The ticking time bomb in our property markets: Robert Simeon

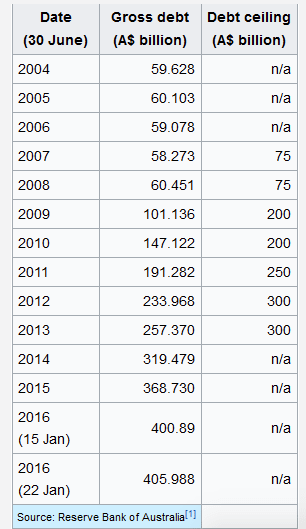

Quite surprising that nothing has been said when last Friday, the Australian government debt ticked just over $475 billion.

For the last twelve months, the government on average has been borrowing $6.35 billion each month, so what happens when they hit the debt ceiling of $500 billion? Will that then bring an end to Australia’s prized membership of the AAA – rated club?

Standard & Poor’s, Moody’s and Fitch have just 9 countries in the AAA club – Australia, Canada, Denmark, Germany, Luxembourg, Norway, Singapore, Sweden and Switzerland. Should our membership be revoked that would mean that borrowing costs would increase overnight, which is not a good sign for the Australian economy. The Australian Taxation Office (ATO) currently estimates that Australian small businesses currently owe $13 billion in unpaid tax debts. Obviously, there is no impact on existing debt although when it comes time to refinance then that would be an entirely different story.

With the federal government recently weighing into the housing affordability debacle there are two things that I would immediately implement to critique our housing markets.

The ATO has taken over responsibility for being Australia’s biggest property manager so land banking must be the first point of call. It is estimated that Sydney now has well over 100,000 permanently vacant apartments so they should be rented out to ease the rental crisis. Look at the lost revenues the ATO is missing out on with these land banked properties, where the clear majority are owned by overseas investors. Land banking in Australia must be outlawed.

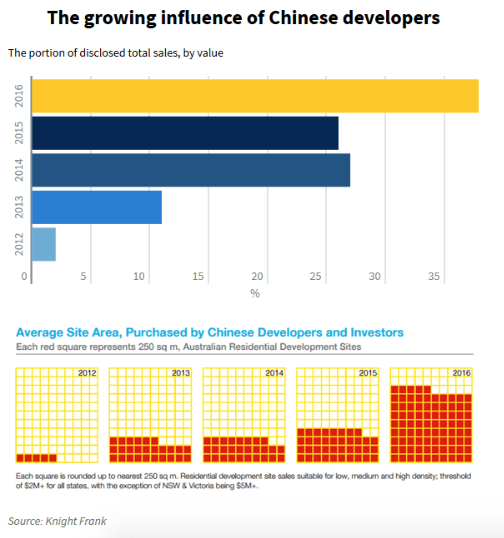

Reverse the ridiculous off-the-plan ratio back to 50 percent from 100 percent to overseas buyers. We are now going into the ninth year of 100 percent and the only clear impact we are seeing is that foreign investors have become a most dominant player. In 2016, Chinese developers acquired almost 40 percent of the Australian residential sites that were offered to the marketplace. All these properties are offered exclusively to Asia and these properties are not available for local buyers. Reducing the ratio back to 50 percent would have a big impact on housing affordability.

A recent survey by Roy Morgan Research found that approximately 7 per cent of Australian mortgage holders have little or zero equity in their homes in the twelve months to October 2016. That would equate to approximately 300,000 properties across Australia. Western Australia has the highest number with 54,000, followed by South Australia with 27,000, Queensland with 63,000, Melbourne has 50,000, Victoria has 65,000, NSW has 73,000 and Sydney has 33,000. Tasmania came in with 5,000 – these are concerning numbers when you consider the east coast has enjoyed unprecedented capital appreciation.

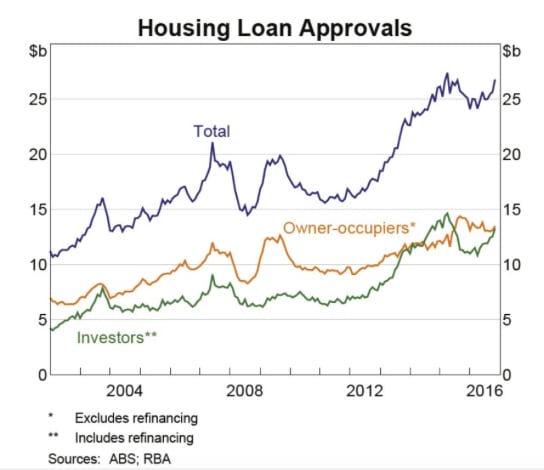

Since 2009, Sydney home values have doubled and Melbourne have climbed 85 percent. In 2011, less than 10 percent of investors held multiple investment properties, according to Digital Finance Analytics. This has now grown to 16 percent nationally, and on the east coast multiple investment properties is now approximately 18 percent.

Really makes one wonder, just what data our elected politicians and policy makers are actually looking at or quite possibly, they don’t even understand this data?

The most recent data from CoreLogic shows that the rental yields in Sydney and Melbourne are on the decline. For Sydney, houses yield is 2.8 percent and units are 3.8 percent. In Melbourne, houses are 2.7 percent and units are 4.0 percent. It will be most interesting to see just how low these yields will go with all the new developments entering the market. It is quite clear that investors have been enjoying the unprecedented capital growth over rental yields in Sydney and Melbourne, although this is about to change.

With very few alternate investment opportunities, we don’t at this particular point in time expect to see investors retreating out of the market, although we do expect to see carnage in the CBD markets. This should not come as a great surprise as these markets have introduced thousands and thousands of new apartments, and many suburbs have constructed less than one hundred new apartments.

Whatever the case, if you like watching real estate machinations 2017 will keep you highly entertained.

To add to this, the Commonwealth Bank advised mortgage brokers this week, that from February 13, it will cease accepting refinancing applications for investment home loans. Will the other major lenders then follow suit?

ROBERT SIMEON is a director of Richardson Wrench Mosman and Neutral Bay and has been selling residential real estate in Sydney since 1985.

He has also been writing real estate blog Virtual Realty News since 2000.