RBA warns arrears rate still rising in mining exposed regions

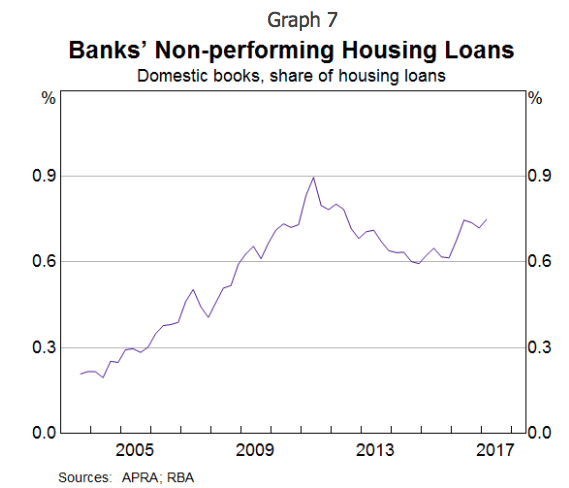

Non-performing housing loans for lenders have edged up over recent years, though they are still low as a share of all housing loans, says the RBA.

The central bank’s Assistant Governor Christopher Kent made these remarks during a speech at Moody's Analytics Australia Conference 2017.

However, at around ¾ of one per cent as a share of all housing loans, non-performing loans remain low and below the levels reached following the global financial crisis, he said.

The RBA official said that the Securitisation Dataset helps the central bank to assess how loans are performing across different parts of the country by examining arrears rates.

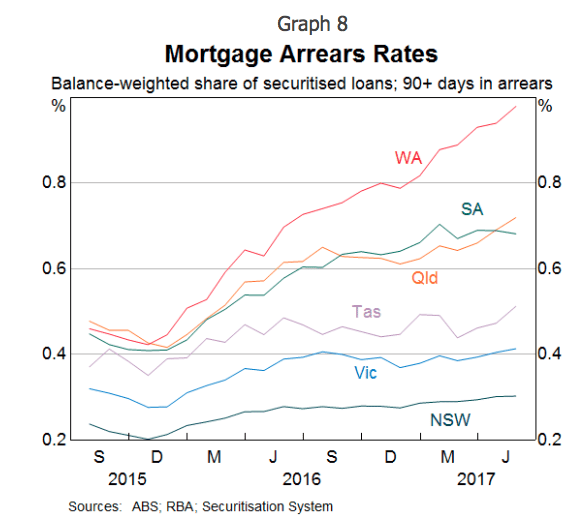

Like non-performing loans, the arrears rates have increased a little but remain low, he observed.

The rise has been more in regions experiencing weak economic conditions over recent years, in particular, Western Australia, South Australia and Queensland since late 2015.

Earlier this year, the central bank noted that conditions had generally improved for businesses in the resource-related sector.

Using the Securitisation Dataset, the bank also found other relationships between arrears and other factors.

A key factor contributing to a borrower entering into arrears is a reduction in income, most obviously via a period of unemployment.

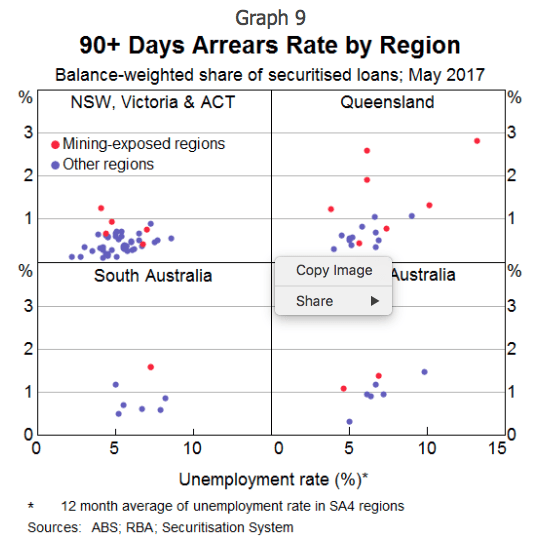

“We find that there is a positive relationship between arrears rates and the unemployment rate across regions (Graph 9).

“However, the relationship is not especially strong, which suggests that other factors are at play.”

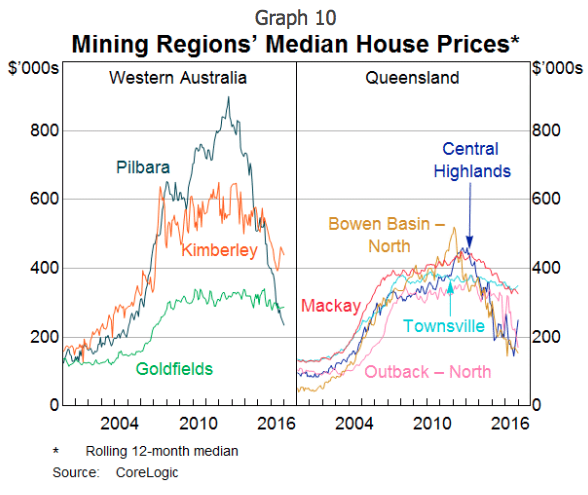

For example, arrears rates are higher in mining-exposed regions, which have generally experienced a sharp fall in demand in the wake of the end of the mining investment boom. This was indicated by the “pronounced fall in the demand for housing” in those parts of the country as indicated by a decline in housing prices (Graph 10).