300,000 mortgage holders have no equity in their homes: Roy Morgan

More than 300,000 home loan customers have little or no equity in their homes, because they either failed to keep up with mortgage repayments or values in their area have fallen, new research by Roy Morgan has found.

Equity in this context is the difference between the value of your property and how much you owe on it.

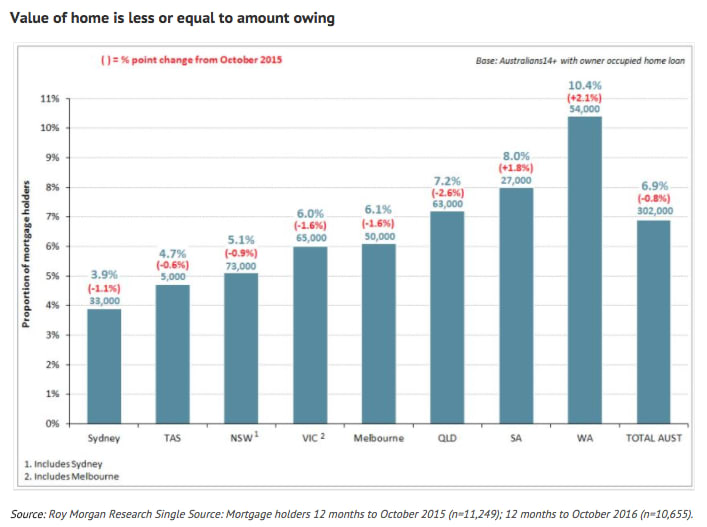

In the 12 months to October 2016, it was revealed that 6.9% (302,000) of Australian mortgage holders had little or no real equity in their home, says a post on the website of Roy Morgan Research. The figure has improved just a little from around the same time in 2015, when around 345,000 home loan customers had no equity.

This is based on the fact that the value of their home is only equal to or less than the amount they still owe, placing them at considerable risk if they have to sell or prices decline.

Roy Morgan communications director Norman Morris said, “this represents a considerable risk to these households and their banks, particularly if home values fall or households are hit by unemployment”.

“With some early signs that home loan rates are rising, the problem is likely to worsen as repayments increase and home values may decline, which has the potential to lower equity levels even further.”

Morris added that there were several reasons that some borrowers were not gaining equity in their homes despite a generally strong property market. These include being in areas with declining values, apartments in Sydney and Melbourne losing value, borrowing more than the real value of the property, falling behind in mortgage payments, and increased borrowing for renovations that haven’t been reflected in increased property values.

The analysis was based on the Roy Morgan Single Source survey of more than 100,000 interviews over the last two years.

Over the last 12 months, Roy Morgan said it interviewed more than 10,000 owner-occupied mortgage holders.

Western Australia had the largest proportion of such homeowners, with 10.4 percent of mortgage holders, or 54,000, having little or no equity in their home, the highest in Australia and 2.1% points higher than the same period in 2015.

“The slowdown in WA’s mining sector is seeing the highest proportion of mortgage holders faced with little or no equity in their homes, and this position has deteriorated further over the last twelve months,” said Morris.

South Australia also recorded an increase in proportion over the last 12 months, up by 1.8 percent points to 8% (27,000), according to the analysis.

Among the states and two largest cities included in this analysis, Sydney had the lowest proportion of mortgage holders with little or no equity in their home: just 3.9 percent (33,000), down 1.1 percent points in the last year.

“This improvement is due to home prices increasing faster than in most other areas of Australia and outpacing the growth in the average amount owing on mortgages,” Roy Morgan’s research said.

Tasmania was the second-best performer with 4.7 percent (5,000) of mortgage holders facing equity risk, followed by NSW with 5.1 percent (73,000), Victoria with 6.0 percent (65,000), Melbourne with 6.1 percent (50,000) and Queensland with 7.2 percent (63,000).

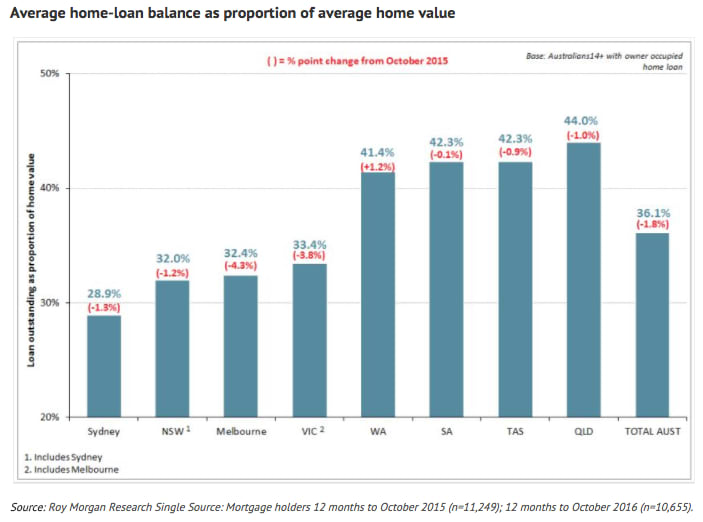

The research also observed that mortgage gearing or risk was lowest in Sydney (28.9 percent) and Melbourne (32.4 percent), mainly because of the rapid rise in property values.