REA Group's Australian revenue up 14% despite fall in listings and lower housing starts

The REA Group, parent group of realestate.com.au, posted double-digit rises in net profit and revenue for the year ended June 30.

“The revenue growth was driven by a 14% increase in Australia and the inclusion of iProperty revenue for the full year.

"The excellent result in Australia was achieved in a market of lower residential listing volumes and a significant decline in new dwelling commencements,” it said in an ASX announcement.

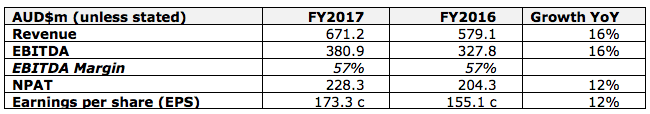

The group’s net profit rose 12 percent to $228.3 million during the period, while revenue grew 16 percent to $671.2 million.

“In Australia, we have extended our position as the clear market leader, with our audience growth reaching record highs against our nearest competitor,” said REA Group CEO, Tracey Fellows.

“We continue to diversify our business and deepen consumer engagement across the property journey. The most significant and exciting has been our move into financial services, through our partnership with NAB and our acquisition of the broking business, Smartline.”

Realestate.com.au acquired an 80% controlling stake in mortgage broking franchise Smartline. Earlier, it had announced a partnership with NAB to building a realestate.com.au-branded mortgage broking business for launch later this year.

The REA Group is majority owned by News Corp.

REA Group operates realestate.com.au, realcommercial.com.au, and Flatmates.com.au.

Its Australian revenue grew by 14% to $633.5 million, while agent numbers rose by 5% on the prior corresponding period, it said.

It said realestate.com.au continued to be the number one property site in the country, with the largest and most engaged audience of property seekers.

Average monthly visits to realestate.com.au grew 13% and were more than over 2.5 times than that of the number two site, it said.

“Australia’s listing depth revenue increased 18% to $481.8m. This was driven by the success of our residential Premiere All offering and increased yield, despite the decrease in listing volumes,” it said.