Euro cities punching above their weight economically: Yolande Barnes

GUEST OBSERVER

Office occupiers and their employees have a wide variety of locations to choose from.

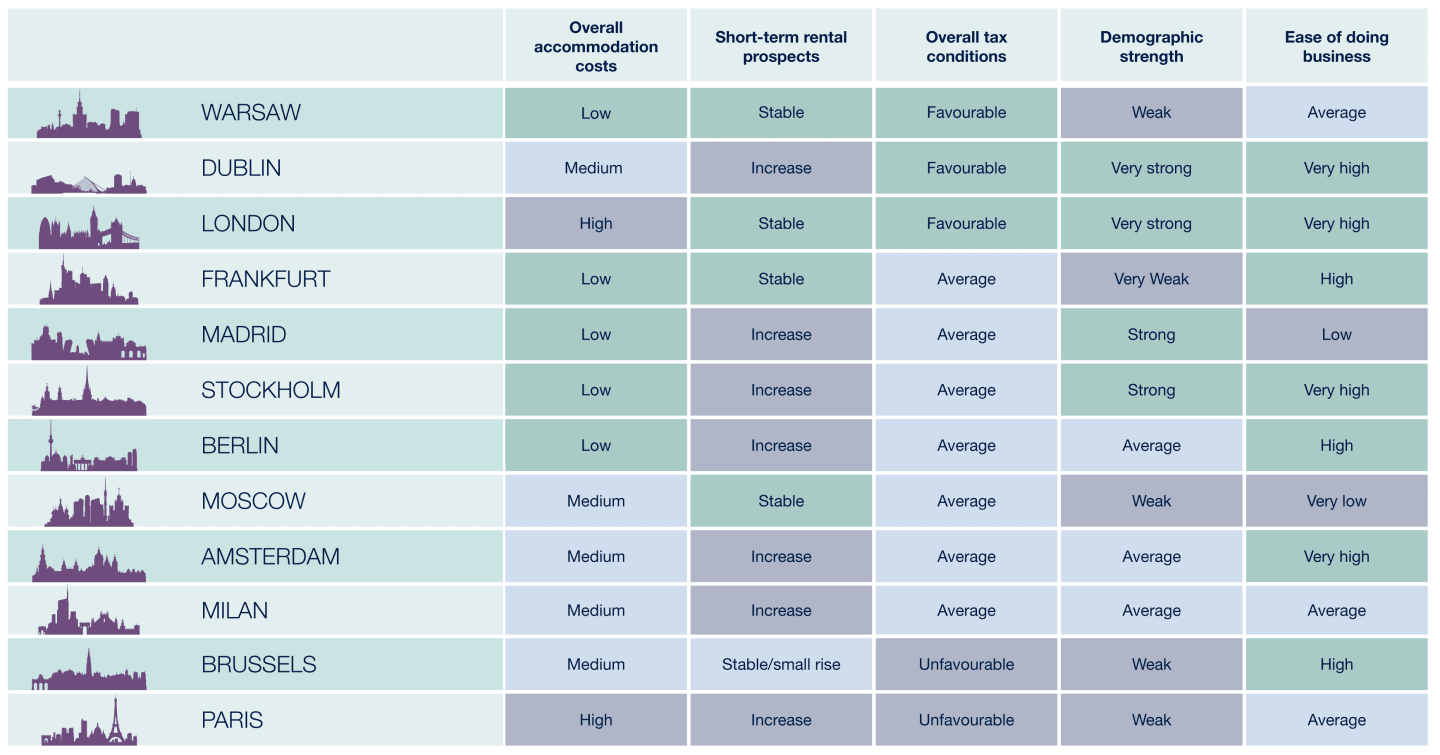

We examine 12 of the most important real estate markets in the region. Discover the performance and prospects for the big ‘Global Powerhouses’ like London and Paris, fast-growing ‘Urban Accelerators’ like Stockholm, Berlin and Dublin, through to small but high profile ‘Contenders’ like Amsterdam, Frankfurt and Warsaw.

KEY FINDINGS

European cities have many of the characteristics of highly successful world cities that make them very attractive to workers looking for ‘urban buzz’ and a high quality city lifestyle. Their authentic environments, varied cultural experience and high quality of living makes the European cities in this study attractive not only to employees but also to employers.

New digital industries disrupt working practices and are growing at a faster rate than conventional finance and business services. Companies are searching globally for the Human Resources they need to win in this environment. This means that companies’ location choices will increasingly be made by the HR rather than premises departments. The questions they will ask are “which cities will help attract human capital?” rather than “where will property costs help save financial capital?”

Europe does contain some of the world’s global powerhouses: the top ranking cities which continue to attract people as well as global investment. Often, they act as hubs to wider, dispersed city networks. They are unlikely to lose this status in the foreseeable future and are adapting well to the digital age. London, Paris and Madrid now employ more people in their information and communication sectors than in their financial and insurance sectors.

London and Paris are the two most global cities in Europe and accommodation costs in these cities reflect that success. Large workforces result in high demand for space in the city which pushes up rents and land values in old cities where space is limited.

There is a big fall-off in annual accommodation costs per worker to the next tier of European cities. Milan, Dublin, Amsterdam, Moscow and Brussels are around half the cost of London at present.

The cheapest cities in Europe in which to accommodate staff are Warsaw, Berlin. Frankfurt, Madrid and Stockholm. Warsaw is just over a quarter of the cost of London.

In some cities, this expense ranking is likely to change. Workspace rents are forecast to rise over the next year in Amsterdam, Dublin, Paris, Madrid, Milan and Stockholm. They are broadly stable in Brussels, Frankfurt, London and Warsaw, giving occupiers more certainty on real estate costs.

Where real estate costs are scrutinised, it is becoming as important to look at residential affordability as well as commercial property costs. Young creative workers are increasingly attracted to good, small cities offering cheaper accommodation as they are priced out of the big global financial centres. This is part of the reason why some very small European cities like Berlin, Dublin and Amsterdam are hugely successful and punching above their weight economically. Their worldwide fame belies their size.

Brexit has raised questions on London’s future as a financial centre and speculation is rife as to which European city might win London’s business. The evidence of this report suggests that no single city will take London’s crown but rather the EU passporting functions of many institutions will be dispersed throughout Europe to a variety of cities for different reasons.

Some small cities, especially those in which it is easy for multinationals to do business, those with favourable tax regimes and strong English language capabilities could do well in attracting global companies but few of these cities have the stock capacity to accommodate many large relocations from London – or elsewhere, especially in the short term. Some cities which larger levels of office supply may find their corporate and personal tax regimes discourage some companies.

Taking a combination of measures into account, London still stands out as the most attractive European city for the finance sector. We think it will continue to serve as a global finance centre but in partnership with some smaller European cities for passporting functions.

Overall, there are good reasons to expect further growth in both the economies and real estate markets of many European cities. Often the strength of the city will buck the trend of the country in which it sits so national comparisons are less useful than city comparisons.

The strength of occupier markets should continue to attract global investment in many European cities and to start attracting it in others. The attractiveness of these cities to investors is important for occupiers in the long run as it will determine whether they can find sufficient workspace of the right type in the right place and whether housing is affordable for their key workers.

The economic and demographic strength of most of the European cities in this report is such that both occupier and investor demand should be assured.

Source: Savills World Research

Yolande Barnes is director, World Research at Savills and can be contacted here.