Low interest rates compressing yields in investment property: Holden Capital

The sustained low interest rate environment in Australia continues to drive yield compression in investment property with sales pushing well below 5% and in some cases 4%.

While this is frustrating for local buyers looking for safe investment opportunities and great for sellers, the question is where is it all going?

Holden Capital’s Construction Finance Market Update for Spring/Summer 2017 tried to figure that out.

The consensus of opinion amongst most economic observers seems to be that for as long as Australia continues to be identified as a safe and stable economy, quality property assets will continue to attract foreign investment. Compared to other competing stable economies, our property sector provides solid returns for investors chasing reliable income with strong WALE’s.

As a consequence the short to medium term outlook appears to be more of the same with local investors forced to look for bargains amongst lesser investment grade stock and yields could potentially tighten further.

With strong competition for quality tenants driving yield compression in large format retail centres, regionals and the key commercial sectors, the prospects for investment outside of these prime assets is likely to be characterised by local investors targeting more affordable investments and the refurbishment/ gentrification of areas previously passed over in order to reduce capital costs. Volatile stock markets, low interest rates and continuing foreign investment will also continue to drive yield compression so the question is, is there a change on the horizon?

Recent press has seen some commentators forecast the potential for interest rate rises in 2018 on the back of easing concerns around the strength of the underlying economy.

"We take the view that while there continues to be pressures on SME profits, household income growth remains weak and general consumer confidence poor, interest rates are unlikely to show signs of increasing for some time to come," says the market update.

As the squeeze on development funding due to APRA's restrictions began to bite, banks turned their attention to what they could continue to lend against and that was property assets which are income producing.

Investment lending against offices, retail, industrial sectors, hotels, etc forms part of the “Commercial” loan portfolio of a bank and while the regulator would like to see overall exposures kept below 10% of their balance sheets, there was scope for them to in some cases actually grow their exposure and then maintain it in line with their balance sheet growth.

“The emerging challenge for them however, has been that many overseas investors who are acquiring property are chasing a positive yield differential as they view the returns more like annuities so their intention is to hold long term, while in some cities a number of commercial buildings are being converted into residential projects,” says the update.

The weight of this additional capital inflow and demand from these overseas property investors (pension funds, investors and sovereign funds to name a few) aided by local demand has been a key driver of strong commercial property sales in an already low yield investment environment and, has led to a dramatic level of yield compression across these investment sectors.”

This in turn has raised concerns about overvalued property prices relative to historical benchmarks leading to suggestions of value bubbles and the future sustainability of the values and as a consequence, the banks debt ratios. As to how this will resolve itself is difficult to predict with the extreme being a significant reduction in values at a future date but the more likely outcome is a smaller realignment combined with a significant period of stagnation in values.

Either way, the banks are playing close attention to these issues and will be looking to avoid a situation where a major realignment would adversely affect their clients but more particularly their ability to remain compliant with APRA’s lending guidelines. All of which serves to demonstrate how the combination of regulatory constraints and concerns around rapidly appreciating values has resulted in a slowdown in investment lending by the major banks.

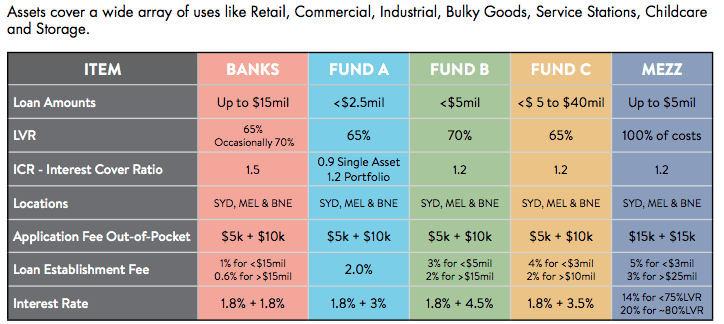

Guide to Commercial Investment Loans

Funding options outside of that sector are somewhat limited. In the recent past, Mortgage Funds provided the bulk of non-bank investment loans however the GFC saw a large number of these players exit the market and the remaining funds have limited capacity and or appetite. Unlike the development finance space where many small private funds have emerged to take advantage of the increased returns (and risk) on offer, there have been few new significant funding sources emerge to fill this void.

As always, there has also been a flight to quality by banks and other lenders seeking to improve the risk profile of their loan portfolios, so while the strong sponsors are being serviced, the gap is widening between them and the rest of the market.

Investment banks, hedge funds and opportunistic funds have increased their presence as funders of development property transactions, however the very nature of their return hurdles means that term debt is not a strongly targeted investment class. There are options out there, however the challenge is to understand who can fund and what the terms are (pricing, tenure, etc) as the market evolves.

“So to sum up, the investment lending landscape is not dissimilar to the construction finance sector with similar pressures and again, they are pressures that are not going to change overnight so it pays to have the right advice and support when you are thinking of raising debt for a new acquisition or refinancing,” it says.