Refinancing mortgages continue to rise as new listings also up: CoreLogic's weekly snapshot

Mortgage holders are continuing to refinance their home loans as banks fight for market share as interest rates continue to hold at record lows.

There's no suggestion from the RBA that rates will change until at least 2022 as the central bank attempt to drive the economy.

And as fixed rate mortgages expire, more and more mortgage holders are likely to refinance.

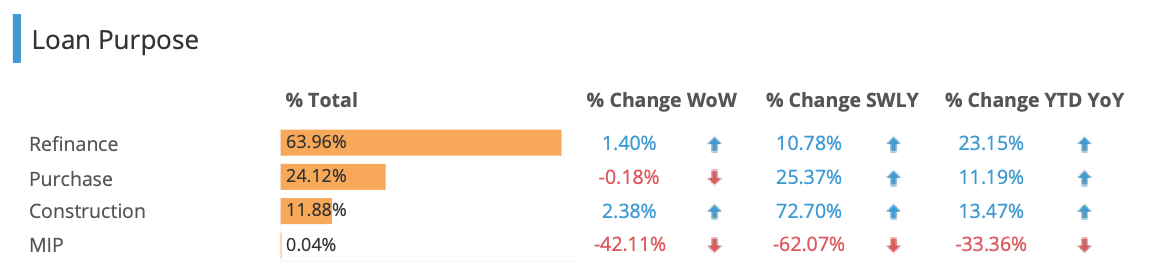

According to CoreLogic's early market indicators, refinancing mortgages have rose 1.4 per cent.

That takes refinancing up over 23 per cent year on year.

Mortgages for new purchases dropped slightly over the last week, down -01.8 per cent, but are still over 25 per cent up year on year.

And CoreLogic has seen a -42 per cent decline over the week in MIP reports, which is reports for a mortgagee in possession valuation..

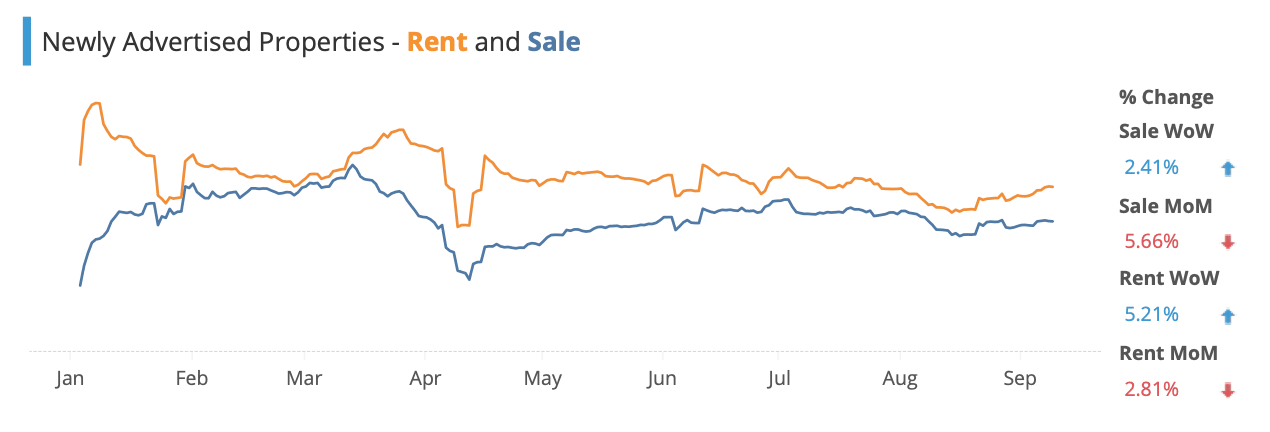

Newly Advertised Properties

Newly advertised properties were up 2.41 per cent over the week, according to CoreLogic's database.

New listings however are still -5.6 per cent down over the month.

Rental listings are up 5.2 per cent, again still down over the month.

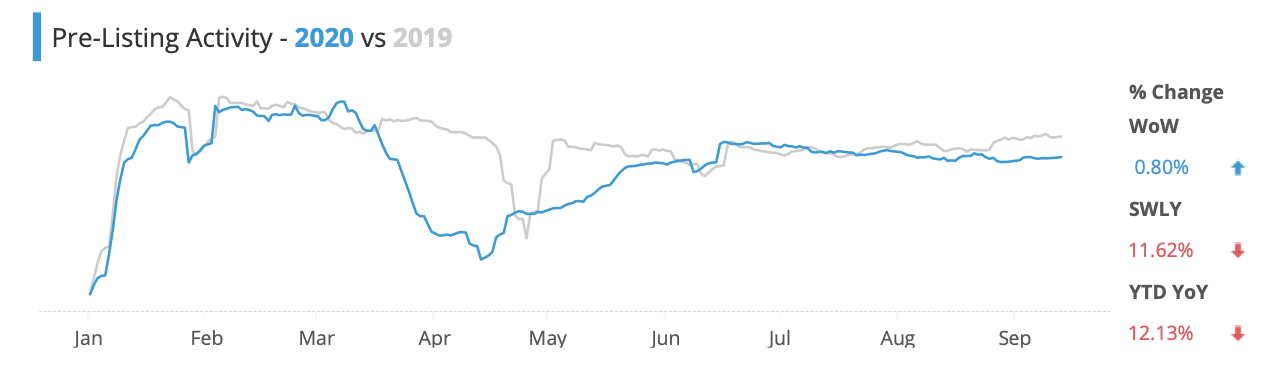

Pre-listing Activity

There's been a small rise in pre-listing activity, which CoreLogic define as more comparative market analysis reports being generated through their platform.

This report is essentially an indicator of new listings on the horizon.