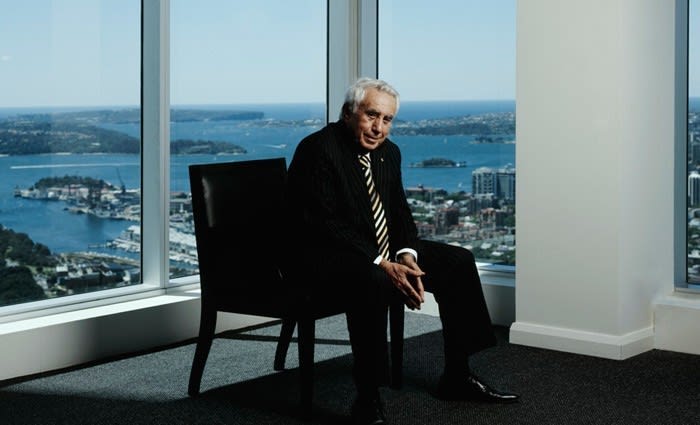

Meriton's Harry Triguboff says FIRB regulations should be liberalised, not further restricted

Meriton Group has indicated its support of the current regulations surrounding foreign investment in real estate, but would like their liberalisation.

"Although offshore buyers represent only a small percentage of Australia’s overall sales, this market is an important factor in maintaining business confidence and giving developers the impetus and security to embark on new projects – directly increasing the supply of new housing" the Meriton founder Harry Triguboff advised the House of Representative inquiry into foreign ownership of residential property.

It was among the most diligent of submissions made to the committee which the Treasurer, Joe Hockey asked in March to report back by October. There were an underwhelming 15 submissions made on the supposed controversial issue which Liberal MP chairperson Kelly O’Dwyer has tried to make her high-profile cause.

"If Australia wishes to keep housing affordable and to keep developers building, it is imperative that we embrace foreign investment in real estate and the certainty it can bring to industry," the Meriton submission said.

"In light of Australia’s recent Free Trade Agreement with China, this review represents an opportunity for FIRB regulations to in fact be liberalised rather than further restricted."

Harry Triguboff said it was his belief that it was a range of other factors, such as excessive local government planning requirements and fees, that added to the cost of housing and which have seen first home buyers effectively pushed out of the market.

"There are many possible solutions and alternatives to this problem which do not involve restricting the flow of foreign investment in Australian real estate.

"The outcomes of this inquiry are of major significance to Meriton, as the nation’s largest apartment developer, and the housing market overall.

"In order to ensure consistent and affordable residential housing supply, it is important that Australia strengthen its ties with overseas markets that are not subject to the ups and downs of the domestic economy.

"Foreign investment remains a welcome source of support for the local housing and construction industries and any changes to regulation would be keenly felt."

He hopes welcome to discuss this issue with the committee.

Their submission noted Meriton is Australia’s largest apartment builder, constructing over 2,500 new apartments annually, and accounting respectively for 6.4% and 1.6% of annual dwelling commencements in NSW and nationally.

Meriton provides employment for around 2,700 people across the building and services sectors. It employs either directly, or as sub-contractors, up to 2,000 people in the construction industry on around 15 active building sites in Sydney, Brisbane and the Gold Coast, and over 700 in the services and tourism sector, contributing significantly to the Australian economy.

Meriton’s forecast turnover for 2014 is some $2 billion.

"Foreign investors contributed to around 13% of Meriton’s sales in the financial year 2012- 2013, and without securing this initial foreign investment, many of Meriton’s complexes may not have been developed," the submission said.

The submission said foreign investment in Australian residential real estate had often been the subject of political controversy.

"In the late 1980s, concerns over Japanese investment, particularly in Queensland, led to the amendment of the foreign investment legislation and the establishment of regulatory arrangements which are essentially operating unchanged today," it said.

Photo of Harry Triguboff courtesy of Wikipedia/Creative Commons.