Buyers flocking to SEQ premium property market: PRD

Buyers are flocking to the South East Queensland (SEQ) premium property market due to affordability, when compared to Sydney and Melbourne median prices, according to the latest PRD SEQ premium property report.

The report suggests the SEQ premium property market shrunk in 2018 and 2019, partly due to a softening in the Sydney and Melbourne property prices, but also as investor confidence declined.

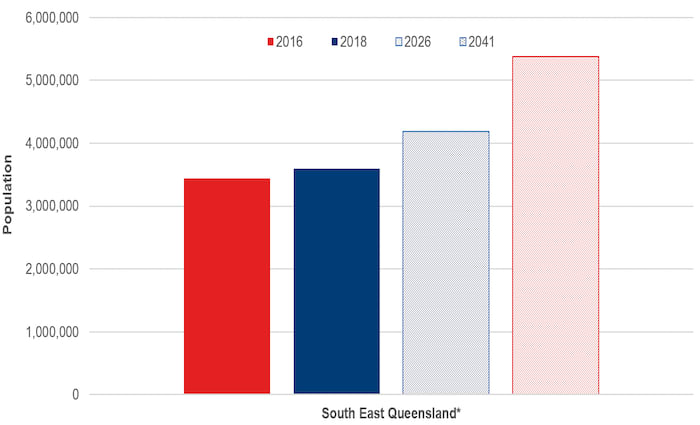

However, SEQ population is projected to increase approximately 49.4% by 2041.

The major increase of property price in Sydney and Melbourne in 2014-2017 shifted buyers toward the SEQ market, capitalising on comparatively lower prices.

During this time, sales transactions in the premium market increased. As the Sydney and Melbourne markets softened, transaction volume in the SEQ premium market also decreased.

The report also analysed interstate migration and vacancy rate trends, to determine future demand and attractiveness of the SEQ premium property market.

"By 2026, it is expected we will see large population increases for Brisbane, Gold Coast and Sunshine Coast by 8.3%, 24.6% and 23.4% respectively. Further, by 2041, it is expected that Brisbane will grow by 25.9%, Gold Coast by 62.5%, and Sunshine Coast by 61.9%.

Click here to enlarge:

Source: PRD SEQ premium property report

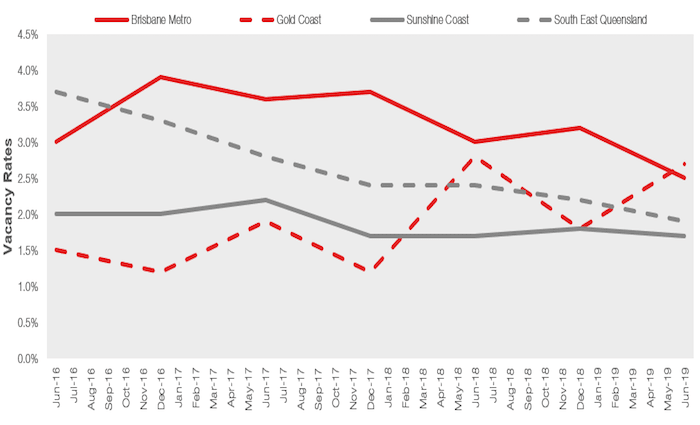

"SEQ has experienced healthy decreasing vacancy rates, with Brisbane (2.5%), Gold Coast (2.7%) and Sunshine Coast (1.7%) all recording below the Real Estate Institute of Australia’s healthy rental demand benchmark of 3.0%. An oversupply of rental properties in Sydney Metro led to an increase in vacancy rates of 3.5% and 2.0% for Melbourne Metro," PRD Chief Economist, Dr Diaswati Mardiasmo said.

Click here to enlarge:

Source: PRD SEQ premium property report

Other key findings in this report include:

Brisbane, Gold Coast and Sunshine Coast premium unit markets have shown strong buyer activity. The Brisbane premium unit market almost doubled from 4.5% in 2014, to 8.0% in 2019. The Gold Coast grew from 5.5% in 2014, to 7.3% in 2019. The Sunshine Coast grew significantly from 2.8% in 2014, to 5.1% in 2019.

Across SEQ, each region saw a significant decline in average days on the market for both premium units and houses. Gold Coast premium units experienced the most significant decline, from an average of 224 days in 2014, to 142 days in 2019.

PRD Research provides expert insight analysis on transaction activity within the SEQ premium property market, particularly to what extent it is influenced by price swings in Sydney and Melbourne.

Data for this report was collected based on the three major Local Government Areas within SEQ: Brisbane City Council, Gold Coast Council and Sunshine Coast Regional.

Find out more about vacancy rate trends and population forecasts by downloading the report at PRD's website.