Big drop in home loan intentions: Roy Morgan

New research has identified a sharp decline in the number of home buyers intending to take out a home loan.

The data from Roy Morgan shows that in the three months to October 2018, 1.21 million people said that they intended to take out a home loan in the next 12 months. This represents a decline of 260,000 or 17.7% from the 1.47 million recorded over the same period last year and is a major challenge to banks in achieving new lending volumes over the coming 12 months.

These are the latest findings from Roy Morgan’s Single Source Survey (Australia) which is based on in-depth personal interviews conducted face-to-face with over 50,000 Australians per annum in their own homes, including details on over 2,500 people who intend to take out a home loan in the next 12 months.

2018 shows deteriorating level of intentions

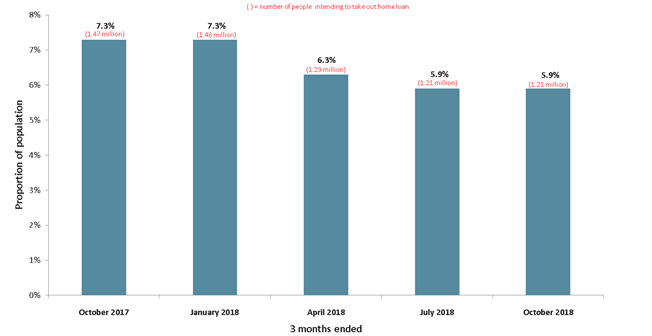

In the January quarter 2018, the level of home loan intentions was a very positive 7.3% of the population, representing 1.48 million people. This deteriorated significantly in the April quarter to 6.3% (1.29 million), a decline of 190,000 or 12.8%. The July and October quarters in 2018 fell further to 5.9% (1.21 million), representing an overall decline of 17.7% since the October 2017 quarter.

Intention to take out home loan in next 12 months

Click here to enlarge

Source: Roy Morgan Single Source (Australia). 15 months to October 2018, n = 62,413. Base: Australians 14+.

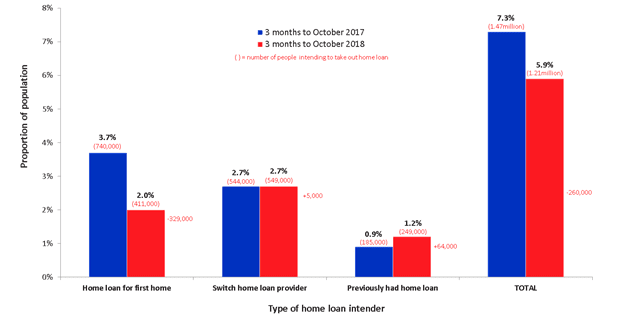

First home borrowers a drag on intention levels

The reason that home loan intention levels have fallen over the past year is due to the decline in first home intenders. In the October 2018 quarter only 411,000 first home borrowers intend to take out a loan in the next 12 months, this is down by 44.5% on the 740,000 recorded a year earlier.

The largest group currently of intenders are those existing borrowers who plan to switch their home loan to a different provider. This segment accounts for 549,000 people or 45.4% of all intenders and has held steady, having recorded 544,000 at the same time last year.

The biggest gain over the last 12 months was in the group that have had a loan in the past but wish to move and take out a loan. They number 249,000 currently, an increase of 64,000 or 34.6% over the year

Intention to take out home loan in next 12 months – By type of intender

Click here to enlarge

Source: Roy Morgan Single Source (Australia). 3 months to October 2017, n=12,054; 3 months to October 2018, n=12,327.

Base: Australians 14+.

Norman Morris, Industry Communications Director, Roy Morgan says:

“The decline in home loan intenders over the last year is likely to have a major impact on banks in the coming year, particularly as the drop has come from first home buyers who are major generators of increasing volumes. The reduction in first home buyers is likely to come from a number of potential reasons, including uncertainty as a result of declining housing values, likely interest rate movements, mortgage stress and job risks.

“The current high level of negative publicity given to borrowing by the Finance Royal Commission is also likely to be impacting on both the supply and demand for home loans. The potential for the tightening of lending criteria and issues relating to mortgage brokers are just some of the likely issues to have a negative impact in this market.

“Data used in this release covers only a small part of what is available from Roy Morgan regarding understanding home loan borrowers and those who intend to borrow in the near future. To find out more regarding long term trends, brands and in-depth profiling, simply ask Roy Morgan.”