Top variable investor loan rates: Mozo

Property ObserverAugust 2, 2015

These are the top variable investor loan rates available right now, including minimum loan amounts and maximum LVRs, according to banking comparison website Mozo.

Commonwealth Bank is applying a premium to its fixed rates for investors - 30bp for 1 and 4 years, 40bp for 2 and 3 years, and 10bp for 5 years.

Bankwest has capped LVR's at 80% for investors across most products. Rates are higher for investors on its 2 year fixed rate and the 3 year introductory rate on its Super Start Home Loan.

NAB is limiting the maximum LVR on investor loans to 90%.

St.George/BankSA/Bank of Melbourne has a discount on its Basic Home Loan of 34bp for owner occupiers and its 2 year fixed rates are 20bp lower for owner occupiers.

2nd TIER LENDERS

ING Direct increased fixed rates for investors by 20bp and removed discounts for investors with larger loan amounts and lower LVR's on its Orange Advantage and Mortgage Simplifier variable rate loans. The interest only option is now only available on loans with LVR's less than 80%.

ME Bank now applies a premium for investor loans of 15bp to the variable rates on its Flexible Home Loan Member Package.

AMP has ceased accepting applications for investor loans and adjusted the rates and tier levels on its Professional Package. Variable rates now start at 4.12% for loans over $750,000. ANZ's Simplicity PLUS loan is no longer available for investors and there's a premium on the bank's fixed rates of 40bp for 1 and 4 years, 60bp for 2 and 3 years, and 30bp for 5 years.

Suncorp is charging a premium to investors on its variable Home Package Plus which varies depending on loan amount and LVR, and has imposed a maximum LVR for investors of 90%. For LVR's less than 80% the rate for owner occupiers borrowing more than $750,000 stayed at 4.15%, but increased by 9bp for owner occupiers borrowing less than that, while increasing by 29bp for investor loans under $750,000 and increasing by 24bp for investor loans over that amount. For LVR's 80 to 90% the rate was cut to 4.34% for all owner occupiers but for investors the rate stays at 4.49% for under $750,000 and 4.44% for more than that.

NON-MAJOR LENDERS

Freedomlend has increased rates for investors by 10bp and capped LVR's at 80%.

Heritage Bank increased variable rates for investors by 30bp across most products and there's now a 10bp premium for its fixed rates.

Homestar increased rates for investors by 10bp and now has a maximum LVR of 85%.

BUILDING SOCIETIES, CREDIT UNIONS & MUTUALS

CUA has dropped the maximum LVR on its Fresh Start loan from 80% to 70% for investors, and launched two new products (Fresh Start Access and Fresh Start Basic) that are priced 30bp higher for investors.

Newcastle Permanent Building Society will lend up to 80% LVR for investor loans and applies a $550 application fee.

UBank will apply a 29bp premium to investor and interest only loans from 10th August.

Westpac has capped LVR's for investor loans at 80%, and is charging an extra 15bp for investors during the 2 year introductory rate period on its Flexi First Option Home Loan.

ANZ's Simplicity PLUS loan is no longer available for investors and there's a premium on the bank's fixed rates of 40bp for 1 and 4 years, 60bp for 2 and 3 years, and 30bp for 5 years.

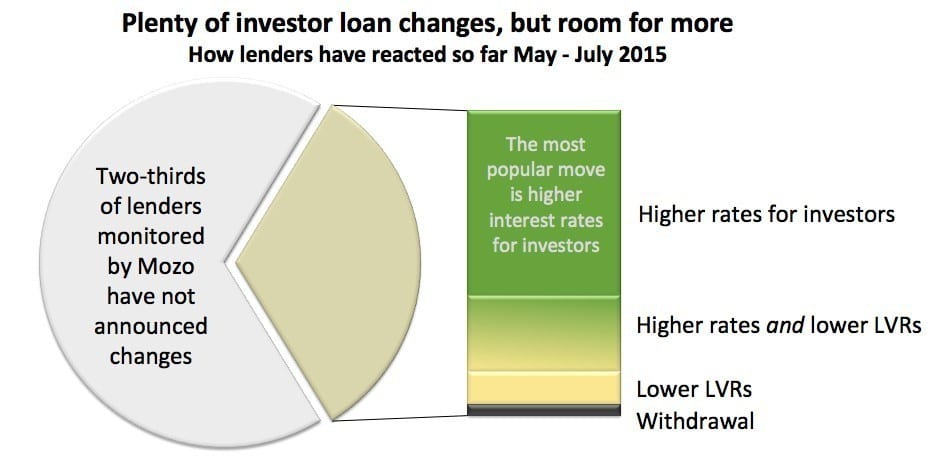

FOR INFORMATION ON PROPERTY LOANS, RATES AND MORE, VISIT MOZO.COM.AU OR CLICK HERE FOR THE FREE PROPERTY OBSERVER EBOOK, GET LOAN-SAVVY – TIPS FOR A FIRST TIME, INVESTMENT OR REFINANCING LOAN, WHICH HELPS YOU DECIDE ON A HOME LOAN THAT MEETS YOUR REQUIREMENTS.