NSW Government to roll out first home buyer stamp duty caps

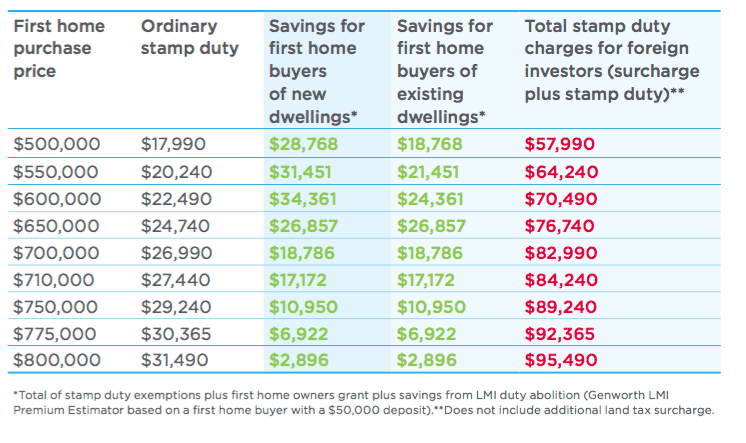

The NSW Government has announced it will abolish stamp duty paid on new and existing homes worth up to $650,000 for first home buyers taking effect July 1, 2017.

The duty concession on properties valued between $650,000 and $800,000 will be gradually reduced.

Concessions on vacant land will remain unchanged.

According to the NSW Government, a property costing $650,000 would have the entire stamp duty of $24,740 waived while a home costing $700,000 would be entitled to a $16,493 reduction.

First home buyers building a new property will be entitled to a $10,000 grant on homes worth up to $750,000. First home buyers purchasing a new property worth up to $600,000 will be entitled to a $10,000 grant.

The $5,000 New Home Grant Scheme will be closed.

Premier Gladys Berejiklian said she wanted to ensure owning a home is not out of reach for people in NSW.

“These measures focus on supporting first homebuyers with new and better targeted grants and concessions, turbocharging housing supply to put downward pressure on prices and delivering more infrastructure to support the faster construction of new homes," she said.

“This is a complex challenge and there is no single or overnight solution. I am confident these measures will make a difference and allow us to meet the housing challenge for our growing State.

The 12-month deferral of duty for residential off the plan purchases by investors will be abolished. Buyers who are purchasing a home they plan to live in off-the-plan will still be entitled to a 12-month delay in the payment of stamp duty, however this is closed to investors. It takes effect from 1 July.