Lucky 888 Visas take-off and is the housing construction boom still on track?

An interesting release from Australia's largest mortgage aggregator Australian Finance Group, showing some notable trends in the Aussie property market.

The index is highly seasonal, of course, as we are now into the cold winter months - and most certainly in Sydney we are!

Stripping out seasonality, mortgage demand sits some 23% higher than it was a year ago.

Even allowing for any possible shifts in AFG's market share, this implies a huge annualised uplift in mortgages sold:

The average mortgage size by state shows that how it has been New South Wales and specifically Sydney which has driven the property boom over the past 18 months.

Queensland has also been a strong performer over the 12 months from July 2013.

Elsewhere, markets have been solid enough, but relatively much more subdued:

One trend we are watching is the role of investors by state, and in particular whether investors will spread their wings to look at the Sunshine State of Queensland next up in seeking yield and value.

There has been an uplift in the share of investors in the Queensland market, but Sydney remains the speculator's paradise with more than 45% of the mortgage market being sen up by investment purchases:

In terms of mortgages sold for the state, New South Wales demand has ripped upwards by +33% year on year, despite the low number of reported first home buyers.

It will be interesting to see if NSW mortgage demand resumes its upwards trajectory from July through to December as it did in 2013:

Overall, a strong release, and stripping out seasonality mortgage demand appears to remain in a secular uptrend which has been in place since 2011.

Article continues on next page. Please click below.

Housing construction boom still on track?

I put forward the view some time ago that residential building approvals would likely hit all-time record highs, driven on by rising dwelling prices over the past couple of years.

Although is is argued by some that supply is effectively strangled by planning restrictions and NIMBY-ism (to some extent, this obviously does play a part, particularly in established inner- and middle-ring suburbs), there has been another factor at play.

And that is, with high labour and construction costs in Australia combined with government charges, dwelling prices were simply not high enough to encourage developers to build.

The numbers are clear - if Sydney's apartment prices were to dip much below $550,000, construction will quickly dry up, even with today's lower financing costs.

In short, projects would not be sufficiently profitable for developers to build and there would be no adequate return on investment.

It's that simple. Ask anyone who works for a major developer in a residential division and they will tell you the same thing.

Dwelling values were previously too low and price action not strong enough for developers to be interested, until recently.

Indeed, RBA Governor Glenn Stevens confirmed as much in a speech this morning.

However, with prices moving up, there is clearly no shortage of approvals being waved through now in Sydney, thus underscoring the point.

In some areas, every second block appears to be under construction, especially in a number of inner south suburbs where thousands upon thousand of apartments are due to come online.

After three months of softer data, most commentators had already called the end of the approvals boom.

Admittedly, things were looking a tad shaky, but at the end of the day monthly approvals data is always necessarily going to be all over the shop.

In the event, after three weak readings building approvals in May jumped by 9.9% month on month to be up 14.3% year on year:

This data is always easier to read when smoothed out on a rolling monthly basis.

As you can see, rolling 12 monthly approvals are approaching the highest level ever recorded in Australia, now tracking at well over 190,000.

The previous annualised record was recorded in 1994 after the cash rate had been slashed from the nosebleed level of 17.5% to just 4.75%, resulting in higher prices and and a construction boom:

The major driver in this cycle has been a big ~20% year on year uplift in apartment approvals, casting a lot of doubt over the sticky supply response theory.

In fact, apartment approvals are booming to new record highs:

New South Wales, a state with both a dwelling and an infrastructure deficit, has been leading the way with gusto in recent years:

In NSW's case too, it's also been largely an apartment story, with nearly seven in every 10 approvals over the past year relating to unit and apartment stock in Sydney and the state-wide level of apartment approvals soaring:

That said, it's notable that what started as a New South Wales and Western Australia boom is now becoming more broad-based.

Only in the Australian Capital Territory jurisdiction, where new supply is essentially not really needed, are building approvals not materially higher than a year ago.

In terms of the capital cities, approvals are generally very strong as detailed by RP Data's Cameron Kusher here:

Source: RP Data, ABS.

"As you can see from the above chart, across each of the major capital cities there has been an upswing in dwelling approvals.

"The most significant upswing has occurred in Sydney and Brisbane however, the number of approvals remains much higher in Sydney and Melbourne than in all other cities.

"The number of dwellings approved for construction is at an all-time high currently in Perth, is very close to its record high in Sydney and at its highest level since the 12 months to June 2004 in Brisbane," wrote Kusher.

No signs of any constipated supply response there, rather the market just seems to be doing exactly what it should do, and the dwelling construction boom remains - albeit tentatively - still on track.

Acquirers of property, particularly buyers of units and apartments, must be wary of pockets of oversupply.

Great wall of foreign capital hits Sydney & Melbourne

Some years ago when I wrote my first book, I noted that one day in the not too distant future, the Aussie dollar would depreciate again and certain parts of our property markets would likely be hit by a great wall of foreign capital.

It's all part of a global shift towards storing wealth in real estate which I discussed in more detail here, and which we have seen playing out in London over the past two decades with ever-widening eyes.

However, as I noted in my book, foreign buyers generally aren't interested in smaller cities and regional centres.

Instead, they will be predominantly interested in buying medium-density properties in the areas they are generally most familiar with - that is to say, inner Sydney and inner Melbourne.

Credit growth in Australia is only just rebounding from 40 year lows and yet prices are surging, with Sydney prices up by 15.4% in the last 12 months alone.

Well, that unprecedented great wall of foreign capital is now here.There has been a lot of debate about foreign buyers purchasing illegally, but even approved annualised spending is up by a whopping 93% to an annualised equivalent of more than $33 billion.

The always-excellent Chris Joye highlighted in the AFR how foreign buyers are buying up to 40% of newly constructed homes in Sydney and Melbourne (while simultaneously completely disregarding the southern states):

"Foreign investors are likely key drivers of the Sydney and Melbourne housing booms, according to new UBS data, potentially buying up to 40% of all newly constructed homes, and accounting for up to one in eight Australian sales overall.

"Unprecedented levels of foreign buyer activity, combined with the ability of the $559 billion self-managed super fund sector to leverage its cash five times when making property purchases, could be two reasons why this Australian housing cycle is different to anything we’ve seen before."

Article continues on next page. Please click below.

Lucky 888 Visas take-off

An interest sub-plot which has not received much airtime in the mainstream media is that the controversial "Significant Investor Visas" are being issued overwhelmingly in New South Wales and Victoria too - 85% of them.

The investor "Golden Ticket" or "Lucky 888" visas (doubtless that subclass was chosen as they will be mainly issued to Chinese immigrants) require a minimum $5 million of investment in qualifying assets in exchange for a visa, and the rules allow them to be processed very rapidly.

Another 81 visas were issued in April and May taking the tally to date up to 255, but the big story is that another 928 applications for Golden Ticket visas have been lodged.

Tally all of that up and that's another $5 billion of investment coming overwhelmingly into the two major states, not to mention the additional wealth that the new visa holders will bring with them.

And this is doubtless only the beginning.

Canada recently shut down its equivalent visa scheme with there still being a staggering 59,000 shut out in the waiting lists, most of them wealthy Chinese.

Throw in all of that together with another new advent - SMSF lending for property investment - mixed in with record low interest rates, and I continue to see little prospect of dwindling prices in inner Sydney any time soon.

Yesterday's Overseas Arrivals and Departures data revealed some very interesting trends.

The number of short-term visitors to Australian shores reached a new record high of 583,600 in May on a seasonally adjusted basis.

The first key point of note today, which has actually been quite evident to me, both in the capital city and up and down the coast, has been the very substantial increase in the number of Chinese visitors to Australian shores.

It's long been argued by commentators that Australia will become a playground for wealthy Asians.

Not to say that all Chinese visitors are wealthy, of course!

But what has certainly been the case that there has been a strong and increasing interest in Sydney and Melbourne for $5 million Significant Investor or "Golden Ticket" Visas, with nearly 1,000 applications reportedly now in the queue to be processed in addition to those already dished out (85% of which were issued in Victoria and New South Wales).

The number of Chinese tourists in May alone hit 66,700 (+5.9% y/y) - which was 11.4% of the total visitors for the month - helping to pump the short-term visitor levels to new heights:

The number of long-term arrivals tailed back marginally to a shade under 760,000 on a rolling annual basis, from a peak level of close to 800,000:

After accounting for long-term and permanent departures, rolling annual net long term migration came in at just a little over 376,000 in May, which is also down from its most recent peak of approximately 408,000 a year ago:

Australia's population growth is now accounted for by approximately 60% net long term migration and 40% natural increase.

These figures appear to be commensurate with annual population growth tailing back from searing highs of well above 400,000 to slightly more moderate (although still undeniably strong) levels, perhaps somewhere in the 300,000s range in 2014.

Article continues on next page. Please click below.

Asian century

The Permanent Movements - Settlers data series showed that significant numbers of today's migrants hail from countries such as the Phillipines, Vietnam, Sri Lanka and Malaysia. From the Middle East, Iraq was another surprisingly strong contributor, at least, to me.

An interesting point of note is how the number of settlers from New Zealand, and in particular, the United Kingdom, have dropped off dramatically since peaking in January 2009 and February 2008 respectively on a rolling annual basis.

In Britain's case, I'm fairly certain from my own experience that this is in part due to dramatic shifts in the exchange rate caused by the respective fortunes of those economies, and therefore the relative cost of living for Poms in Australia, as I discussed in this timely post.

For my money, the biggest news of today's data set is explained by the graph below:

Note how permanent settlers from both China and India are now tracking at or close to record highs.

Incredibly, approximately one in every eight permanent settlers in Australia hails from China (12.3%), and nearly one in every seven from India (13.7%).

Unevenly spread

The above charts show how clearly Australia has increasingly embraced a "populate or perish" mentality in recent years, and this decade and the next are likely to be noteworthy for the dramatic impact of immigration from Asia.

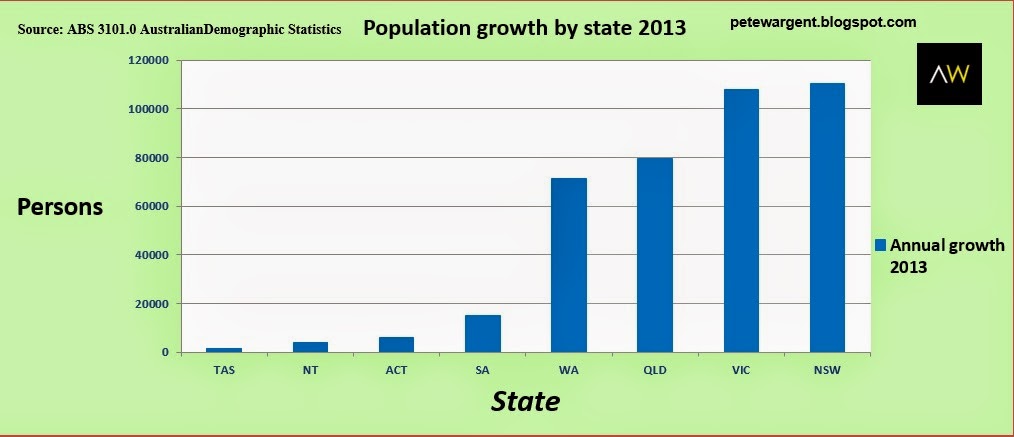

It's worth noting here though how the population growth differs greatly by state and by region:

The Australian Demographic Statistics for the year to December 2013 showed how the New South Wales population increased by a thumping +110,300 in the 2013 calendar year, with the overwhelming majority of that taking place in Greater Sydney.

Many of the highest growth rates are being seen in the inner and middle-ring suburbs if the harbour city, placing a colossal strain on existing infrastructure and housing markets.

This population and labour market growth has occurred, and is occurring, at the expense of nearly every New South Wales regional centre where population growth rates below the national averages have been seen.

On the other hand, net absolute population growth in Tasmania, the Northern Territory, the Australian Capital Territory and South Australia remained fairly minimal in 2013:

Summary

Population growth in 2014 looks set to be driven more by China and India than ever before, as well as a number of other south-east Asian and far-east Asian countries.

However, the absolute Australian population growth figure looks to have peaked for this cycle and perhaps may be closer to 300,000 than 400,000 in this calendar year.

On the face of it this ongoing strong population growth is all great news for property investors.

However, some alarm bells are starting to ring in a number of areas as higher prices and lower interest rates are driving a glut of new supply in some regions.

In particular, certain parts of Melbourne and regional Victoria appear to have worryingly high vacancy rates, as do some parts of regional New South Wales and Queensland.

Moreover, there has been plenty of questinable advice over the last couple of years about investing for high yields in overpriced mining towns.

Yet in some mining locations we now we have the prospect of a potentially devastating trifecta of declining commodity prices, a crunching drop-off in mining construction and a jumping in unemployment in the resources sector.

Each to their own, but personally I'd be giving the one-trick mining towns a very wide berth.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .