Nelson Bay retains most delinquent postcode crown, but Surfers Paradise drops down list: Fitch

Whale sightings and rash holiday apartment investments remain seemingly popular activities in the NSW coastal town of Nelson Bay.

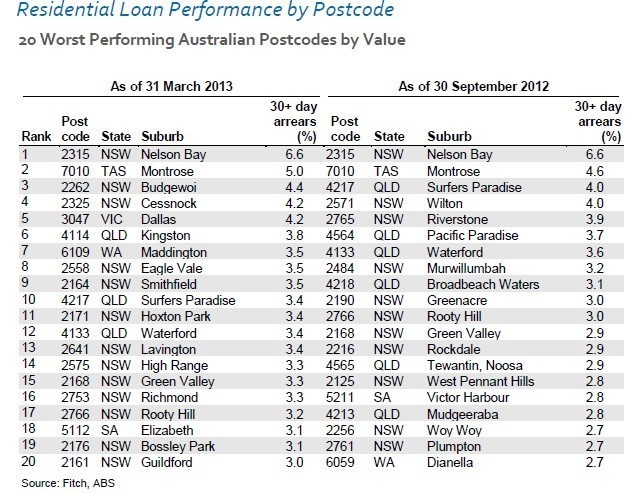

The tourist and holiday home destination has maintained its unwanted crown of most delinquent post code in Australia, a title it has held since Fitch Ratings began compiling its mortgage delinquency by post code list in 2007.

Nelson Bay (post code 2315), within the local government area of Port Stephens in the Hunter region, has maintained a delinquency rate of 6.6% as of March 31, unchanged from six months ago.

This translates into around one in 15 mortgage holders being more than a month behind on mortgage repayments.Second on the list and unmoved from six months ago is Montrose, a northern suburb of Hobart, with one in twenty (5%) borrowers 30 days or more behind on their mortgage repayments.

Suggesting perhaps a tentative recovery in the apartment-laden Surfers Paradise market, where a number of high-rise developments fell into receivership, the marquee Gold Coast suburb’s 30 days plus arrears rate improved from 4% to 3.4% from September 2012 to March 2013.

As a consequence its ranking fell from fourth on the list of worst performing postcodes by value as of September 2012 to 10th as of March.

Nelson Bay has a population of around 5,400 people according to census 2011 with 44.9% of the nearly 3,900 dwellings unoccupied on census night, July 19, during the middle of winter.

A high proportion of these unoccupied dwellings would have been seaside holiday apartments.

Sales histories on realestate.com.au indicate that many of the properties sold as mortgagee in possession in Nelson Bay in recent years have been holiday apartments.

A recent mortgagee auction was a two-bedroom unit Mantra Aqua Resort, which sold through Rebecca Dean of PRDnationwide – Port Stephens.

RP Data records indicate it sold for $215,000 having last sold for $380,000 in April 2010 a compound annual growth rate of – 28.9%.

Another apartment in the same resort is listed for July 27 auction.

“Stagnation in the local housing market has increased the time required for foreclosed properties to sell, leading to an accumulation of arrears in the 90+ days bucket (4.71% at end-March 2013 versus 5.78% at end-September 2012),” notes Fitch in its report.

“There has been an increase of 1% in new delinquent borrowers despite the recent improvement in 90+ days arrears.”

Fitch Ratings James Zanesi analyst says some properties are more than 300 days in arrears with lenders struggling to sell them. He says a number are in the same building.

When the Fitch Ratings figures came out in August last year, local estate agents and mortgage brokers highlighted that most of the delinquent properties related to holiday home purchase.

Local agent Daniel O'Meara of O'Meara Property said that while the rate was high there were few cases where residents are losing their homes.

“The vast majority of owners of these properties are not owner-occupiers and rarely live locally. As these are not the family home, the mortgage will often be let slip once money becomes tight.

Local broker Ben Eick of Hunter Home Loans Solutions in Nelson Bay told Australian Broker Online that it was his understanding that the properties are bought basically from people coming up here on holiday, liking the area, seeing an apartment or unit that looks fantastic.

Eick said holidaymakers bought a slew of properties in 2005 and 2006 gambling on prices going up, but a weaker rental market made it harder for investors to rent the property out for most of the year.