After a bit of pause in the ABS Overseas Arrivals and Departures survey we have had no fewer than seven such releases since May...and there's yet another in the post in the next couple of days too!

The slowdown in Australia's population growth to +330,000 in 2014 was straightforward enough to predict for those who were paying attention - with Sydney and Melbourne leading the population growth charts - and regular readers will be well across the drivers of the downtrend.

While most commentary is finally just about latching on to last year's story, I'm now getting more interested in trying to anticipate the eventual rebound - the causes thereof, and the likely timing.

Let's have a look at a four trends to watch, and particularly the role of exchange rates thereon.

Let's have a look at a four trends to watch, and particularly the role of exchange rates thereon.

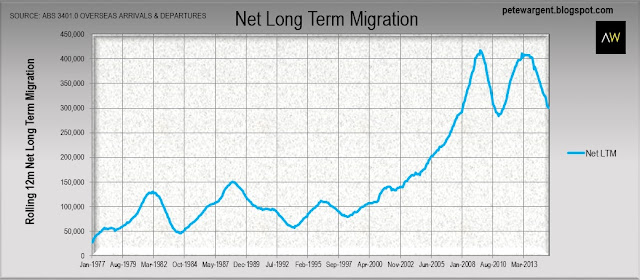

1 - Net long term migration

Rolling annual net long term migration slowed considerably from around 411,000 in January 2013 to just above 300,000 by April 2015.

The downtrend is still in place but appears to be slowing.

In any case, following some analysis of previous years' data the ABS itself cast doubts on the relevance of the permanent departures statistics.

The ABS research implied that while ostensibly more than 380,000 Australians left the country on a long term or "permanent" basis over the past 12 months, a high proportion of them are likely return home within just a year. Observed the ABS:

"Analysis shows that the majority of those with an intention of permanently departing, return to Australia within the following year. For example, in the calendar year 2011, out of the 84,240 Australian residents who stated they were departing permanently, only 15,890 spent 12 months or more overseas."

whether or not this proves to be true in the future is less clear, but it does serve as a timely reminder that all is often not as it seems when it comes to demographic trends.

2 - Record short term arrivals

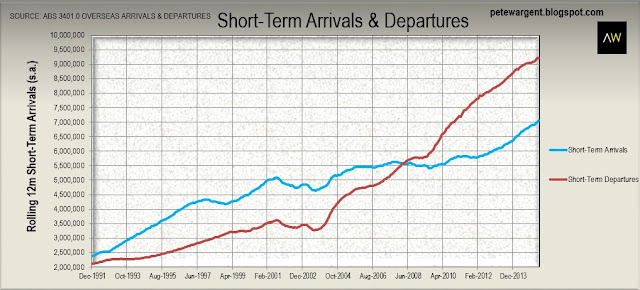

As the Aussie dollar has declined from around 110 US cents close to just 75 cents, the domestic economy is set to benefit from record high short term arrivals, now tracking at well over 7 million in the year to April 2015.

The chart below suggests that we might expect trends in short term arrivals and departures to dovetail with respect to changes in the strength or otherwise of our currency.

With the awesome strength of the Aussie dollar through the mining investment boom it was no surprise to see short term departures exploding higher.

I even took full advantage of this myself to undertake a rather extravagant world cruise in 2011, something which seems somewhat less appealing now, at least from a cost perspective!

Now that the dollar has depreciated it is all but inevitable that this rampant trend towards overseas travel will reverse and comparatively fewer Australians will choose to travel and holiday overseas.

In fact, although the above chart doesn't yet appear to suggest so, this has already begun to happen, which is a net positive for the domestic economy.

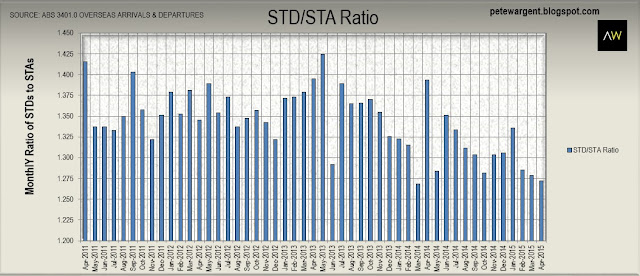

The below chart records the ratio of short term departures to short term arrivals by month, and reveals that the ratio has steadily fallen to sit at its lowest level since the first quarter of calendar year 2011.

The Aussie dollar likely has further to fall, and in turn so too does this ratio.

3 - Compositional shift of arrivals

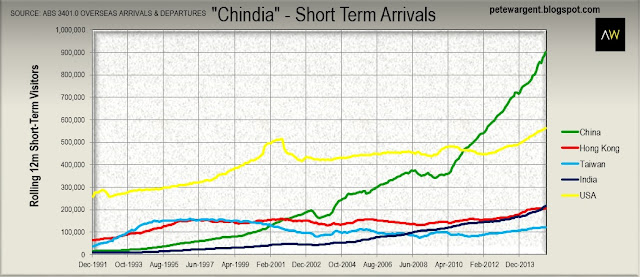

When people observe housing market trends and opine that the role of Chinese investment might be a passing fad, they might want to think again.

Credit Suisse projects that Chinese investors will drop some $60 billion into Australia's housing markets over the five years to 2020, more than double the estimated $28 million in the preceding five years.

Meanwhile the number of Chinese USD millionaires is expected to rise at 14% per annum (Chinese stock market corrections notwithstanding!) thereby doubling to 2.6 million by the end of the decade.

While there must be an element of guesswork and extrapolation involved here, I've seen nothing in the housing market activity which causes me to cast doubt on the estimates.

Comfortably the most significant change in short term visitors to Australia has been the explosion in Chinese short term arrivals since the turn of the century.

In February 2015, the month which incorporated Chinese New Year, an astonishing 198,700 visitors came to Australia from China, Hong Kong and Taiwan combined.

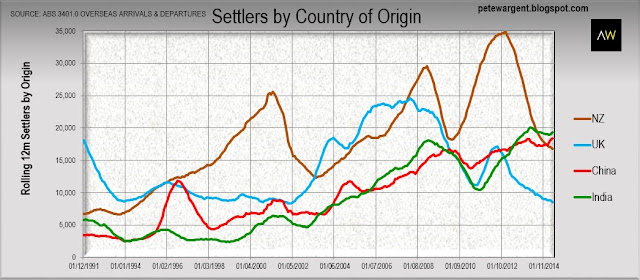

We can expect that eventually some of these trends will flow through to Australia's permanent settler figures.

While the number of Brits settling is threatening to become immaterial - at just 590 settlers in April, less than a quarter of the levels seen in 2008 - and permanent New Zealander immigrants are trending sharply down, Indian and Chinese settlers are rapidly tracking at or close to record levels.

Indeed, there were 73,370 settlers hailing from Asia in the year to April 2015 as compared to fewer than 15,000 from Europe.

It's a huge shift in composition that is underway.

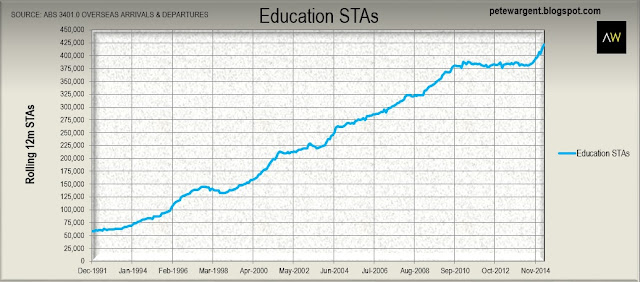

One other unfolding trend to watch which is also tied to the depreciation of the currency is the record number of foreign student enrolments seen in the first quarter of 2015.

The ABS series shows that the rolling annual number of short term arrivals into Australia in the year to April for education has blasted to its highest ever level at 421,400.

This is another demographic trend which is heavily skewed towards Asian participants, and Chinese students in particular, and one we can expect to keep on growing.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.