It's now become clear (if it wasn't already obvious) that interest rates aren't going to be hiked this year, and probably not next either.

Employment is picking up nicely in some capital cities, and population growth is rising too, driving demand for housing.

Meanwhile, the lack of enticing alternatives will keep a healthy volume of investors interested in real estate, with the cash rate stuck at record lows for the foreseeable future.

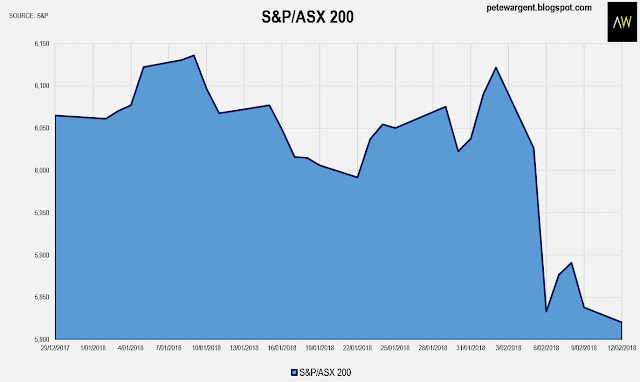

Since closing at 6135.81 on January 9, the Aussie share market as measured by the ASX 200 index has already dropped by -5.13 per cent.

An inauspicious start to 2018 to say the least.

'Pain trade'

US stock futures are up quite strongly at the time of writing, so perhaps tomorrow will be a better trade Down Under.

But somehow it seems doubtful that stock market nerves are going to be settled for a while yet.

That's the uncanny tendency of markets to deliver the maximum amount of punishment to the most investors from time to time, especially after a long, strong run.

Myer (ASX: MYR) finished today's trade with a fresh low close of 55 cents.

Shorters should now be wary of the takeover risk.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.