FHB's take six and a half years to afford their first house: Domain

The time it takes for first home buyers to save 20 per cent deposit for an entry-level house has risen in the last 12 months, according to date released by Domain.

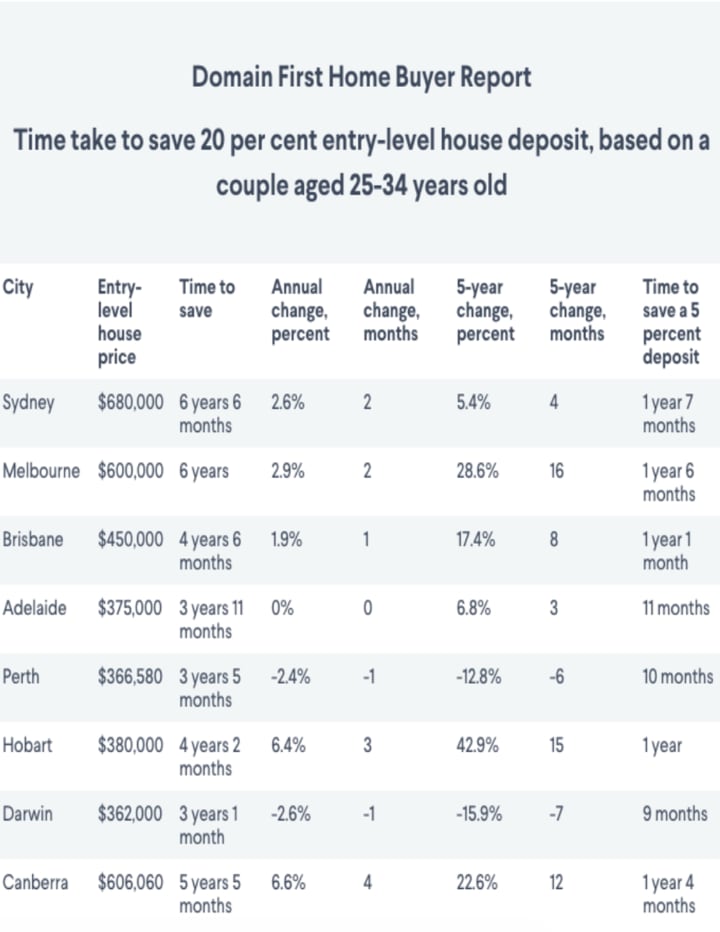

The Domain First Home Buyers Report, which is based on a couple aged 25-34 years old, found first home buyers of houses in Sydney and Melbourne had to save over six years for a house deposit of 20 per cent, up 2.6 per cent on last year.

That's an extra two months for each capital.

Melbourne prospective buyers of a $600,000 entry level house price would take six years, Sydney six and a half for their entry level price of $680,000.

The biggest jump since the same report last year came in Canberra, closely followed by Hobart.

It would take five and a half years in Canberra for a 20 per cent deposit on a $606,500 house, up 5.6 per cent from last year.

Hobart's surging house prices has seen a 6.4 per cent jump in amount of time needed to save since last year, equating to an extra three months.

An entry level home, now $380,000, would take four years and two months to save for in the Tasmania capital.

First home buyers in Perth and Darwin Perth and Darwin have a shorter journey to save for a deposit, with the average time taking less than three and a half years

Units

The length of time to save for an apartment has also jumped across most of the capitals, although Perth, Darwin and Brisbane saw their time slashed.

Brisbane's entry to buy an apartment is now -4.9 per cent less than it was last year, now three years and three months, with an entry level unit costing $328,000.

Melbourne and Sydney's time to save increased by a month over the year, Sydney now at five years and seven months and Melbourne at four years and three months.