After so many years of hearing that Australia's elevated housing prices were due to us not having built enough dwellings, it is now widely considered that we are building too many.

There's rarely much room for a middle ground in such debates of course, and we've apparently gone from "chronically undersupplied" to "Irish" in the relative blink of an eye!

Yet more fabulous research from Cameron Kusher of CoreLogic-RP Data using figures derived from

Cordell estimates has revealed the expected number of unit and apartment settlements over the next two years to April 2018.

There isn't too much of concern to to write home about in inner

Sydney where supply has been undwerwhelmingly inadequate for years, and where relatively few detached houses are built due to space constraints, thus necessitating the construction of more attached and higher-density dwellings.

Melbourne and

Brisbane have somewhat livelier risk profiles since these markets tend to supply detached and medium-density housing far more effectively.

Below are the expected unit settlement figures by capital city, courtesy of Kusher's once again outstanding research.

If (and this is a huge "if") every single one of these units makes it through to settlement, there will be 231,129 new capital city units and apartments settling over the two years to April 2018, which I calculate would in aggregate add just under 2.4 per cent to Australia's total established dwelling stock.

Of course there will be detached houses constructed too, and on the other side of the ledger there will also be demolitions and stock obsolescence to account for.

In reality at this stage in the construction and lending cycle it appears likely that a significant number of units and apartments will fail to settle - at least, not in accordance with the proposed schedule - while a fair proportion of those bought by foreign buyers will by and large be left vacant, and yet other units may never make it to completion at all.

Sub-regional risk areas

Drilling down to the SA3 statistical level it becomes clear that certain sub-regions have greater oversupply and emerging settlement risks than others, most notably in inner city

Melbourne and

Brisbane.

Inner

Sydney is expected to see comparatively few unit settlements, at least relative to the incumbent population, while if you're a hapless buyer trying to secure an apartment in the eastern suburbs right now you'd probably think that the "oversupply" talk must be some kind of cruel of perverse joke.

The statistical sub-regions of elevated risk in the harbour city include

Parramatta, where thousands of units are expected to settle over the next couple of years, and the statistical area incorporating

Strathfield-Burwood-Ashfield.

I also expect that the avenue of unbridled joy that is

Parramatta Road will become a unit construction hotspot in the years ahead.

"Greater oversupply than the US?"It was reported in the media yesterday that fundie Roger Montgomery has once again predicted sharp declines for property prices based upon these numbers:

"If we assume an average of 47,000 dwellings were constructed per quarter in the years 2012 to the first quarter of 2016, and we add to the 18,000 or 19,000 monthly approvals occurring now and project this number for eight months until the end of 2016, we arrive at a supply of 923,000 dwellings. During this period the number of dwellings required, as estimated by household formation, is 716,249. That suggests an oversupply of 200,000 dwellings".

Yikes, where to start?

Although faithfully reproduced in the media, this is a fairly hackneyed calculation to say the least.

Commencements did hit a record high in Q3 2015, but remember that high density projects can take several years to build, so actual dwelling completions are generally a worthier guide to housing supply.

Even before critiquing the projected approvals figures, the completions data shows that 47,000 dwellings were not constructed or completed in the years 2012 to 2015 - not even remotely close to this level, in fact - so why assume it?

Here's the real deal, with the rolling annual total completions actually tracking in a range broadly from only 140,000 to 150,000 per annum all the way through calendar years 2012 and 2013.

Only in Q2 2015 did the annual completion rates finally reach the levels assumed by Montgomery's figures.

Click to enlarge

Montgomery's national or macro level estimate is likely to be inaccurate, partly because it takes no account of demolitions and stock obsolescence, and partly because the "18,000 or 19,000 monthly approvals" projected forward are just that - approvals.

I can't move my young family into a building approval (and certainly not feasibly into a 45 square metre high rise unit approval).

If we are overtly generous and assume that that completions track at their highest ever level and a further 200,000 dwellings or so are completed this year then the total number of actual dwelling completions from the end of 2011 to the end of 2016 would be close to 860,000, and that's before accounting for demolitions and stock obsolescence.

Montgomery uses an estimated or projected "household formation rate" from March 2015 to derive an estimated oversupply of 200,000 dwellings. Since households can't be formed into dwellings that don't exist or aren't yet built (or for families, more pertinently, aren't family-appropriate), and since foreign investors may leave dwellings vacant, it's a pretty unreliable indicator to draw panoramic conclusions from.

Moreover, if there really is an oversupply of 200,000 dwellings, with a few notable localised exceptions, these dwellings aren't really showing up much in listings or available rental stock.

Actual population growth

We obviously cannot know the precise total population growth figures from the beginning of 2012 to the end of 2016, but my projections show that the total figure is likely to end up being close to 1.75 million, with an extra 26,000 or so heads in need of housing in Australia each and every month.

Recall that international student numbers are also going ballistic, particularly from China.

Especially given that this construction cycle has been unique in its undue focus on undersized high-rise dwellings, Montgomery's oversupply calculation has been...well, oversupplied.

Don't get me wrong, the outlook for the high rise sector is indeed bleak, but for the wider homebuyer market, not so much.

Looking at the actual completions data, the number of detached house completions has actually remained below previous cyclical peaks.

Click to enlargeClick to enlarge

Generally I prefer to look at what is actually built through to completion rather than building approvals (except where the building approvals figures provided offer superior opportunities for disaggregation).

In reality when the construction cycle turns, which given recent developments is likely to be hard upon us, monthly approvals and then commencements will swiftly decline, as they do in every cycle. Indeed, dwellings approved but not yet commenced have already increased to their highest level on record.

Certainly, developers are prone to partake in posturing or game theory - or in plain English, "playing chicken" - at this stage in the cycle, which can lead to localised overbuilding.

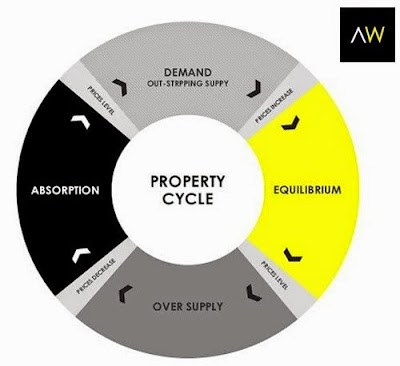

But on the other hand, the apparently rebuttable presumption that developers are completely thick-witted isn't veracious either, and where pre-sales and completions ultimately cannot be met then construction activity will in turn drop off. It's a cycle.

The above having been said, it has been well known for some time that forthcoming settlement risks on apartments are likely to be elevated, and the prospects for the high rise sector in particular appear to be quite desolate in more ways than one!

Contagion?

Montgomery then goes on to take an enormous leap of faith in noting that Australia "has a greater oversupply problem that the US did in 2007":

"It looks like Australia has a greater oversupply problem than the US did in 2007. The estimated 18 months is more than the 12 months oversupply the US had and after their property market collapse, it took five years before property prices began recovering."

For the reasons already noted the oversupply calculation has been overestimated.

The chart below shows just how skewed approvals have been to the high rise sector, with much of this stock being sold offshore.

Like all booms, high rise booms end in busts, and this one will be little different. However, if you look at what's been happening in the homebuyer market, we've actually been approving and then constructing fewer dwellings than in previous cycles, not more.

Montgomery's macro theory is presumably that when foreign buyers or domestic investors are unable to settle on new units over the next couple of years this will spark some kind of contagion across the homebuyer market.

However, much of this comes back to substitutability - more dwellings constructed do not necessarily equate to lower prices as I explored in more detail closer to the beginning of the construction cycle in 2013.

In the larger capital cities "where the ratio of new stock to existing stock is low, the impact of new stock on the price of existing dwelling prices is diminished".

Nobody can predict the future of housing markets accurately (including Montgomery's team - in fact, they warned investors to steer well clear of property before the last boom, and every year since) and, yes, this includes all analysts. There are simply far too many variables and unknown factors, with record low interest rates representing the latest distorting factor.

Settlement risks

Ultimately when a unit settlement fails to proceed there are only a few things that can happen. The property doesn't sell and it stays empty, the property use is changed by the developer (e.g. to short stay lets), or another buyer eventually buys the unit for a lower price.

Let's face it, new apartments in Australia are frequently excruciatingly expensive to say the least, so even if the prices of new apartments were to come back a bit in the short term the impact of established dwellings could simply be nil.

As for the oversupply of rentals, well strewth I'm not seeing that in inner Sydney, but granted the dynamics may be a little different elsewhere. The market is quite opaque, and it is unclear how much of the new stock purchased by foreign buyers remains uninhabited.

Temporary oversupply

It is worth noting that any cyclical oversupply of units is only likely to be temporary, with the level of population growth in Greater Sydney (up by 83,300 over the year to June 2015, to move beyond 5 million today) and Greater Melbourne (up by 91,600 in the year to June 2015, and today sitting at around 4.6 million) in particular being exceptionally strong.

Over the past ten years, the population of Sydney increased by more than 703,000. That of Melbourne increased by more than 832,000.

The wrap

Historically, supply responses generally don't stop capital city property prices from rising, but tightening of lending criteria or mortgage rates can.

Australia's 10 year bond yield fell to its lowest level in history yesterday at just 2.22 per cent, implying that further interest rate cuts may be in the post. Cash rate futures markets are pricing in at least one more cut in this cycle, and possibly two.

With the cost of money so cheap, ultimately the outlook for the new high rise apartment sector will be determined by whether lending criteria are tightened or relaxed.

Although Montgomery notes that property markets are "already cooling", established housing markets in the popular suburbs already seem to be responding to the record low cash rate. In Sydney's eastern suburbs auction clearance rates have been tracking at a dizzying 90 per cent rate. On the lower north shore the preliminary clearance rate this week was above 93 per cent.

There's not much evidence of oversupply in these areas. However I do agree that the high rise hubris could be a case of pride coming before a fall - for that sector.