No real surprises to be found here, based upon what we have already seen.

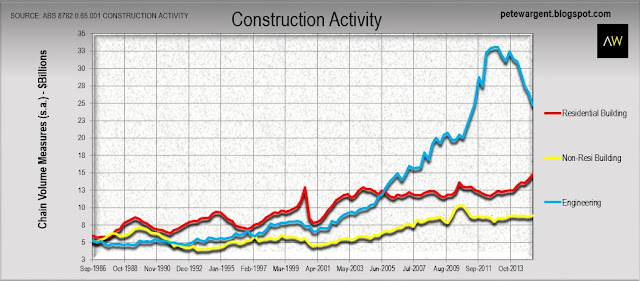

Resources construction continues to decline apace, with engineering construction in chain volume measures terms declining by a further 7.0% in the first quarter of the calendar year, to be down by more than 20% year-on-year.

Recent commodity price action suggests that the pace of the decline may even accelerate from here.

Recent commodity price action suggests that the pace of the decline may even accelerate from here.

On the positive side of the ledger, as implied by record high building approvals, residential construction has begun to respond to low interest rates, increasing very strongly by more than 5% in Q1 to be up by 11.9% over the past 12 months.

Non-residential building was up by 1.3% in the March quarter, but has increased only by a paltry 0.7% over the past year.

Here's the chart:

Here's the chart:

Piecing these figures together it's clear that residential construction alone will not fully compensate for the decline in mining capital expenditure, with total construction activity of $48.3 billion now declining back to the levels seen in Q4 2011.

That said, $48.3 billion is still an elevated level of activity in historical terms...for now at least.

The full force of the challenge will come when the last of the mega projects finally reaches completion, with a number of massive projects still in the construction phase such as the $34 billion Ichthys LNG project in the Northern Territory.

Regional centres

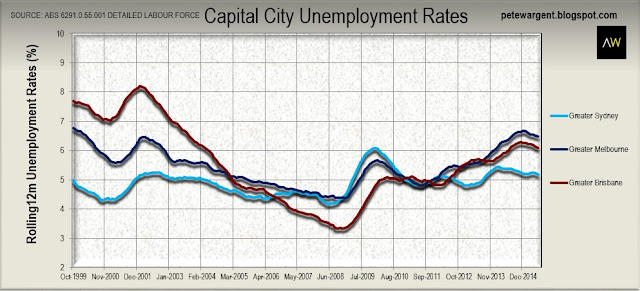

The big picture is that as part of this rebalancing of the economy construction activity - and therefore employment - is shifting back away from the regions and towards the largest capital cities.

The latest unemployment rate figures for Sydney (4.7%), Brisbane (5.2%) and Melbourne (5.8%) may prove to be seasonally low, but the smoothed rolling 12 monthly data does suggest that unemployment rates in all three of the most populous cities may just be trending steadily down.

Regional centres

The big picture is that as part of this rebalancing of the economy construction activity - and therefore employment - is shifting back away from the regions and towards the largest capital cities.

The latest unemployment rate figures for Sydney (4.7%), Brisbane (5.2%) and Melbourne (5.8%) may prove to be seasonally low, but the smoothed rolling 12 monthly data does suggest that unemployment rates in all three of the most populous cities may just be trending steadily down.

Click to enlarge

The economy is Sydney in particular is thriving. Indeed, with employment, retail trade and house prices all booming, monetary policy settings are all too easy for the harbour city.

Unemployment rates in Newcastle and Lake Macquarie seem to have steadied of late, but the trend in the Hunter is still upwards for now.

It's likely to be a tough period of adjustment for towns in the Upper Hunter such as Muswellbrook and Singleton, with further job cuts at BHP Billiton's Mr. Arthur reported to be "imminent".

It is worth noting that directly the mining industry is only a relatively small employer, but the reversal of the mining capital expenditure boom does have significant flow-on effects to other ancillary industries.

Labour market conditions had seemed to be picking up in the Illawarra, but it is nevertheless the case that the outlook for domestic steelmaking remains potentially bleak.

The Australian put it fairly bluntly, stating that the closure of BlueScope's Port Kembla steelworks is "a matter of when, not if".

A recent poll in the Illawarra Mercury showed that more than 70% of respondents believe that the closure of the plant would cripple the Illawarra economy.

The economy is Sydney in particular is thriving. Indeed, with employment, retail trade and house prices all booming, monetary policy settings are all too easy for the harbour city.

Unemployment rates in Newcastle and Lake Macquarie seem to have steadied of late, but the trend in the Hunter is still upwards for now.

It's likely to be a tough period of adjustment for towns in the Upper Hunter such as Muswellbrook and Singleton, with further job cuts at BHP Billiton's Mr. Arthur reported to be "imminent".

It is worth noting that directly the mining industry is only a relatively small employer, but the reversal of the mining capital expenditure boom does have significant flow-on effects to other ancillary industries.

Labour market conditions had seemed to be picking up in the Illawarra, but it is nevertheless the case that the outlook for domestic steelmaking remains potentially bleak.

The Australian put it fairly bluntly, stating that the closure of BlueScope's Port Kembla steelworks is "a matter of when, not if".

A recent poll in the Illawarra Mercury showed that more than 70% of respondents believe that the closure of the plant would cripple the Illawarra economy.

Click to enlarge

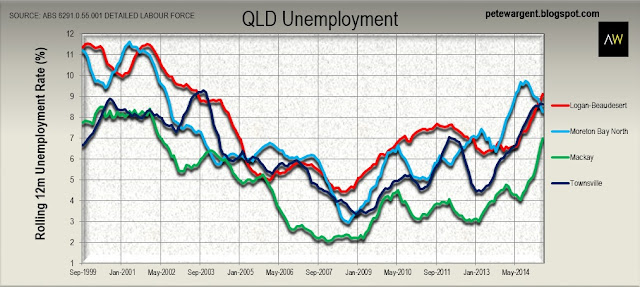

Parts of regional Queensland have similar tales to tell.

Again, unemployment rates from month to month don't tell us a great deal, and things seem to have stabilised in some regions, but the general trend has been towards unemployment rates reverting higher as the resources investment boom phase falls away.

Parts of regional Queensland have similar tales to tell.

Again, unemployment rates from month to month don't tell us a great deal, and things seem to have stabilised in some regions, but the general trend has been towards unemployment rates reverting higher as the resources investment boom phase falls away.

Towns facing something of an uphill struggle include Dalby, Chinchilla, Roma, Moranbah, Emerald., Dysart, Bowen and others.

Gladstone has also been going through its own transition phase over the past year or two.

Tourism regions on the other hand should benefit from the ongoing depreciation of the Aussie dollar.

Gladstone has also been going through its own transition phase over the past year or two.

Tourism regions on the other hand should benefit from the ongoing depreciation of the Aussie dollar.

There is not a lot new here, of course, and the rapid decline of engineering construction has evidently been in the post for some time now.

Although it is generally reported that a decline in construction is a "bad thing", it is also clear that Australia couldn't go on building mines for ever - at some stage they need to produce exports.

Reductio ad absurdum, if any decline in construction activity is bad, then Australia would've been better off not having a mining boom in the first place.

That said, the rising levels of regional unemployment reported over the past week represent compelling evidence that many resources-influenced regions are set to be hit hard by declining demand in the years ahead.

On the other hand the largest capital cities are benefiting from a boom in residential construction in particular together with the associated multiplier effect.

One consequence of this is that certain inner city areas will evidently end up with an oversupply of apartments, particularly of high rise stock. Unit developments marketed overwhelmingly to investors may include those to avoid.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.