Mortgage arrears down again, including shadow lenders: Pete Wargent

Pete WargentJanuary 16, 2018

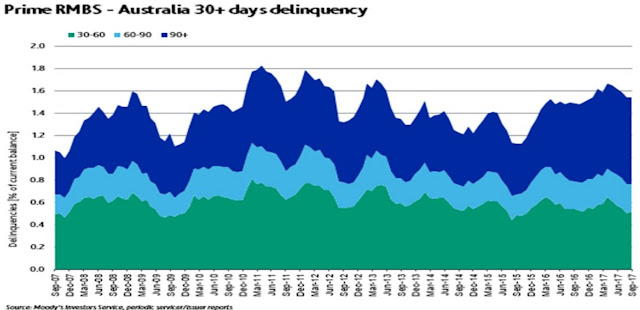

Another data series suggesting that 30-60 day arrears are now very close to the lowest level on record.

First it was S&P Global that reported as such, as I charted at the attached link.

And this time, it's Moody's.

Source: Moody's

Total 90+ day Prime RMBS arrears declined from 1.62 per cent to 1.54 per cent in the September quarter, according to Moody's Investor Service.

The main improvement was seen in shadow lenders, with delinquencies declining from 2.85 per cent to 2.59 per cent, which there was also a solid decline in non-confirming loan arrears to 3.3 per cent.

Elsewhere it was reported that loan impairment charges were also close to record lows in 2017.

The main improvement was seen in shadow lenders, with delinquencies declining from 2.85 per cent to 2.59 per cent, which there was also a solid decline in non-confirming loan arrears to 3.3 per cent.

Elsewhere it was reported that loan impairment charges were also close to record lows in 2017.

Good to see.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.