Canberra and Hobart are turning into rental disaster zones

EXPERT OBSERVER

Despite a record investor boom since 2013 vacancy rates are now falling as investment loans are squeezed harder, with the national rental vacancy rate down from 2.3 per cent to 2.1 per cent over the year to September 2018 according to SQM's latest release.

In absolute terms, that represents a decrease from 72,955 to 70,172 rentals.

Every month I'm bombarded with theoretical constructs about how Canberra's land tax experiment won't impact the rental market...and every month the rental vacancy rate falls further, now down from about 2½ per cent to just 0.6 per cent since taxes were initially all but doubled.

I guess the idea was that people in the ACT earn high incomes so homeowners can afford to pay exorbitant taxes, but unfortunately ludicrously high taxes don't discriminate and it's turning out to be a disaster (especially for asset-rich but income-poor homeowners, and now for renters too).

The ABS rental CPI index has more lag than my nanna's boiler, but more timely industry asking rents indices are now pointing to double-digit rental price increases for the nation's capital.

Indeed, SQM Research's asking rents index shows the median asking rent for houses increasing by 31½ per cent over the past three years.

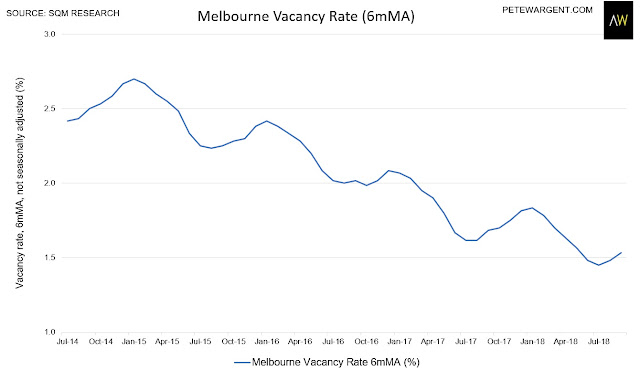

Plotted below are the capital city vacancy rates reported by SQM Research on a 6mMA basis so that you can see the trends.

Click here to enlarge.

Ouch.

Hobart rentals evaporate

Hobart has increased in popularity over the past few years, but with banks either dithering or knocking back investor loans the rental stock has now totally evaporated.

Hobart has increased in popularity over the past few years, but with banks either dithering or knocking back investor loans the rental stock has now totally evaporated.

With median asking rents in in the Tasmania capital city already up by 29 per cent over the past 3 years new rental supply should be abounding.

But instead it has completely crashed to sit close to the lowest level on record for any Australian capital city at just 0.4 per cent.

Asking rents for houses in Hobart were up by more than 6½ per cent over the past quarter alone.

With only 108 (!) rental vacancies now remaining - please see the definition of a rental vacancy before emailing me - Hobart rents are now destined to increase by more than 50 per cent through this cycle.

Meanwhile kamikaze commentators continue to call for tighter lending criteria for investors and scrapping negative gearing.

Before you pile in to Hobart real estate too late in the cycle remember that small markets can be more volatile and building approvals in Hobart are just coming off 99-month highs.

I suppose a supply shock is one way to get consumer price inflation somewhere closer to the target range, with some forecasters already anticipating another dismal 1¾ per cent CPI print next time around.

Adelaide is heading in a similar direction, with the vacancy rate now down to just 1.1 per cent.

Brisbane has considerably more breathing space following its preceding record apartment construction boom, with the vacancy rate down far more comfortably from 3½ per cent to 2.9 per cent over the past year.

As an interesting aside, check out how seasonal Melbourne's rental market these days as population flows become more fluid, partly due to more international students.

As an interesting aside, check out how seasonal Melbourne's rental market these days as population flows become more fluid, partly due to more international students.

Christmas could be interesting this year.

Sydney elevated

The only major city that's seen a meaningful increase in rental vacancies over the past year is Sydney at 19,469 or 2.8 per cent (largely due to investors that bought off the plan a couple of years ago).

Unfortunately for these investors that bought new at inflated prices they'll probably be in negative equity as they settle.

While most of the city doesn't have especially high vacancy rates - for example, the Canterbury-Bankstown region sits only at 2.2 per cent - some parts are experiencing a surge of completions, and thus very high rates of vacancy, including most notably the Hills District.

Click here to enlarge.

19,469 sounds like a lot for Sydney vacancies, and it sort of is - arguably about 16,000 would be a rental market in balance - but let's face it, at the present rate of population growth this could turn around into a rental shortage on a dime if investors pull up stumps.

The summer months tend to be much busier in Sydney and Melbourne these days, so let's see what happens over the festive period.

Finally, the coal price bust and subsequent super-boom has seen the vacancy rate in the Hunter Valley tumble from sky-high levels in 2015 to just 1.3 per cent.

There could be an interesting twist in the tail for the coal-mining towns that took such a hit in the aftermath of the resources construction boom.

The coking coal price has burned up into the stratosphere at $215/tonne (or about A$300/tonne) which is huge for Queensland.

The summer months tend to be much busier in Sydney and Melbourne these days, so let's see what happens over the festive period.

Finally, the coal price bust and subsequent super-boom has seen the vacancy rate in the Hunter Valley tumble from sky-high levels in 2015 to just 1.3 per cent.

There could be an interesting twist in the tail for the coal-mining towns that took such a hit in the aftermath of the resources construction boom.

The coking coal price has burned up into the stratosphere at $215/tonne (or about A$300/tonne) which is huge for Queensland.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.