The latest interest rate changes following the RBA cuts: Canstar

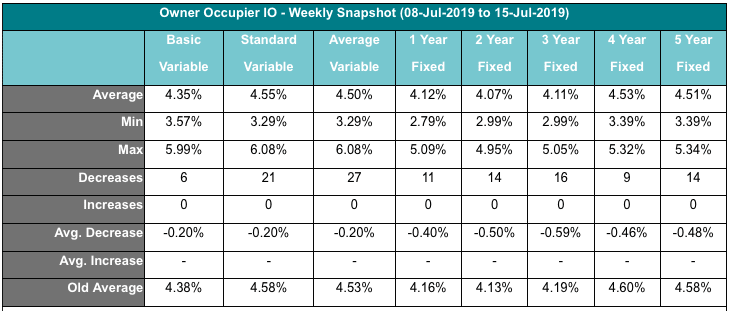

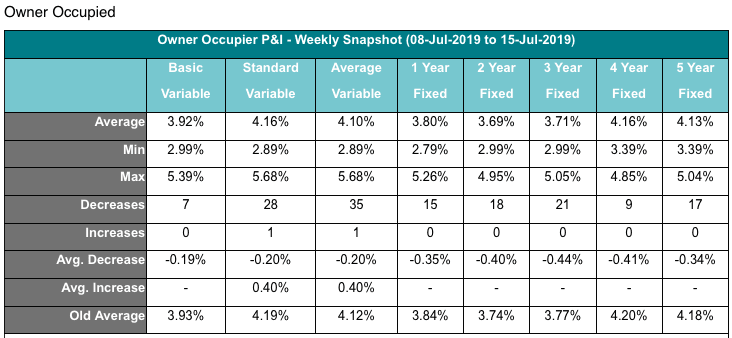

Over the past week, 14 lenders decreased owner occupier variable rate loans, while 12 providers decreased owner occupier fixed rate loans, according to Canstar.

Greater Bank have introduced new low rates for owner occupier fixed rate loans: 2.79% for a one-year fixed rate, 3.39% for four and five-year fixed rates.

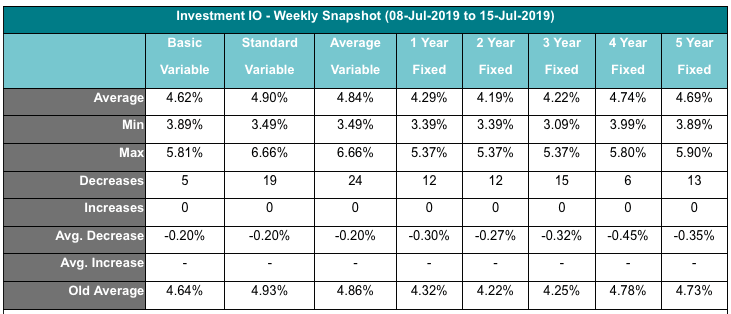

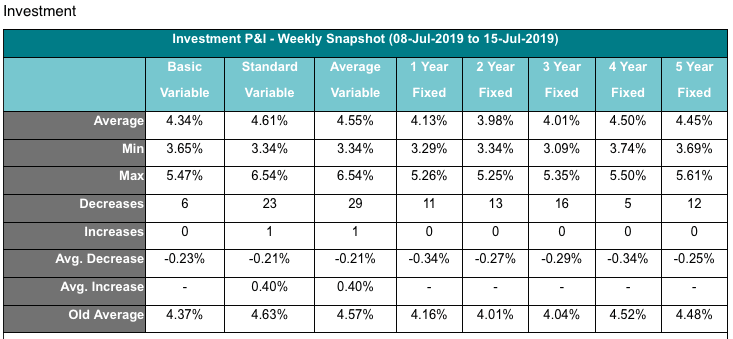

They also found when looking to investment rates that 12 providers decreased variable investment rates and 10 lenders decreased investment fixed rates.

ANZ and NAB made variable rate decreases of 0.25% and 0.19% respectively; NAB also reduced its fixed rates by between 0.30% and 0.80% for both owner occupier and investment loans.

The tables below display these latest changes: