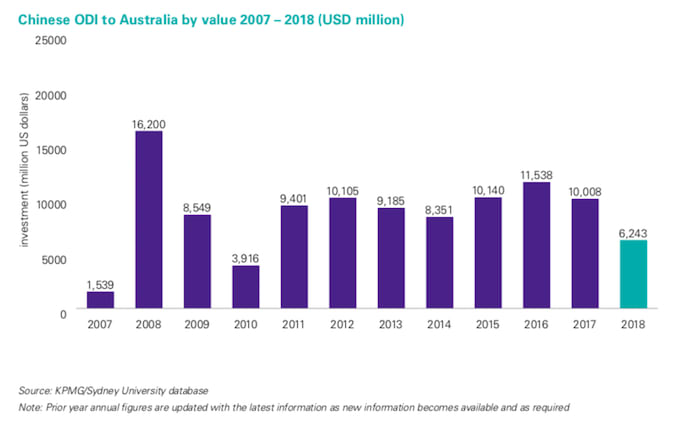

Chinese investment in Australia falls 36.3 percent in 2018

Chinese investment in Australia dropped to AUD 8.2 billion in 2018 – down by 36.3% from 2017, according to the latest research from professional services firm KMPG.

KMPG's Demystifying Chinese investment in Australia report, written with The University of Sydney, found that private companies dominated the investment landscape.

They accounted for 87% of deal value and over 92% of deal volume, with an overall trend towards smaller sized deals.

Healthcare was the most popular sector for Chinese investors, with commercial real estate falling to second position.

Chinese investors still see Australia as a relatively attractive country to invest in, the report notes, with an improving political climate, but they also confirmed that they are finding it harder to get capital out of China, and there are challenges raising capital in Australia.

Knight Frank contributed data and analysis on commercial real estate transactions.

Click here to enlarge:

“Despite Chinese global outbound direct investment actually growing by 4.2% in 2018, Australia has felt the pinch of a significant reduction to our shores, reflecting the impact of policy changes in China," said Doug Ferguson, KPMG's head of Asia and international markets and report co-author.

"Our rate of decline has been accelerating and is now closer to the trend observed in the United States and Canada, where Chinese Overseas Direct Investment dropped by 83% and 47% respectively in 2018.”

Click here to enlarge:

“While this annual result brings Chinese ODI in Australia back to the second lowest level since the mining and gas driven investment peak year of 2008, there is no reason why Australia can’t return to higher levels of Chinese capital inflow seen historically.”

“2018 need not define a trend of lower Chinese investment in Australia into the future but it is a moment to reflect upon. There are a great many opportunities for Chinese companies to contribute towards the development and internationalisation of Australian industries in the coming years. Australian companies seeking further investment must continue to explore and present unique opportunities that appeal to the key value drivers of targeted Chinese investors,” Mr Ferguson said.

Fellow author, Professor Hans Hendrischke, Professor of Chinese Business & Management at the University of Sydney Business School cited a number of factors in the decline.

“The continued reduction in Chinese investment in Australia reflects a combination of factors, including changing drivers of Chinese ODI such as an increased demand for outbound investment in high value-added sectors to ‘bring back’ expertise and high-quality brands and products that can support China’s industrial upgrading and meet the evolving demands of Chinese middle class consumers.

"As part of this trend, large strategic investments in resources, energy and infrastructure have given way to smaller investments, into projects that are tactical and directly linked to Chinese consumer market demand.

"This is particularly evident in the targeting of the Australian healthcare sector by Chinese investors.”

REPORT SUMMARY

Investment by Industry

After a steady growth trajectory since 2015, healthcare was the most significant sector for Chinese investment in 2018 representing 41.7% of total ODI, up 111% from 2017 to AUD 3.4 billion; followed by commercial real estate (36.7%); energy/gas and oil (8.8%); and mining (5.6%).

Healthcare saw three mega deals of over AUD 500 million were recorded in 2018 - from CDH Investment and China Grand Pharm into Sirtex Medical; By-Health into Life-Space Group; and China Jianyin’s Investment into Nature’s Care. There were another five other significant healthcare deals completed including a Chinese/Hong Kong consortium investing into IVF and fertility clinic group, Genea.

Click here to enlarge:

Commercial real estate remained a leading sector for Chinese investment in 2018, accounting for AUD 3 billion of investment (down from AUD 4.4 billion in 2017), continuing to attract a similarly significant proportion (11%) of China’s total global overseas real estate investment. Mixed use development accounted for 40% of total investment inflow, driven by the Yuhu Group’s AUD 1.1 billion acquisition of Dalian Wanda’s property assets in Australia. Investment in the office sector made up 31% of the total, supported by Zone Q’s acquisition of 55 Clarence Street. Residential development sites also continued to account for a significant share (18%) of investment in Australian real estate.

“Australia continues to attract a high level of Chinese investment into commercial real estate, with total investment reaching AUD 3 billion in 2018. While this was 31% down on the 2017 level, the drop was in line with a wider global trend toward lower Chinese outbound investment in other key markets such as the US and UK during 2018. So Australia remains a key destination, taking around 11% of total Chinese outbound real estate investment,” said Ben Burtston, Partner, Head of Research & Consulting, Knight Frank Australia.

“Changing conditions in the residential market have acted to dampen the appetite for large development site acquisitions, although we continue to see a high volume of private investment in the office sector in particular. Looking ahead, we expect to see more Chinese investors venturing beyond Sydney and Melbourne as market conditions improve in the likes of Brisbane, Perth and Adelaide.”

Three deals in 2018 saw Chinese investment in energy (oil and gas) grow 295% to AUD 726 million, however this was primarily driven by ENN’s acquisition of more shares in Santos for AUD 619 million. The other deals were smaller scale investments in Queensland and Western Australia.

The mining sector accounted for 5.6 percent of the total Chinese investment inflow with five mining deals totalling AUD 464 million in 2018, a decrease of over 90 percent from 2017. Chinese mining investment in Australia returned to 2016 levels after a peak in 2017 due to Yancoal’s AUD 3.4 billion acquisition of Rio Tinto’s thermal coal assets.

Renewable energy recorded four new investments in 2018, totalling just under AUD 400 million, which is a similar level to 2016 and an increase over the AUD 124 million recorded in 2017.

Food and agribusiness investment totaled less than AUD 100 million in 2018, while the only infrastructure and construction transaction recorded was John Holland’s (owned by CCCI) acquisition of engineering group RCR Tomlinson’s rail business.

Investment by Geography

Chinese capital was again focused in NSW in 2018, with the state accounting for over half (53%) of all investment: AUD 4.4 billion. Victoria saw a drop from 36% of total investment in 2017 to 27% in 2018. Investment in South Australia rose to AUD 640 million from AUD 455 million, with the state attracting 8% of total inflows. Queensland investment fell to AUD 396 million in 2018, compared to AUD 667 million last year. Tasmania accounted for 4% of total investment, with deals worth AUD 342 million, while Western Australia saw inflows of AUD 263 million.

Investment by Deal Size

The trend toward smaller deals continued in 2018 with an average deal value of AUD 111 million, down from AUD 130 million in 2017. The number of deals also dropped to 74 from 100. 85% of deals fell below the AUD 100 million mark. This reflects more deals being done in mid-sized Australian markets in health, technology, services and real estate sectors.

Investment by Ownership

Private investors accounted for 92% of the Chinese deal volume and 97% of deal value in 2018, up from 83% in number and 60% in volume in 2017.

Investment by State Owned Enterprises (SOEs) dropped to just over AUD 1 billion – representing 8% of deal volume and 13% of deal value.

Click here to enlarge:

Chinese Investors in Australia Survey

The Chinese Investors in Australia Survey involved surveys and interviews with senior executives from 56 Chinese-invested companies located in Australia on their perceptions of the Australian investment climate and key challenges they face in Australia. The research was undertaken in February 2019.

Click here to enlarge:

Source: KPMG

Commenting on the survey results, Professor Hendrischke said the investment climate for Chinese companies in Australia was mixed in 2018. While Australia remains a preferred investment destination relative to other countries, Chinese executives are finding it harder to get investment approvals and capital out of China.

“Our local survey also revealed mixed sentiment amongst the perceptions of Chinese investor," Hendrischke noted.

"There was an increase in the number of Chinese executives who told us they feel welcome to invest in Australia - up to 38 percent, compared to 35 percent in 2017. However there was also an increase in the percentage of respondents who feel unwelcome, from 15% to 19%.

"One area of note is the improving perceptions around Australia’s political environment regarding China, with the number of respondents saying that past year’s political debate has made them more cautious to invest falling to 59%, compared to 70% in 2017.”

“Our survey and interviews with Chinese investors indicate a level of concern around the costs of doing business. Australia continues to be seen by Chinese investors as a more expensive country to operate in than the UK, US and Canada, with challenges noted in areas such as obtaining finance, low profitability, government approvals, finding qualified staff and building relationships with local Australian management,” added the Professor.

Outlook

“Looking forward, it seems Australia’s investment links with China may be increasingly affected by global, rather than purely bilateral dynamics. At the same time, the recent decline in Chinese investment in Australia provides an opportunity to reflect on the role that future Chinese investment should play in Australia’s long-term domestic economy and our economic integration into the Asian region. This should be done with clear focus on the new opportunities for foreign investment which are expected to continue to open up in the China market, including with the implementation of the new Foreign Investment Law and related rules and regulations,” said Mr Ferguson.

“There is still a long journey ahead for many Australian industries that have the potential to receive much greater sums of Chinese investment – but there is much that must be done on both sides to improve the perception of the Australian market to Chinese investors,” he concluded.