Australian banking needs to start preparing for a rainy day: APRA's Wayne Byres

GUEST OBSERVATION

On 1 July, APRA turned 20. Two decades of prudential regulation have required APRA to tackle all manner of issues, but a constant theme in our work has been building strength and resilience. The community wants their financial institutions to be safe, but the business of finance is the business of risk-taking. So building resilience against those risks is fundamental to preserving ongoing trust and confidence in the financial sector.

Australia’s last recession predates APRA’s existence. But there are no guarantees into the future. At some stage, the financial skies will darken, and it’s important our financial institutions have prepared themselves to weather the storm.

Australia’s financially sound banking system

Particularly in the past six months, significant attention has been placed on governance and culture within banking institutions, and rightly so, as these are issues of vital importance to the Australian community. Equally important for long-term prosperity is the underlying strength and resilience of our banking system.

The Australian banking system is widely regarded as financially sound. The major banks, for example, are some of the most highly rated banks in the world; they are ranked much higher by market capitalisation than asset size; and their capital ratios measured on a like-for-like basis are undoubtedly strong relative to international peers. The banking system’s funding profile has improved considerably since the global financial crisis, and asset quality remains solid. All in all, it’s a pretty positive financial story.

But so it should be: after 26 years (and counting) of almost continuous economic expansion, the banking system should be nothing if not financially sound.

History tells us, however, it’s not wise to assume good times will last forever. It might be sunny today, but financial storm clouds and strong winds will arrive at some point. In banking, a prudent strategy is therefore founded on three pretty simple premises:

- maintaining sound lending standards when the sun is shining and winds are calm;

- building and maintaining financial resilience today to protect against stormy weather in the future; and

- preparing contingency plans to ride out a severe storm, if one does hit.

While the banking system is in a sound financial position today, we should always remember that building resilience is easiest when times are relatively good. Put simply, it’s better to prepare for stormy weather well before a storm hits.

While the sun shines – building resilience and maintaining sound lending

Let me start with residential mortgage lending standards.

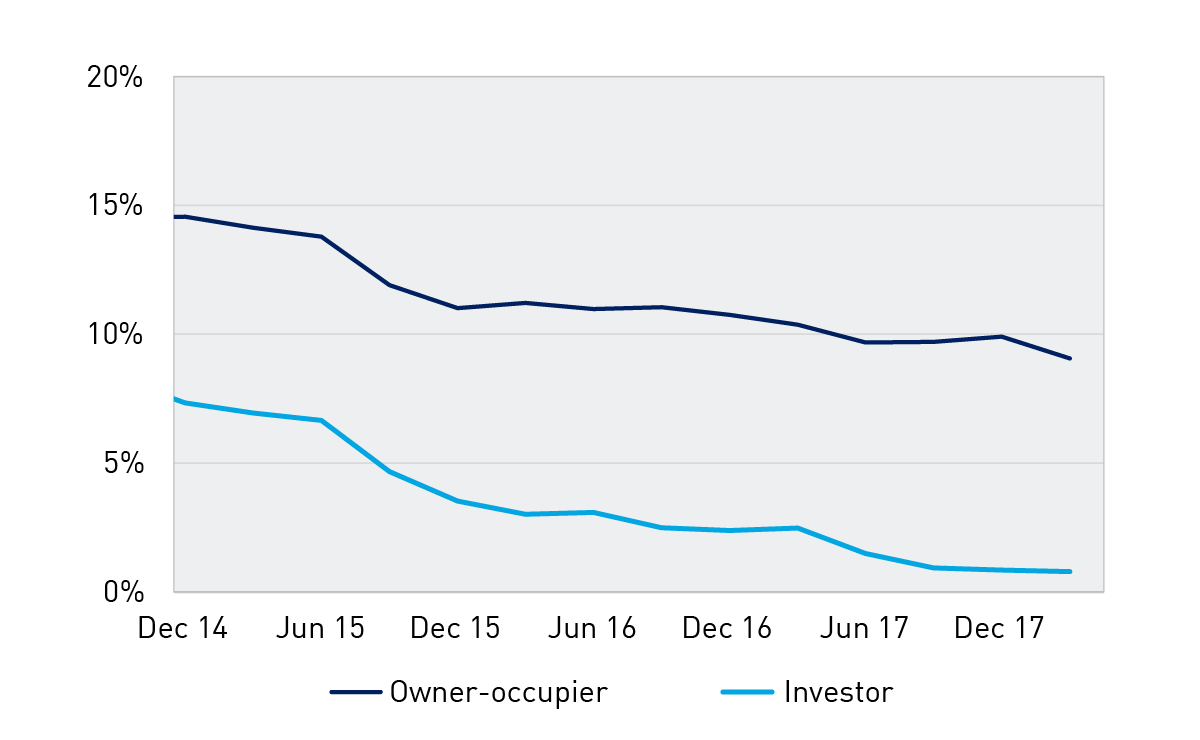

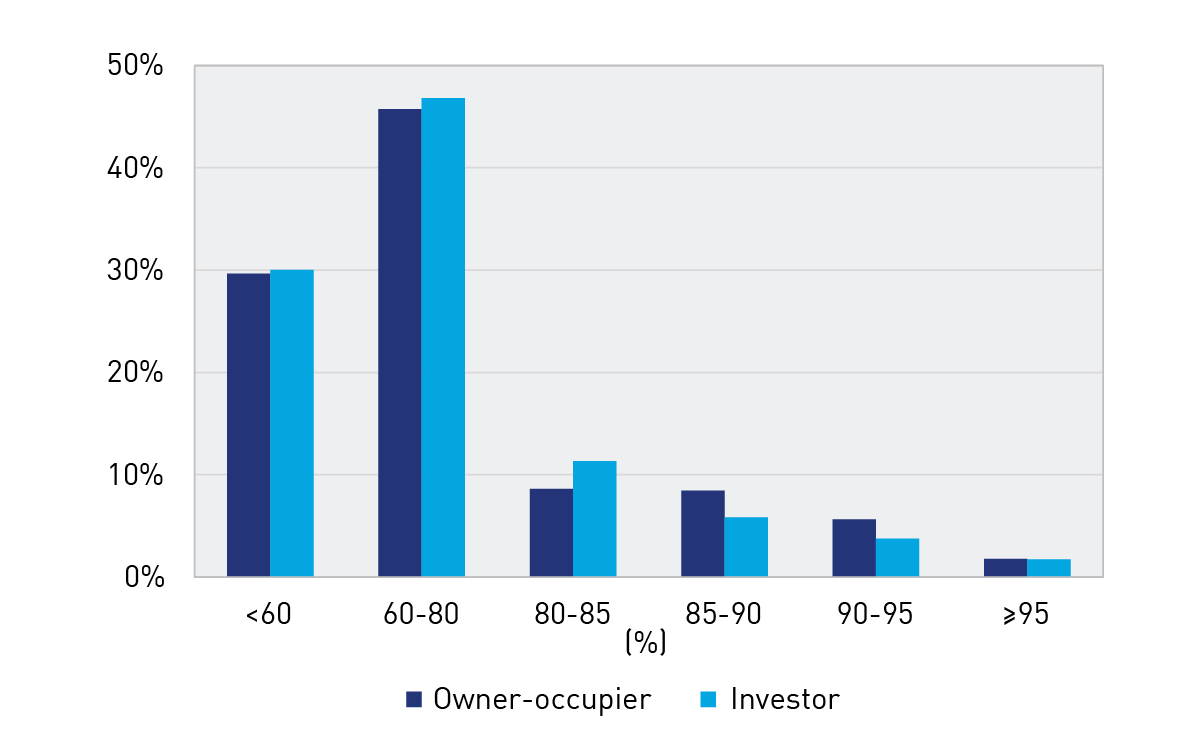

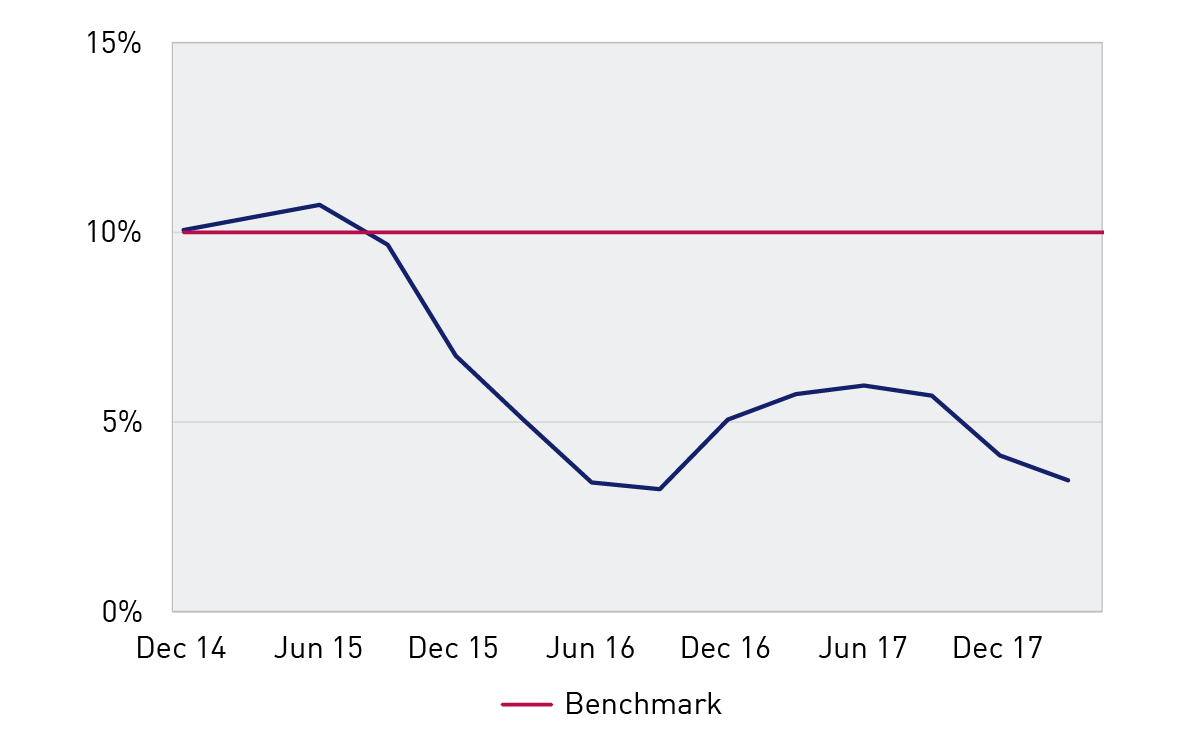

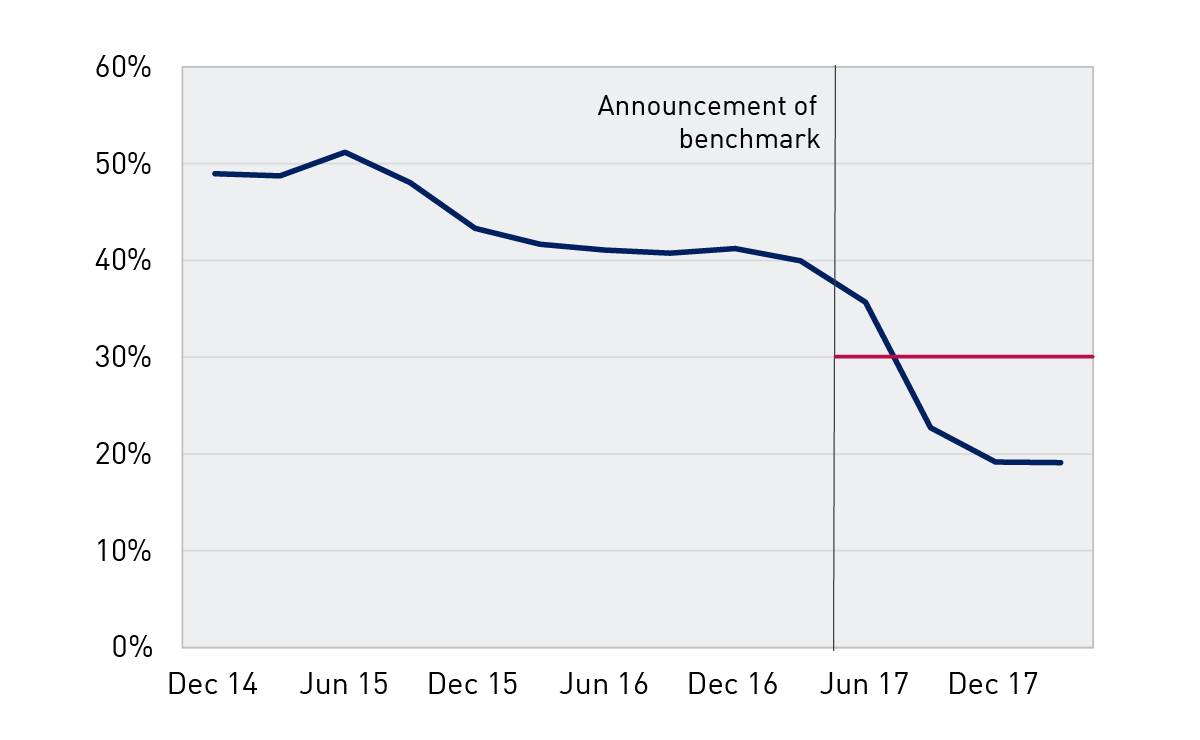

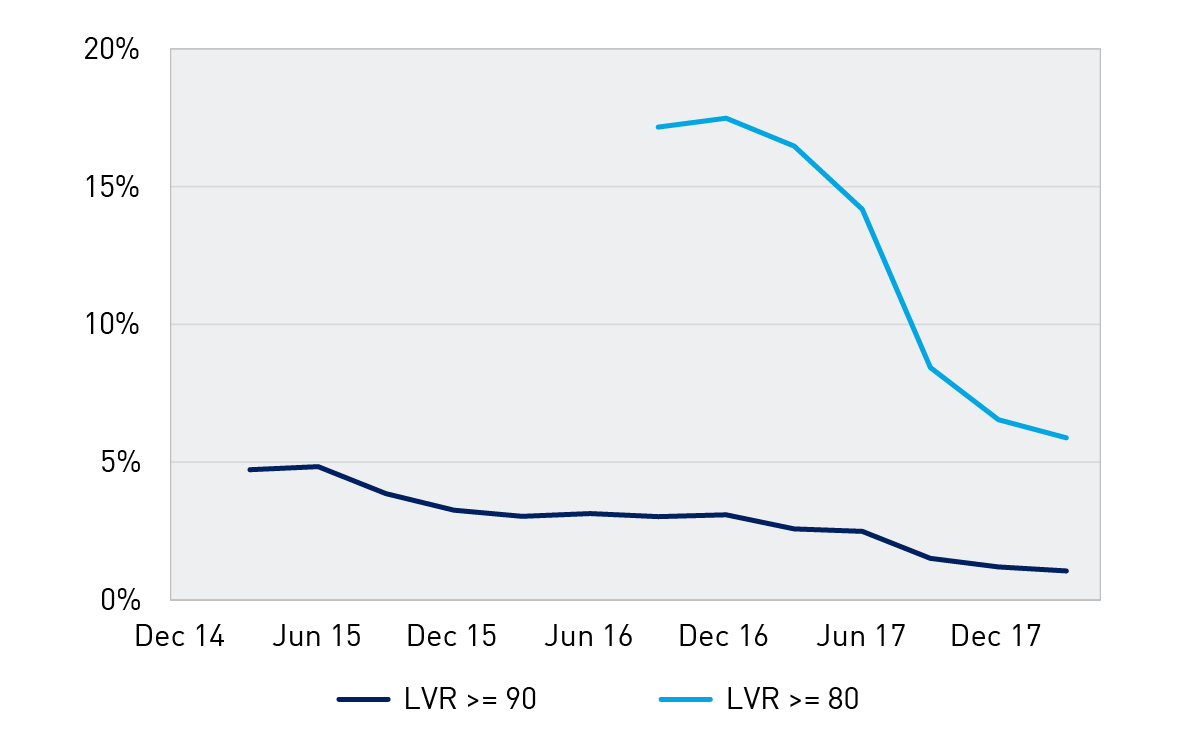

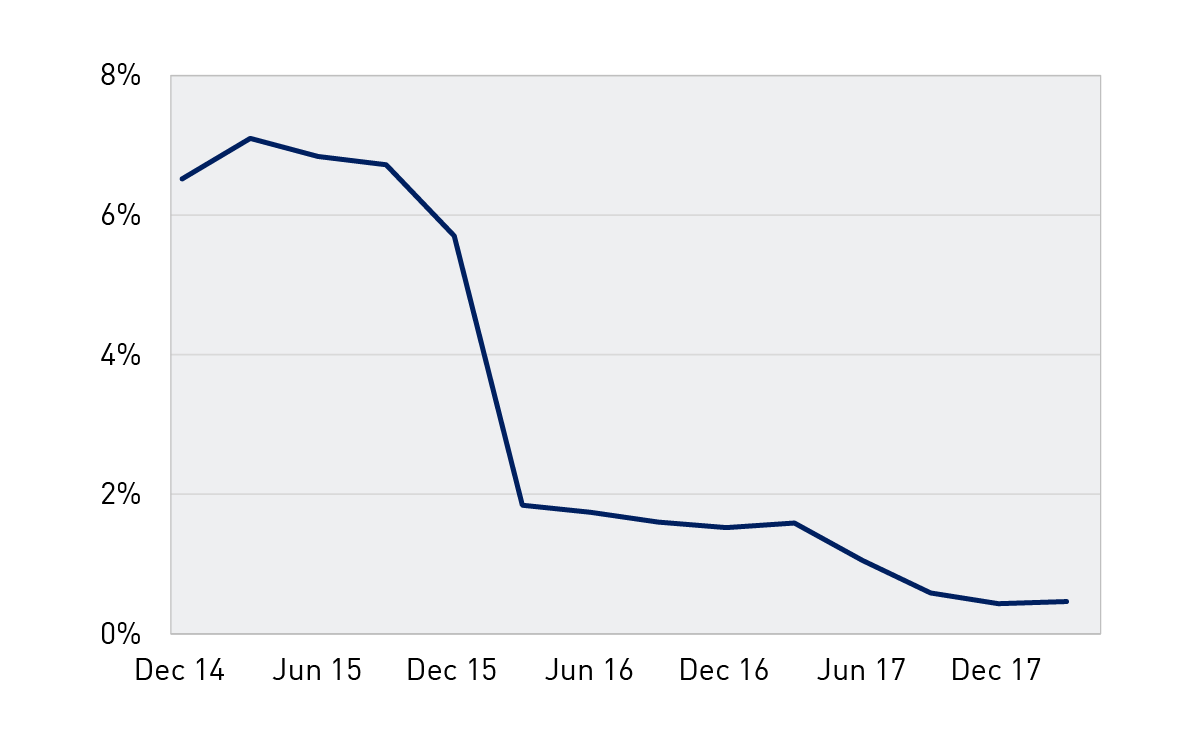

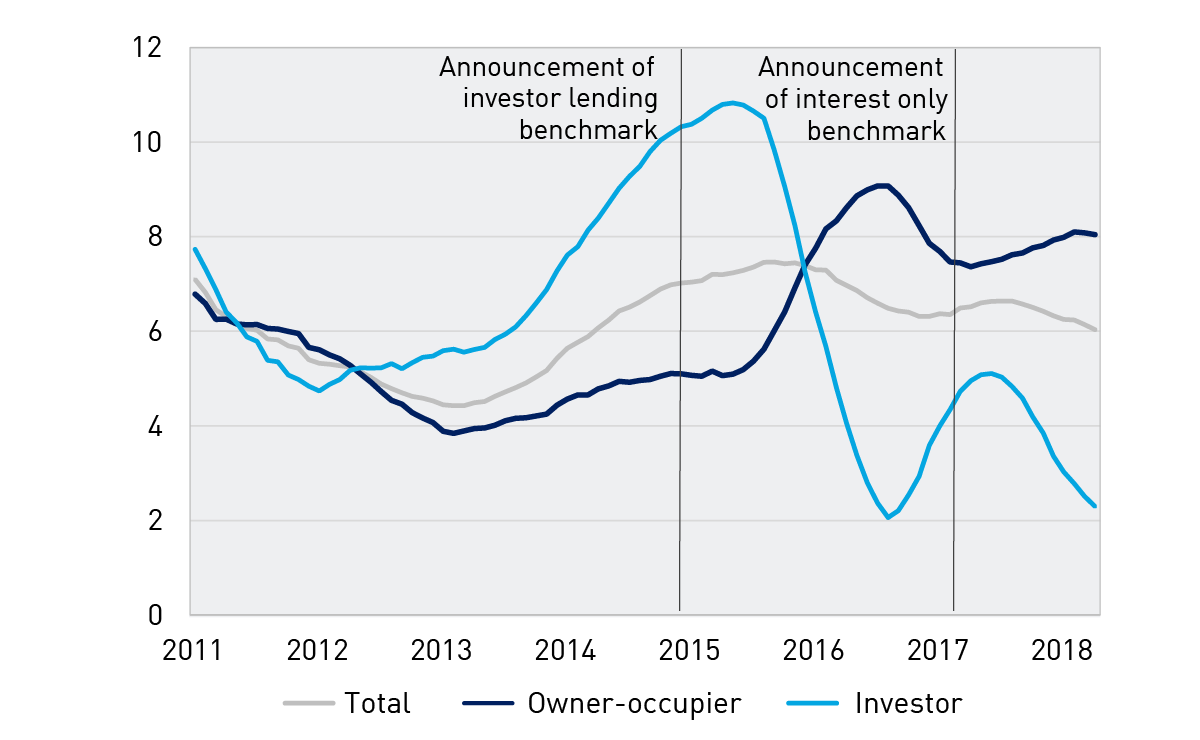

APRA has been focused for some time on steadily strengthening mortgage lending standards, reversing an earlier erosion in policies and practices that had flowed from strong competitive pressures. At a portfolio level, this has prompted a reduction in higher risk lending, evident across a number of different metrics. For example, the proportion of new lending at high loan-to-valuation ratios (LVRs) has declined (Charts 1 and 2), both for lending to owner-occupiers and to investors. Investor loan growth has also moderated (Chart 3). The share of interest-only lending has fallen to less than half the levels seen in recent years (Chart 4), with a notable decline in interest-only lending at high LVRs and at long terms (Charts 5 and 6).

Chart 1: LVR > 90% (share of new lending)

Chart 2: Residential mortgage terms loans outstanding on LVR, Mar 18

Chart 3: Investor lending growth (year-on-year)

Chart 4: ADIs' new interest only loans (% of housing loans funded per quarter)

Chart 5: High LVR and interest only lending (share of total new lending)

Chart 6: interest only lending with term > 5 years (share of total new lending)

These trends in higher risk lending, however, only tell part of the story. They have also coincided with a strengthening in the rigour with which banks assess borrowers’ ability to service and repay their loans. Together with the benchmarks we set on investor loan growth and interest-only lending, which eased unhealthy competitive pressures, the heightened scrutiny applied to serviceability has produced a clear improvement in the quality of new lending.

However, this has neither been a quick nor straightforward process. As we ‘peeled the onion’ through our reviews and examinations of lending standards, we encountered a new layer at each step: enhanced oversight was not always translating into more prudent policies, and more prudent policies were not always translating into more prudent practices. And just like peeling an onion, it hasn’t always been easy on the eye. Implementing a policy of interest rate buffers within serviceability assessments only makes sense if these are used in practice and not overridden by frontline lenders, and applying these buffers to a borrower’s other existing debts only works if information on those debt commitments is properly sought.

In 2016, APRA commissioned a review of the way the largest banks gather and verify information from borrowers for serviceability assessments, and the controls designed to ensure that this leads to prudent lending decisions. Last year, we extended this exercise to encompass a range of smaller banks, completing more of the industry picture.

Across the board, this revealed several core areas of lending practices that needed improvement. These included:

- more accurately assessing borrowers’ income and expenses, and in particular reducing the reliance on the use of (relatively low) expense benchmarks to estimate borrowers’ living costs;

- improving the way in which borrowers’ pre-existing debt commitments are checked and verified, to ensure that lending decisions are not based on an incomplete view of a borrower’s circumstances; and

- increasing the level of oversight around exceptions to lending policies, through better defining and reporting policy overrides, and sharper monitoring of how consistently standards are being followed in practice.

To ensure reasonable inquiries are made into borrowers’ expenses, for example, banks now typically request expenses by different categories, rather than as a single number that can be difficult to estimate. As others have commented, borrowers appear to make poor financial historians – let alone forecasters! Under ASIC’s responsible lending obligations, banks are required to make reasonable inquiries into borrowers’ living expenses, and APRA’s own prudential practice guide is clear that benchmarks shouldn’t be relied on to proxy expenses. Benchmarks can be helpful in providing a prudent floor where borrower declared expenses appear low, but should not be a replacement for making reasonable inquiries.

Banks that follow better practice have gone beyond expense categorisation and have also invested in enhanced training for frontline lenders, review of transactional statements and monitoring of reliance on benchmarks. This has already yielded benefits, producing a reduction in the reliance on benchmarks and greater use of more accurate forecasts of future borrower living expenses.

To improve the verification of borrowers’ pre-existing debts, many banks are preparing to participate in Comprehensive Credit Reporting (CCR). Although this will be required for the major banks, other banks have also committed to developing the capabilities to participate in the new regime. CCR will provide much greater visibility of a borrower’s existing debt commitments, and in turn should furnish banks with an ability to enhance not only their serviceability assessments for new borrowers but also risk analytics for the mortgage portfolio overall.

CCR should also support the move from limits around loan size relative to borrower income to controls on total debt relative to income. As a simple metric, this can provide a useful cross-check on overall serviceability risk, to complement the more detailed net income tests for individual borrowers. Acting in tandem with these tests, it is likely to function as a backstop, however, rather than primary constraint. In addition, it may take some time for controls on total debt-to-income to be fine-tuned and properly calibrated, as data histories in Australia will initially be short. This is a key reason why APRA has been careful not to be prescriptive, and has left it to banks to determine the calibration of their policy and portfolio limits in accordance with their own risk appetite and experience.

The other area where improvements are evident is in the management of policy overrides. At some banks, for example, overrides can be higher in certain origination channels, brands or business segments. Monitoring at this level of granularity can help ensure that more prudent standards are flowing through consistently to prudent lending decisions.

As a room of business economists, no doubt one of the issues you are interested in is the impact of all of this regulatory activity on the flow of credit. My first response is that it’s difficult to tell: while APRA’s actions primarily influence the supply of credit, there has also been a range of factors at play that may have had an impact on the demand (including affordability constraints, and changes to tax policy and foreign investment rules). But there are still a couple of observations that can be made:

Chart 7: Housing credit growth (% per annum)

First, the changes in lending practices to date do not seem to have had an obvious impact on housing credit flows in aggregate (Chart 7). Total housing lending grew at around 6% in the year to May 2018, which is only marginally below long-run averages and roughly in line with the average run rate since 2011 (covering the period since house prices last went through a period of softening in Australia). Indeed, cumulative credit growth in the roughly three and a half years since APRA stepped up the intensity of its actions was greater than cumulative credit growth in the preceding three and a half years. Credit growth appears to be slowing somewhat at the moment, but that is not surprising in an environment of softening house prices and rising interest rates.

Second, it is evident that the composition of housing credit has shifted notably. Lending to investors is certainly now growing more slowly compared to three or four years ago. But despite the tightening in lending standards – which, it’s important to remember, also apply to owner-occupiers – lending to owner-occupiers grew at a very healthy 8% over the past year. This relatively high rate of rate of growth for owner-occupiers (running broadly at almost 3x household income growth) has been sustained during a period in which lending policies and practices have been gradually strengthened.

The Australian Prudential Regulation Authority (APRA) released Chairman Wayne Byres’ address at the Australian Business Economists Lunchtime Briefing titled ‘Preparing for a Rainy Day”.

Despite the prominence it has been given, our goal in seeking to reinforce standards and practices has been relatively modest: ensuring that internal policies are followed in practice, and applying what is, in most cases, a healthy dose of common sense. This has been an orderly adjustment, and we expect it to continue over time. While there is more “good housekeeping” to do, the heavy lifting on lending standards has largely been done. Any tightening from here on is expected to be at the margin as banks seek to get a better handle on borrower expenses, and better visibility of borrower debt commitments.

Over the past few years, APRA has seen clear improvements and moves to better practice. While we remain alert to slippage, our current stance is one in which, having made good progress on a return to sound lending standards, we are happy to remove one of the more prescriptive measures that we had instituted: we recently indicated that we will not apply our benchmark on investor lending growth from 1 July 2018 for those banks that are able to provide assurances on the ongoing strength of their lending standards. The benchmark was always intended to be temporary, and we think it has now served its purpose.

When the storm hits – APRA’s most recent industry stress test

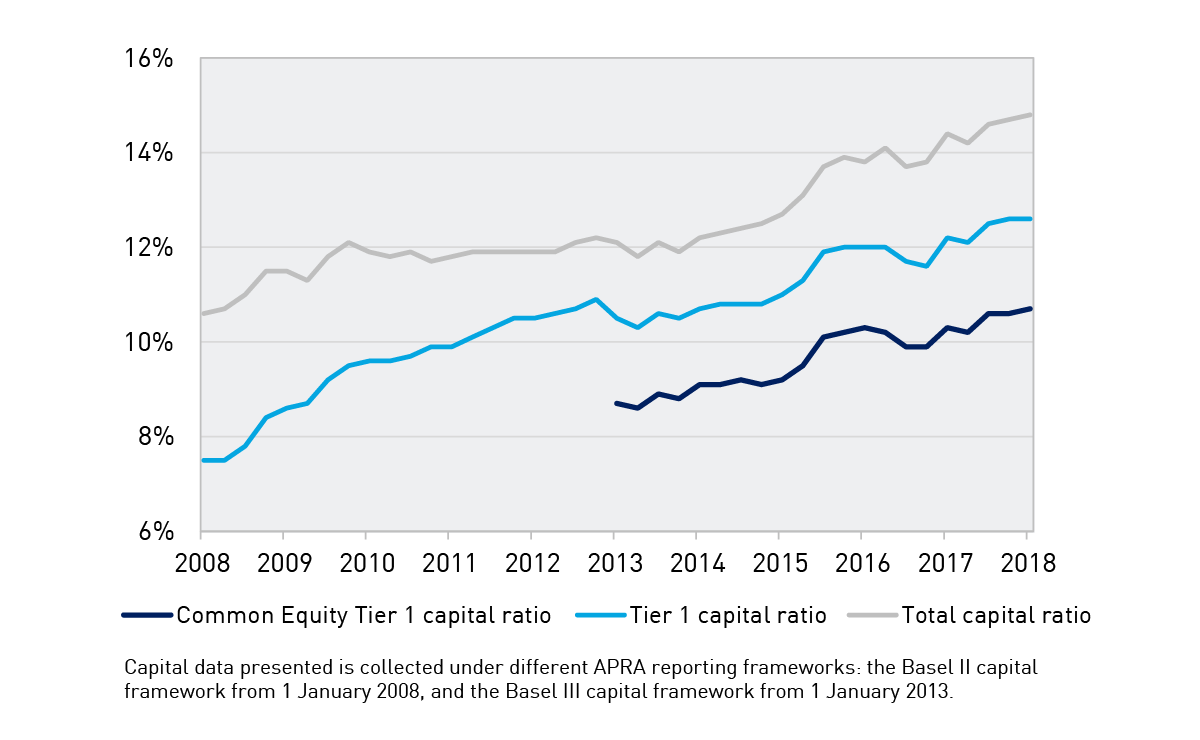

Alongside the gradual improvement in lending standards has been a significant increase in capital within the banking industry (Chart 8). This has been built first on the post-crisis Basel III reforms, and then on the recommendations of the 2014 Financial System Inquiry. As banks reach the “unquestionably strong” benchmarks that we announced last year, it will complete a decade-long build-up of capital strength.

Chart 8: ADI industry capital ratios

That capital exists today so that it can be called on in adversity. In 2017, we conducted our most recent test of banks’ resilience through an industry stress test. The aim of the stress test was not to set capital levels, and consistent with past practice it was not run as a pass or fail exercise. Rather, APRA utilises stress tests to examine the resilience of the largest banks, individually and collectively, and to explore the potential impacts of grim and challenging periods of stormy economic weather.

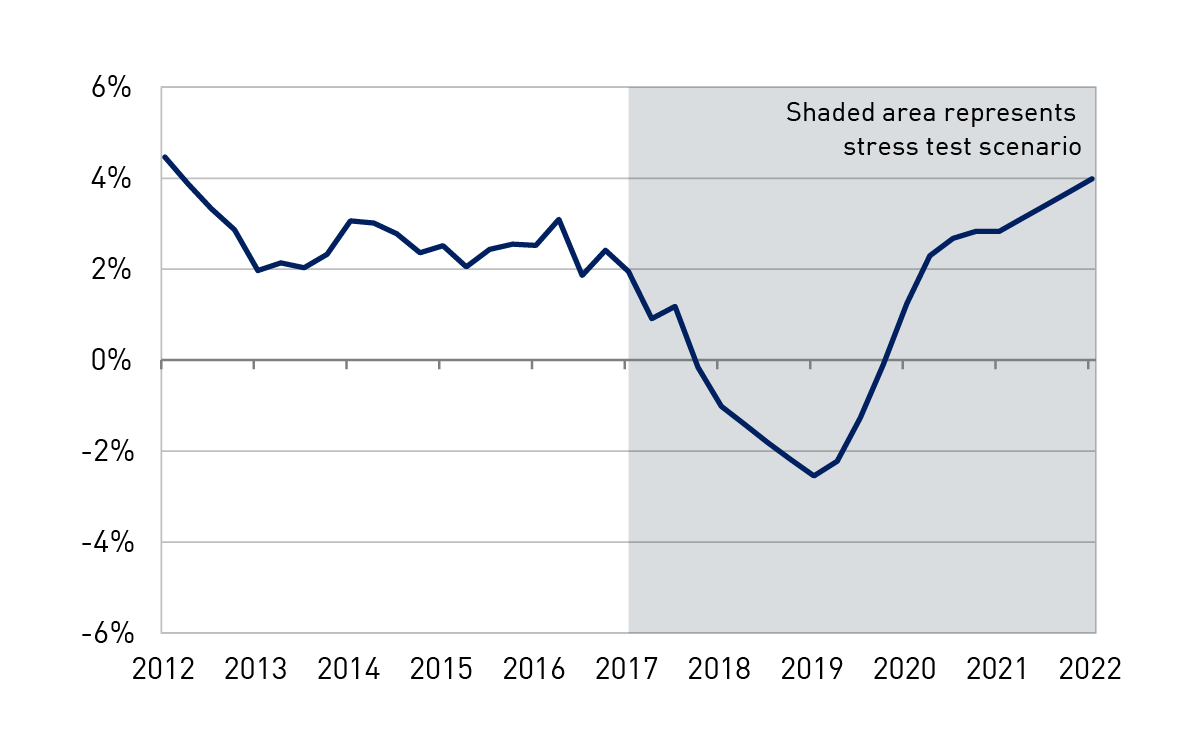

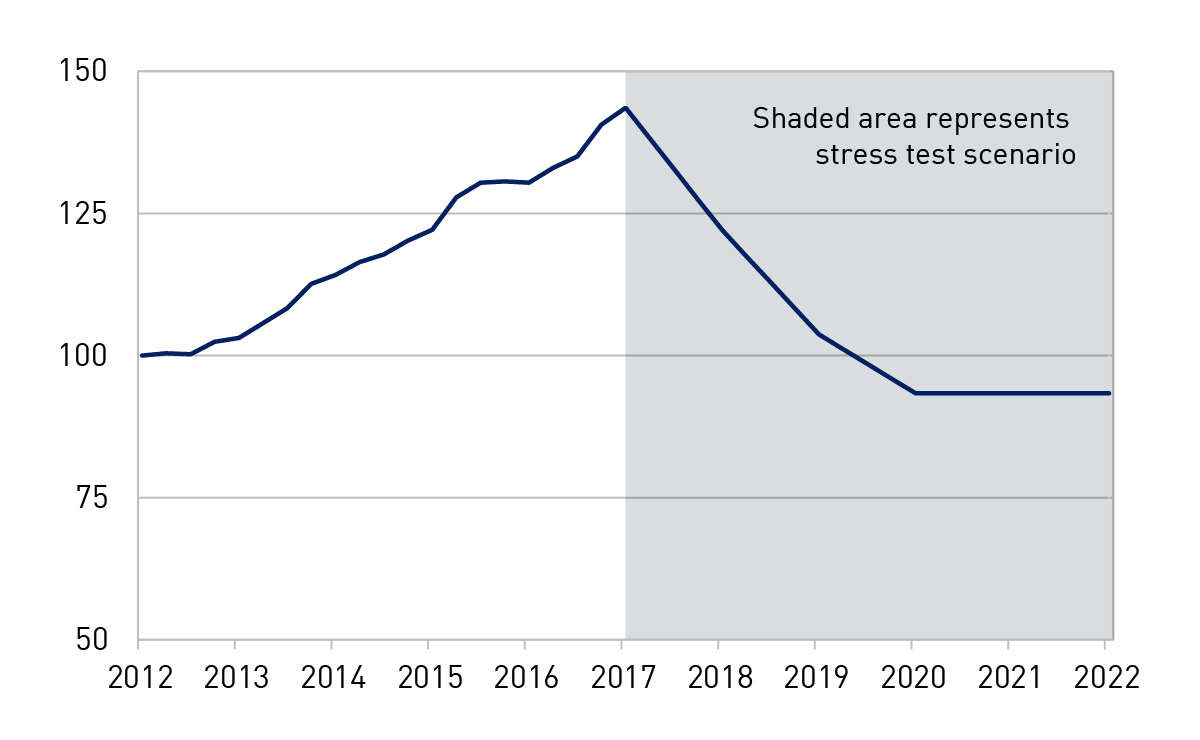

The scenario for the stress test was designed to be severe but plausible, and to target the key risks facing the industry. The basic scenario was a severe economic stress in Australia and New Zealand, with a significant downturn in the housing market at the epicentre. This was triggered by a downturn in China and a collapse in demand for commodities. The subsequent downgrade in sovereign and bank debt ratings leads to a temporary closure of offshore funding markets, a sell-off in the Australian dollar and widening in credit spreads. Australian GDP falls by 4%, unemployment doubles to 11% and house prices decline by 35% nationally over three years (Charts 9 and 10).

Chart 9: Stress test - Real GDP growth

Chart 10: Stress test - House price index

To this traditional macro stress scenario we then added a twist. In addition to the sharp downturn in the economic environment, banks had to consider an operational risk loss event involving misconduct and mis‑selling in the origination of residential mortgages. The additional operational risk element served as an amplifier of the stress, adding a further shock to bank balance sheets.

Before sharing the results with you, I do need to note that these scenarios do not represent our official forecasts! They are obviously quite different from the base-case projections contained in most forecasts for the economy. But that is also why it is so important to test these severe but hopefully hypothetical scenarios – to avoid the risk of disaster myopia and a belief that we are somehow immune to tail risk events, given a benign track record and outlook.

The stress test involved 13 of the largest banks, and our approach was to generate the results in two phases. In the first, banks used their own models and parameters to estimate the impacts of the stress, subject to common guidelines and instructions to ensure a degree of consistency in the results. In the second phase, banks were asked to apply APRA estimates of the stress impacts, based on our own research, modelling, benchmarks and judgement.

While the phase 1 results were useful in shining a light on the banks’ modelling capabilities, and provided a view on what the banks themselves believe the impact of the scenarios would be, I’ll focus on the results from phase 2. These ironed out the kinks in modelling and, in our view, provided a more reliable and consistent set of results at a bank-specific and industry aggregate level.

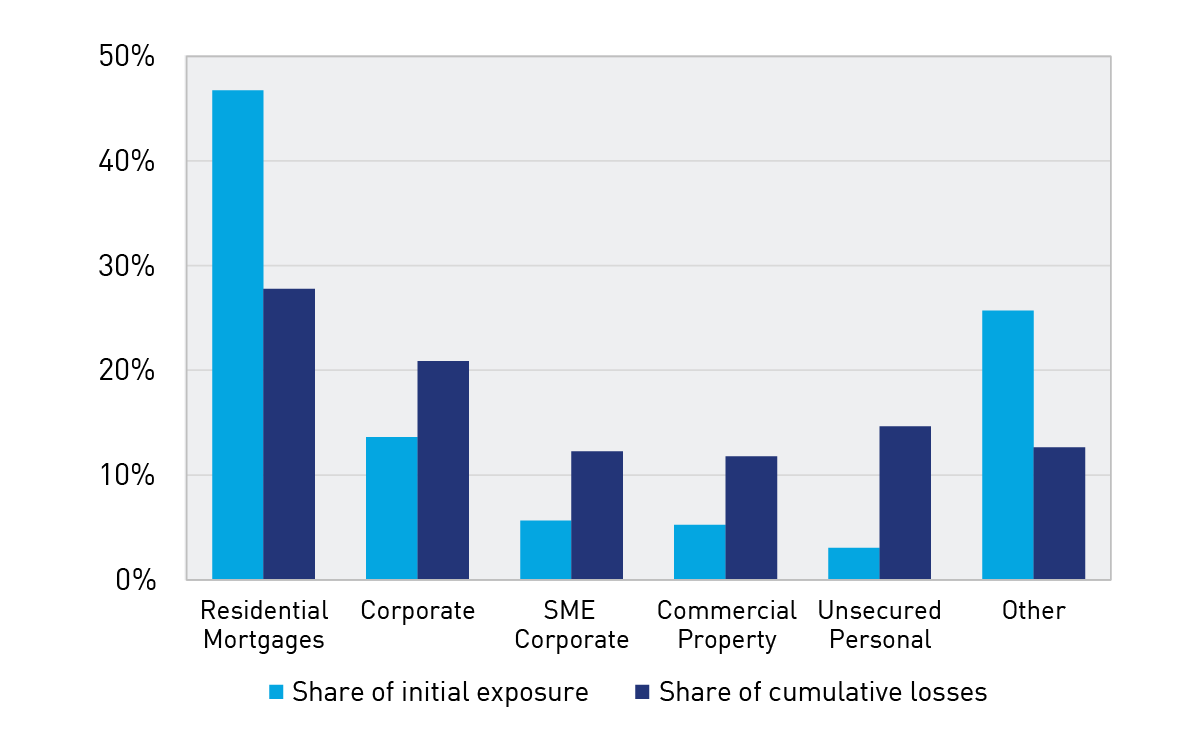

Chart 11: Proportion of cumulative credit losses

As you would expect given the severity of the macroeconomic scenario, banks incurred significant losses, producing a substantial reduction in capital. Projected losses on the residential mortgages portfolio were large, consistent with the depth of the fall in house prices and the rise in unemployment (Chart 11). Overall, banks projected credit losses of around $40 billion on their residential mortgage books, which was equivalent to a little over a quarter of overall projected loan losses. As a loss rate, this would be broadly consistent with the experience in the UK in the early 1990s, but lower than the losses seen in Ireland or the US during the global financial crisis. It also represented a slightly lower loss rate than in APRA’s previous industry stress test in 2014. Some of this is due to differences in the scenario and in modelling, but it was also arguably reflective of the improvement in asset quality in recent years.

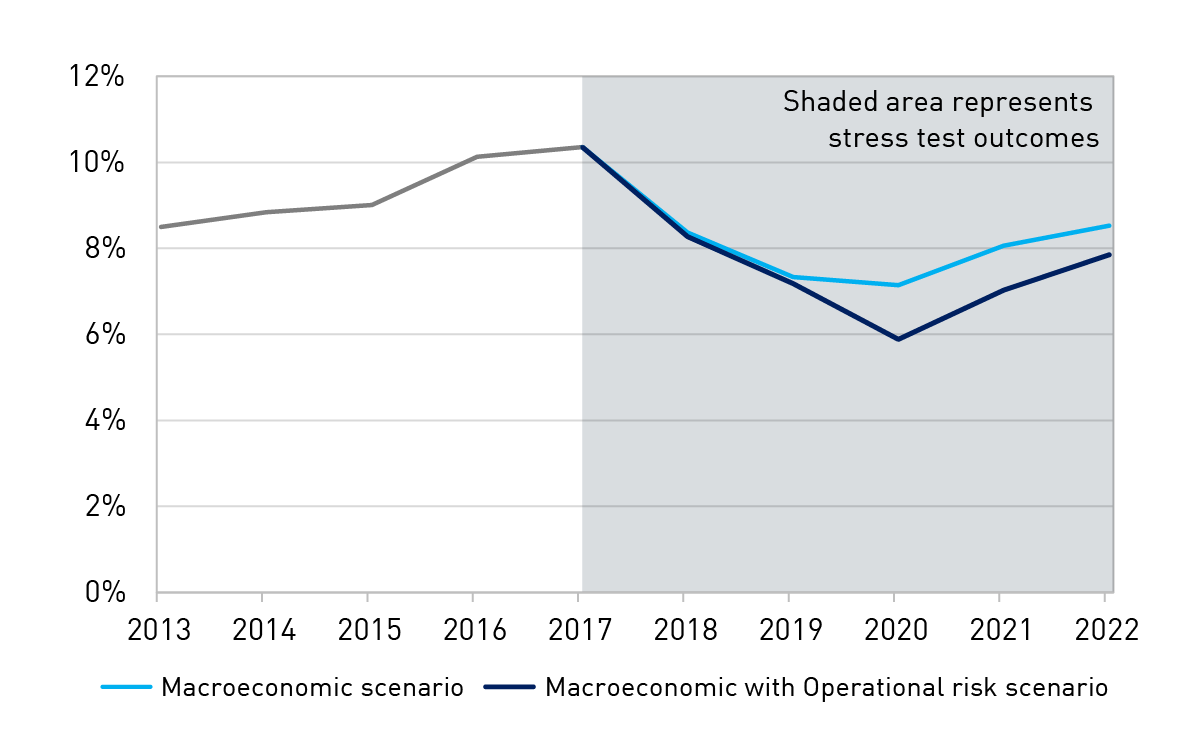

In aggregate, the common equity tier 1 (CET1) ratio of the industry fell from around 10.5% at the start of the scenario to a little over 7% by year three, a fall of more than 3 percentage points from peak to trough (Chart 12). This was driven by a combination of higher funding costs, significant credit losses and growth in risk weighted assets reflecting the deterioration in asset quality. Adding in the operational risk event, the aggregate CET1 ratio fell further to just below 6%, driven by additional costs from customer compensation, redress, legal fees and fines.

Chart 12: CET1 capital ratio results Macroeconomic and operational risk scenario

Despite significant losses, these results nevertheless provide a degree of reassurance: banks remained above regulatory minimum levels in very severe stress scenarios. As importantly, these results have been estimated without assuming any management actions to respond to and mitigate the stress, such as equity raisings, repricing and cost cutting – all of which would occur in reality and lessen the impact. The results therefore represent if not a worst case scenario, then at least a scorecard towards one end of the spectrum of possible outcomes. Once we take into account expected (and plausible) management actions, the banks remain above the top of the capital conservation buffer throughout, and rebuild back towards unquestionably strong levels by the end of the recovery periods.

The funding and liquidity positions of the industry also stood up to the test. Despite difficulties accessing funding markets, most banks maintained their liquidity coverage ratios (LCRs) above 100% through the crisis scenario. Some dropped below 100%, but even then, those banks were able to initiate strategies to restore their position to good order within a reasonable timeframe. This is entirely consistent with how the LCR is intended to operate in severe conditions – liquidity is held in good times so it can be used when needed.

That general reassurance comes, however, with a note of caution. Like weather forecasting, stress testing is an inexact science. Modelling in Australia is complicated by a lack of experience of significant stress and periods of high loan defaults. This is a good problem to have, but it makes the stress testers’ task difficult, and widens the margin for error. That is particularly the case for the mortgages portfolio, and estimates of misconduct losses are of course necessarily judgement-based. In addition, the feedback loops from second order effects and competitor reactions are inherently difficult to model.

Given these challenges, stress testing needs to continue to evolve, and no one scenario can be relied upon for a definitive answer. In this vein, our 2016 exercise didn’t set a scenario at all, but instead asked the major banks to conduct a “reverse stress test”: to assume a fall in capital to minimum prudential levels, and estimate the scenarios that could have caused these outcomes.

The scenarios generated invariably included a macroeconomic downturn, compounded by a shock amplifier such as a cyber-security attack, mis-selling case or additional ratings downgrades. One bank assumed that it was last to market and couldn’t get an equity raising away, challenging a long-held belief that this cornerstone recovery action will always be available. The exercise was valuable primarily for broadening the stress testing imaginations of the participating banks, and reinforcing the importance of continuing to invest in capabilities.

This year, we will be assessing a range of banks’ stress testing capabilities through a review of internal capital adequacy processes (ICAAPs). Our review will focus on scenario development, internal governance and the use of stress testing to inform decision-making on appropriate capital buffers. In parallel, APRA and the industry will be subject to external examination: the IMF will be conducting a stress test of the Australian banking industry as part of its Financial Sector Assessment Programme (FSAP). We look forward to the results from this exercise, and to understanding what we can learn from their approach. Just as we expect banks to continue to invest in their modelling, data and capabilities, APRA will be reviewing its stress testing framework this year to identify areas for enhancement. We will also be preparing for the next industry stress test in our cycle, another opportunity to test resilience, explore vulnerabilities and challenge assumptions.

Dealing with the aftermath – robust recovery planning

Hypothetical scenarios provide a level of assurance, but we know with certainty that conditions will not pan out exactly as stress test scenarios envisage. And regardless, the community needs banks that can not only survive a stress event, but also keep credit flowing. So APRA expects banks to not only hold a sufficient capital cushion to withstand a severe stress, but also to be well-prepared to rebuild that resilience if needed. Just as the emergency services invest in contingency planning for natural disasters, banks develop recovery plans for the financial equivalents.

As part of our broader program of strengthening resilience, and to supplement our stress testing work, APRA conducted a detailed review earlier this year of the latest recovery plans of a sample of large banks. The purpose of a recovery plan is to present a menu of options available to the bank to rebuild capital and liquidity during, and in the aftermath of, a severe downturn. Importantly, the plans are designed to be scenario agnostic, to cater for a wide range of systemic and idiosyncratic stress conditions.

APRA first initiated formal recovery planning amongst the largest banks in 2011, and subsequent iterations have been refined and improved through rounds of review. In our review this year, we examined the operational effectiveness of recovery plans. If a plan is unwieldy and not helpful to decision-makers in practice, or would only be useful in certain scenarios, it is likely to remain on the shelf at precisely the time it is most needed. Similarly, if it is triggered too late in the piece, then the opportunity to deploy some options may have been missed.

To further strengthen recovery planning, our key feedback centred on three main areas – namely ensuring that:

- triggers for activating the plan are designed effectively, encompassing a sufficiently broad range of indicators and calibrated to a prudent level;

- recovery options are underpinned by realistic assumptions on the benefits that they could yield, with sufficient conservatism in pricing and valuations; and

- execution risks for proposed recovery actions have been thought through in advance, with implementation plans, regular operational testing and suitably taxing scenario analysis.

Pleasingly, improvements continue to be made to the industry’s plans. Compared to earlier versions, the better plans now include refined and more realistic valuations, and expanded menus of potential recovery actions that extend beyond a narrow reliance on equity raisings. The suite of recovery actions in these plans cover a full gamut of options, including portfolio restructuring, cost cutting, repricing, assets sales and business disposals.

The better practice observed in the assessment also included well-calibrated trigger points, set high enough to provide decision-makers with a sufficient lead time to implement actions. While the level of triggers is for individual banks to configure, they obviously need to be set with sufficient buffer above regulatory minimum levels to ensure actions can be taken well before limits are challenged. In other words, they should be able to detect the first drops of rain, rather than wait and allow for this to turn into a deluge before decisions are made. In prudential terms, this means that capital triggers should be set at a credible distance above minimum prudential requirements. Similarly, while a bank’s Liquidity Coverage Ratio may dip below 100% during a severe funding crisis, banks shouldn’t be waiting until this point to activate their plans.

The more sophisticated trigger frameworks have moved beyond simple balance sheet metrics, to ensure signals from financial markets and the operating environment are also picked up and listened to systematically. These more advanced trigger frameworks encompassed a broad range of indicators to ensure warning signs were not missed. They also set triggers at different points on the financial barometer, with links drawn to different actions to prompt a staged approach to launching the plan: from monitoring, to escalating, to full activation.

The recovery options themselves are, of course, at the heart of a credible plan. The best recovery plans included carefully considered supporting analysis for potential options, with conservatism built into key assumptions on pricing, valuations, and execution time frames. Across the industry, however, there still remains a wide variation in banks’ assumptions, including on the share price discounts that would be required to raise significant equity in very adverse conditions. It is obviously important that banks don’t over-estimate the extent of market appetite in stress.

Finally, regular testing of the plan helps to build confidence that the governance and escalation procedures are well understood and could be implemented quickly in a crisis. These “fire drills” are, however, still too rare, and this brought into question the level of engagement of senior management in contingency planning while it is still, fortunately, a theoretical exercise. In addition, scenario analysis was limited at some banks, which in turn limited visibility on which actions would be effective in which conditions, and which would potentially be ruled out. We expect that plans will continue to evolve to address these issues, and we will be looking at the next editions in the year ahead.

Concluding remarks

The Australian banking system is financially sound; our task is to keep it that way.

It has been a long time since a serious economic storm hit the Australian financial system. Maintaining sound practices in good times, and remaining ready for stormy weather, are essential for a resilient banking sector. APRA’s agenda to build banking system resilience has therefore sought to ensure that:

- lending standards are reinforced to maintain risk at prudent levels;

- capital strength has been built, providing greater capacity to handle adversity;

- the potential impact of stress is regularly assessed; and

- readiness to recover remains in focus.

Of course, none of this will prevent storms from occurring, or provide a guarantee against a crisis. But it does at least give us greater comfort that, when a severe economic storm does next hit us, we are better prepared to navigate our way through it.

This is an edited extract of Wayne Byres, Chairman of the Australian Prudential Regulation Authority (APRA) speech to the Australian Business Economists (ABE), Sydney, on 11 July 2018.