Current renovation work reverses Q3 dip: Andrew Hanlan

GUEST OBSERVER

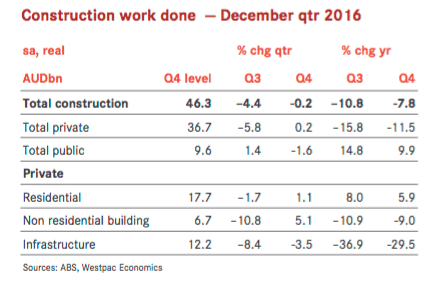

Construction work, which is trending lower, stabilised in Q4, -0.2 percent, after a surprising sharp fall in Q3, -4.4 percent.

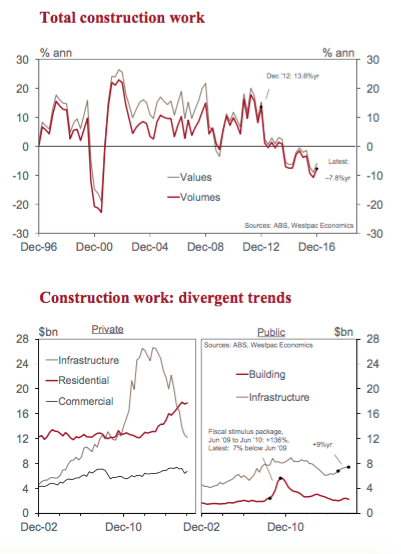

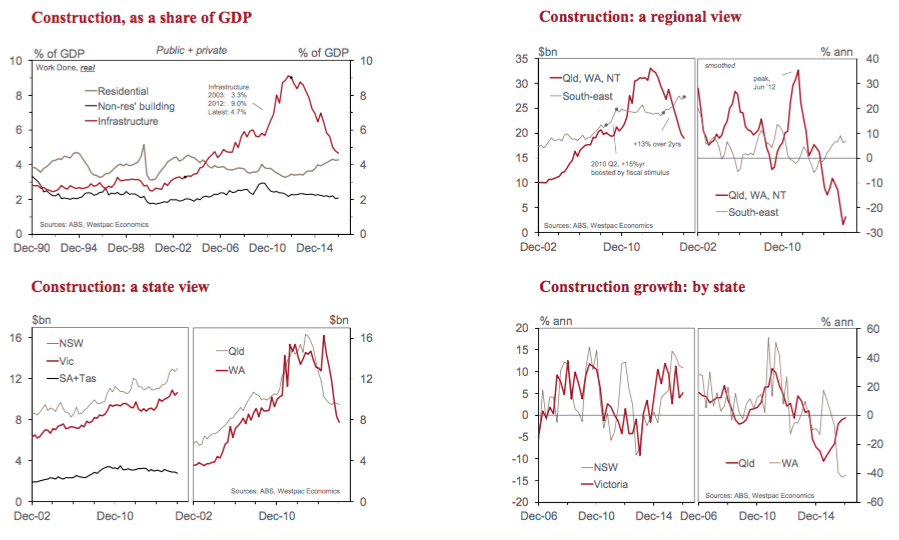

Construction work has been trending lower over recent years as mining investment falls back to more normal levels.

Within that trend, the second half of 2016 was a volatile half year. Q3 was particularly weak, -4.4 percent, in part due to bad weather. Q4 saw construction work stabilise at lower levels, -0.2 percent.

The Q4 result was not greatly different to our expectations (Westpac f/c -0.8 percent and market median +0.5 percent).

The outcome does not alter our views on Q4 GDP, with our forecast at 0.4 percent/qtr, 1.5 percent/yr after a Q3 outcome of -0.5 percent/qtr, 1.8 percent/yr.

By asset, key points are:

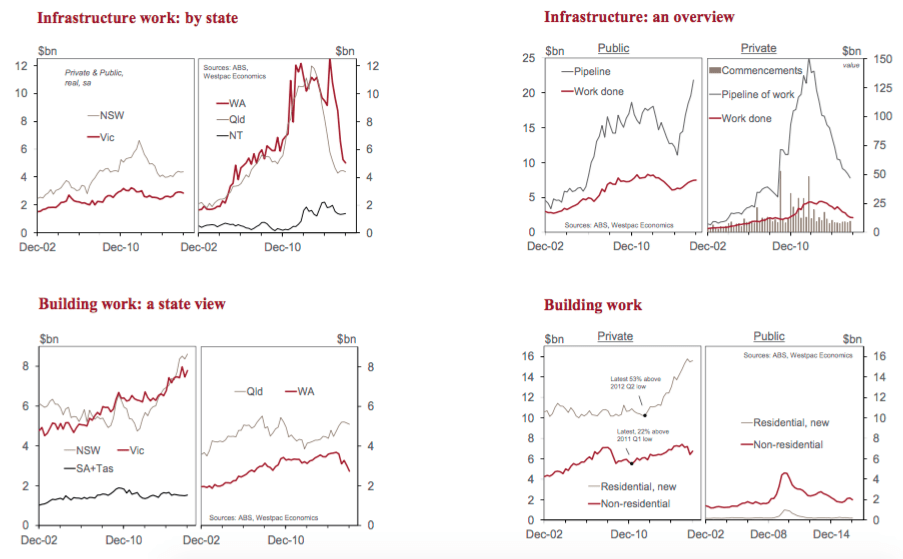

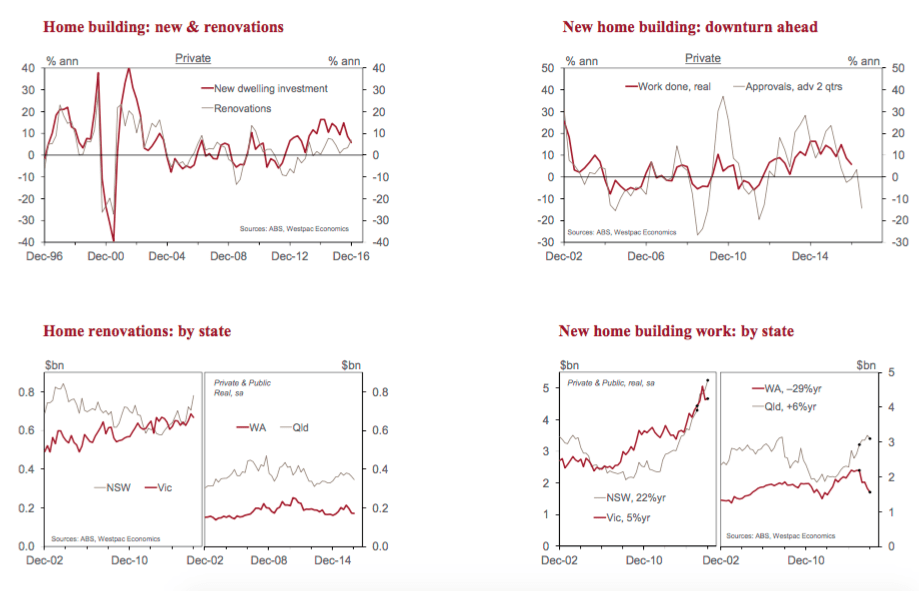

Private infrastructure activity fell further, -3.5 percent, with the mining investment downturn nearing its end. We had expected a sharper fall, -6 percent. New home building activity advanced, +0.9 percent, consistent with strength in building approvals and a sizeable work pipeline. That follows a surprise 1.9 percent fall in Q3, constrained by bad weather.

Renovation work rose 2.2 percent, more than reversing a 0.3 percent dip in Q3, consistent with rising approvals and positive fundamentals.

Private commercial building rose 5.1 percent, after a sharp 10.8% fall in Q3, a decline that was overdue given earlier falls in approvals. More recently, approvals have lifted.

Public works surprised to the low side, declining by 1.6 percent, whereas we had anticipated a rise of 1.6 percent. Public building work fell sharply, while public infrastructure activity consolidated in the quarter whereas a sizeable and rising work pipeline points to upside.

Andrew Hanlan is senior economist for Westpac and can be contacted here.