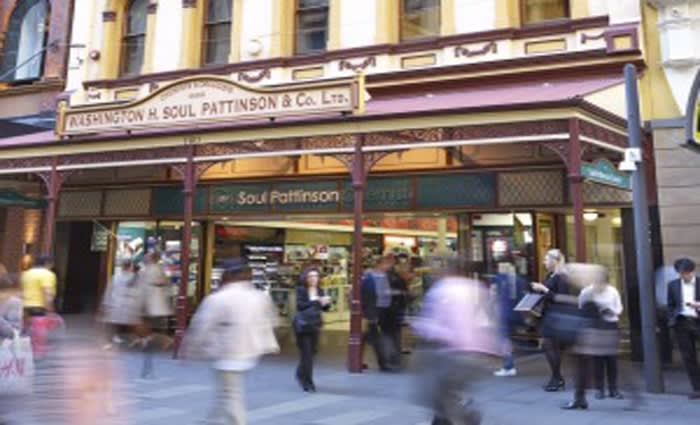

Soul Pattinson lists on Pitt Street Mall

There are $100 million-plus hopes for Washington H Soul Pattinson's Pitt Street Mall headquarters which has been listed by JLL.

The head office and pharmacy of the company, now known as WHSP, has operated at 160 Pitt Street since 1885, after it was rebuilt following a fire to the 1870s building.

The company - managed by the family - has evolved into an investment house with $5.5 billion in assets under management.

One of its best-known assets is the Victorian Italianate retail and office building in the heart of Sydney, one of the select properties with prime Pitt Street Mall.

"It unquestionably is a highly unique, super strategic and really a 'one-off' opportunity to secure an absolute prime foothold in Australia's strongest retail strip," said JLL's Simon Rooney, who has been appointed to sell the property with colleague Rob Sewell.

Pitt Street Real Estate Partners is advising WHSP on the divestment.

The property has a gross lettable area of 1290sq m.

"As a result of the high retailer demand for presence along Pitt Street, it now commands some of the highest rents in the world, with recent evidence showing rates of $12,000 to $15,000 per sq m annually," Mr Rooney said.

According to JLL’s Australasian Retail Investments head, Simon Rooney, Pitt Street Mall is the most productive retail in Australia with estimated sales of approximately $1.4 billion or productivity of around $14,000/sqm and exposure to exceptionally high pedestrian traffic with 65,000 visitations a day, which has drawn high profile international retailers to Pitt Street Mall in recent years such as H&M, Zara Home, Topshop, Sephora, Forever 21, Uniqlo and Microsoft.

There are limited options for contiguous space in Midtown. Vacancy has compressed to 6.4 percent - well below the 10 year average of 8.1 percent.

There is tangible evidence that rents are rising in Midtown.

"Multiple capital sources are subscribers to the Midtown investment thesis and investor expectation of above trend effective rental growth is reflected in under-writing assumptions," Rob Sewell said.

"This was evidenced by the recent sale of Fortius’s 75 percent share in MidCity Centre to Hong Kong based NGI Investments for $320 million, Brookfield’s 50% share in World Square to ISPT for $285 million and the sale of the Telstra Discovery store at 396 George Street for $26.25 million, representing a record sale rate per square metre of lettable area of $262,500,” said Mr Rooney.