Slower population growth implications for property investors: Pete Wargent

As I argued a year ago, by the third quarter of 2014 it had become evident that the assumption reported widely in the media that the population of Australia would boom by around 2.4 million persons over the next six years was too high - much too high, in fact!

Over the longer term we might indeed expect to see much stronger levels of population growth return for the reasons I have already explored, but for the foreseeable future lower population growth will be the new norm.

Let's take a look at the implications of the latest figures in three parts.

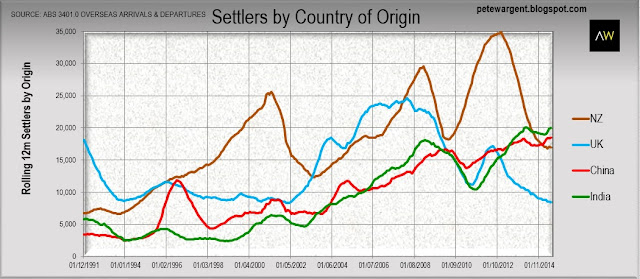

Part (i) - Slowing immigration nationally

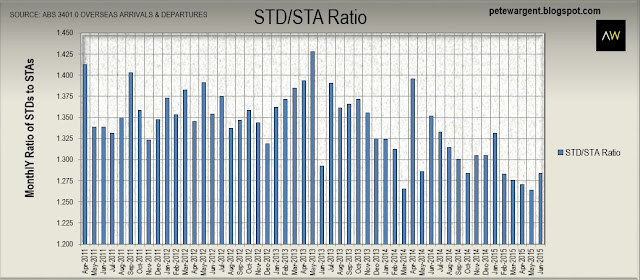

Part (ii) - Record visitors to Australia

While the corresponding drag on overseas travel by Australians has only been fairly gradual to date (denoted by the red line above), the weaker dollar also means that over time comparatively fewer Aussies will be inclined to make overseas trips, which in turn will act as a further boost for the domestic economy.

After all, travelling overseas is not quite as much fun as when the dollar was at sky high levels just a few years ago!

One trend which is definitely not slowing down is the number of Chinese visitors to Australia with more than 1.25 million visitors from China, Taiwan and Hong Kong over the past 12 months, with the latest figures showing no signs of this emerging mega-trend easing off.

Furthermore there has been an explosion in the number of foreign students in Australia - also largely hailing from Asia - another trend which has in part been driven by exchange rate movements.

This is an emerging demographic trend which will impact Sydney and Melbourne most keenly.

Part (iii) - 3 implications of lower population growth

So what are the impacts of slower population growth in Australia, which could continue for the foreseeable future?

Over the next few years there will be a lower than expected requirement for investment in building offices, warehouses, housing, machinery, plant and equipment.

Secondly, with employment growth having tracked at an estimated 2.1% or 243,600 new jobs over the past year - which is considerably faster than the estimated rate of population growth of just 1.4 per cent - the Reserve Bank now believes that the unemployment rate has likely peaked for this cycle.

Accordingly population growth has become more capital city focused.

The most recently available data showed that Greater Melbourne and Greater Sydney alone accounted for all but half of Australia's total population growth, while Greater Brisbane and Greater Perth accounted combined for close to nearly a quarter of the total.

Regional population growth on the other hand has in aggregate been been slow and slowing.

As for whether the mining boom will have a second wind? Highly unlikely: that's not the way that commodity cycles typically tend to work.

The Reserve Bank's Commodity Index was once again smoked by another 5 per cent on a monthly average basis in SDR terms in July to be a punishing 20.2 per cent lower over the past year.

Ouch.

In Aussie dollar terms the decline has been a somewhat less dramatic 8.5 per cent year-on-year, but nevertheless Australia's terms of trade (TOT) remain well above their long run average (and TOT booms have historically tended to over-shoot on the downside too).

Oil, aluminium, copper and gold have all hit half decade lows in recent times, while the price of silver has tracked little better.

Slightly bizarrely - given that coal prices are well below the project's notional break even point - the Adani Carmichael Mine is one possible exception to the accelerating decline in mining investment.

Some folk with the power to exert material influence evidently has the government's ear relating to this essentially unviable mega-project.

Generally speaking, however, mining production is ramping up, there is heavy downward pressure on commodity prices, and ever fewer material projects have been passing viability.

Going forward population growth in Australia will follow the employment growth, which has been heavily focused on Sydney and Melbourne, and to a somewhat lesser extent Brisbane and the Gold Coast.

Indeed, over the past year more than 80 per cent of employment growth has been found in New South Wales and Victoria, and overwhelmingly in Sydney and Melbourne.

The Reserve Bank added its own outlook for the housing market in the latest SOMP:

"Supply constraints, particularly in Sydney, may limit the extent to which new dwelling investment can satisfy growing demand, which raises the possibility that housing prices will grow more quickly than forecast.

Also, housing prices outside Sydney and Melbourne are little changed over the past year or so and may not yet have responded fully to the very low levels of interest rates."

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.