Job vacancies at 6-year highs: Savanth Sebastian

Households held a record $1,046 billion in cash and deposits at the end of December. Cash and deposit holdings represented 22.4 per cent of financial assets. A record $798.2 billion was held in shares.

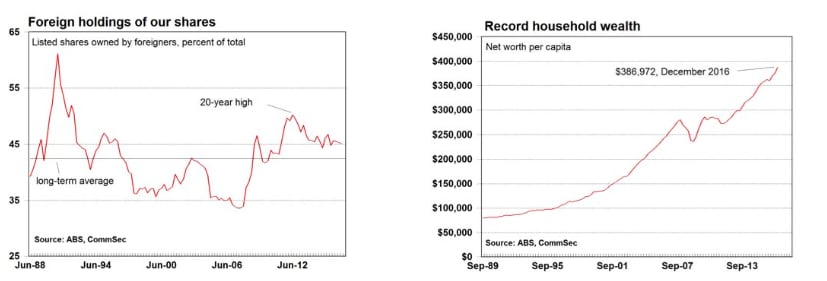

Foreigners held a record $792.2 billion of Aussie shares in the December quarter or 45.1 per cent of the total.

Job vacancies: Job vacancies rose by 1.8 per cent to 185,600 in the three months to February – a 6-year high. Job vacancies are up 7.3 per cent on a year ago.

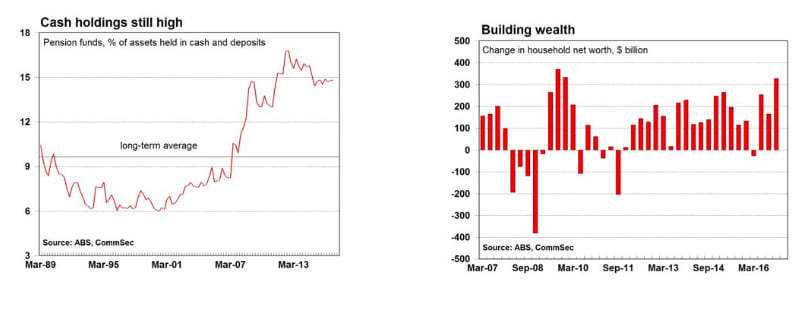

But conservatism still reigns. The proportion of all financial assets in the economy held in cash and bank deposits has lifted to a 4-year high. In the December quarter over a fifth of all financial assets – 21.4 per cent – was held in cash and bank deposits. Aussie consumers, businesses and pension funds are all holding more than the “normal” proportion of financial assets in cash – especially companies and super funds.

Interestingly there are around 13,000 more vacancies than at the same time in 2016. The jobs being created are primarily in the services sector, with healthcare and admin roles leading the gains. These jobs tend to be spread over a raft of small and medium-sized businesses as well as large firms, so generally don’t attract the same degree of media attention as jobs lost in mining. Importantly the lift in commodity prices should support the resources sector. In fact the latest figures suggest that the number of jobs across the mining sector has bottomed and now lifting – albeit incrementally.

What do the figures show?

Financial Accounts:

Total household wealth (net worth) stood at a record $9,404.5 billion at the end of December 2016, up $328.1 billion or 3.5 per cent over the quarter – marking the largest quarterly increase in net wealth in seven years. In per capita terms. CommSec estimates that wealth rose to a record $386,972 in the December quarter, up $12,227 over the quarter.In real terms, the value of land and dwellings rose by $217 billion in the December quarter, while the value of financial assets rose by $29.3 billion. Net saving plus real wealth rose by $274.5 billion in the quarter.

Household financial liabilities fell by $8.6 billion in the December quarter in real terms.

Foreigners held a record $792.2 billion of Aussie shares in the December quarter or 45.1 per cent of the total (long-term average 42.7 per cent). Share of bond holdings by foreigners rose from a 14-year low of 47.7 per cent in the September quarter to 47.8 per cent in the December quarter.

Job vacancies:

Job vacancies rose by 1.8 per cent to 185,600 in the three months to February – a near 6-year high. Job vacancies are up 7.3 per cent on a year ago.Vacancies rose 13,100 in original terms over the year. In terms of industries, vacancies rose the most over the year in Health Care & Social Assistance (up 4,700), Other Services (up 3,000), Administrative & Support services (up 2,900) and Professional, Scientific and Technical Services (up 1,900). Vacancies fell most in Retail trade (down 3,300), Accommodation & Food services (down 1,400), and Rental, Hiring and Real Estate Services (down 800).

New home sales

In seasonally-adjusted terms, new home sales rose by just 0.2 per cent in February. The number of detached house sales fell by 0.1 per cent while multi-unit dwelling sales lifted by 1 per cent.The Housing Industry Association reported: “Detached house sales increased in two out of five mainland states in February 2017 - Western Australia and Victoria. Detached house sales in WA increased by 11.3 per cent in February 2017 following a rise of 12.1 per cent in January. Note that these rates of growth are exaggerated by the extremely low base for detached house sales. Detached house sales in Victoria posted a monthly gain of 5.1 per cent in February. Elsewhere for the mainland states, in February detached house sales fell by 12.6 per cent in New South Wales and were down by 5.7 per cent in Queensland and 0.2 per cent in South Australia.”

What is the importance of the economic data?

The Australian Bureau of Statistics releases the Financial Accounts publication each quarter. The data covers assets, liabilities and financial flows for the key sectors of the economy. Figures on financial wealth help reveal the true state of household finances.The Australian Bureau of Statistics releases Job Vacancies data each quarter. The data is useful in gauging the strength of the job market.

The Housing Industry Association releases data on the sales of new homes each month. The HIA collects the data each month from a sample of Australia's largest 100 home builders. The survey covers around 14 per cent of the home building industry.

What are the implications for interest rates and investors?

Record household wealth will continue to support spending. And it is clear that household balance sheets remain in very good shape. While the gloomsters focus on higher household debt, the simple fact is that money is being used to buy assets, assets that are providing better returns than the cost of the loans being taken out. Aussies aren’t borrowing in droves to buy luxury cars – although some indeed are. No, the majority are investing in shares, putting money to work in superannuation and investing in property.There is always a risk that asset values can fall as well as rise. But Aussies are well placed to deal with that situation should it eventuate.

A number of retailers have noted that the ‘wealth effect’ has been positive for their sales – areas like furniture, cars, boats and electrical equipment.