (flat at 139.9 c/l), Canberra (flat at 139.6 c/l) and Hobart (down by 0.2 cents to 143.3 c/l).

The national average Australian price of diesel petrol fell 0.1 cents to 130.6 cents per litre in the week to March 5. The metropolitan price fell 0.2 cents to 130.8 c/l, while the regional average price fell 0.2 cents to 130.3 c/l.

The national average wholesale (terminal gate) unleaded petrol price fell to an 11-week low of 115.7 cents a litre on Monday, down 0.9 cents a litre over the week. The terminal gate diesel price stands at 115.3 cents a litre, broadly flat over the previous week.

Last week the key Singapore gasoline price fell by US$3.55 or 5.2 per cent to a 13-week low of US$64.85 a barrel. In Australian dollar terms the Singapore gasoline price fell by $2.88 a barrel or 3.3 per cent to $85.76 a barrel or 53.94 cents a litre.

MotorMouth records the following retail prices for capital cities today: Sydney 128.6c; Melbourne 119.6c; Brisbane 121.4c; Adelaide 118.7c; Perth 123.3c; Canberra 138.5c; Darwin 138.5c; Hobart 142.6c.

What is the importance of the economic data?

The Bureau of Statistics’ Retail trade publication contains the most current readings on the performance of consumer spending. The ABS surveys 500 ‘larger businesses’ and 2,750 ‘smaller businesses’. Retail trade covers spending at a broad range of retail outlets but excludes both petrol and motor vehicle sales. A weak retail trade result may point to a slowing economy as well weighing on the share prices of listed retail stocks. But retail trade estimates can’t be assessed in isolation – it is important to look at the influences determining future trends in consumer spending, such as income, employment and confidence levels.

The monthly Job Advertisements release is a leading employment indicator. Employers only seek additional staff if business activity is strong, and more importantly, if they expect that conditions will remain favourable in coming months. It takes around 5-6 months for the new staff to be added to the payrolls. But a fall in job advertisements would have a more immediate impact on monthly employment estimates.

Weekly figures on petrol prices are compiled by ORIMA Research on behalf of the Australian Institute of Petroleum (AIP). National average retail prices are calculated as the weighted average of each State/Territory's metropolitan and non-metropolitan retail petrol prices, with the weights based on the number of registered petrol vehicles in each of these regions. AIP data for retail petrol prices is based on available market data supplied by MotorMouth.

The Federal Chamber of Automotive Industries releases estimates of car sales on the third business day of the month. The figures highlight the strength of consumer spending as well as conditions facing auto & components companies.

What are the implications for interest rates and investors?

The economy is chugging along nicely. Retail spending is growing at a monthly pace just above the long-term average, vehicle sales are healthy and trend growth of job ads has lifted. The Reserve Bank has no reason to lift or cut interest rates.

Petrol prices have retraced from recent highs, and not surprisingly consumer confidence has also lifted – especially the question on family finances.

The recent falls in petrol prices are positive for retailers – especially discretionary retailers.

The only thing exercising minds at present is the housing market with conditions varying markedly across the country.

Craig James is the chief economist at CommSec.