Off-the-plan property buyer confidence surges post-election

New statistics reveal 48% of off-the-plan buyers feel more confident to purchase property following Liberal’s election win on Saturday. Since the election result announcement, the property industry has been forecasting the future of the new development sales in Australia, with many forming the opinion that the market is likely to surge. [1]

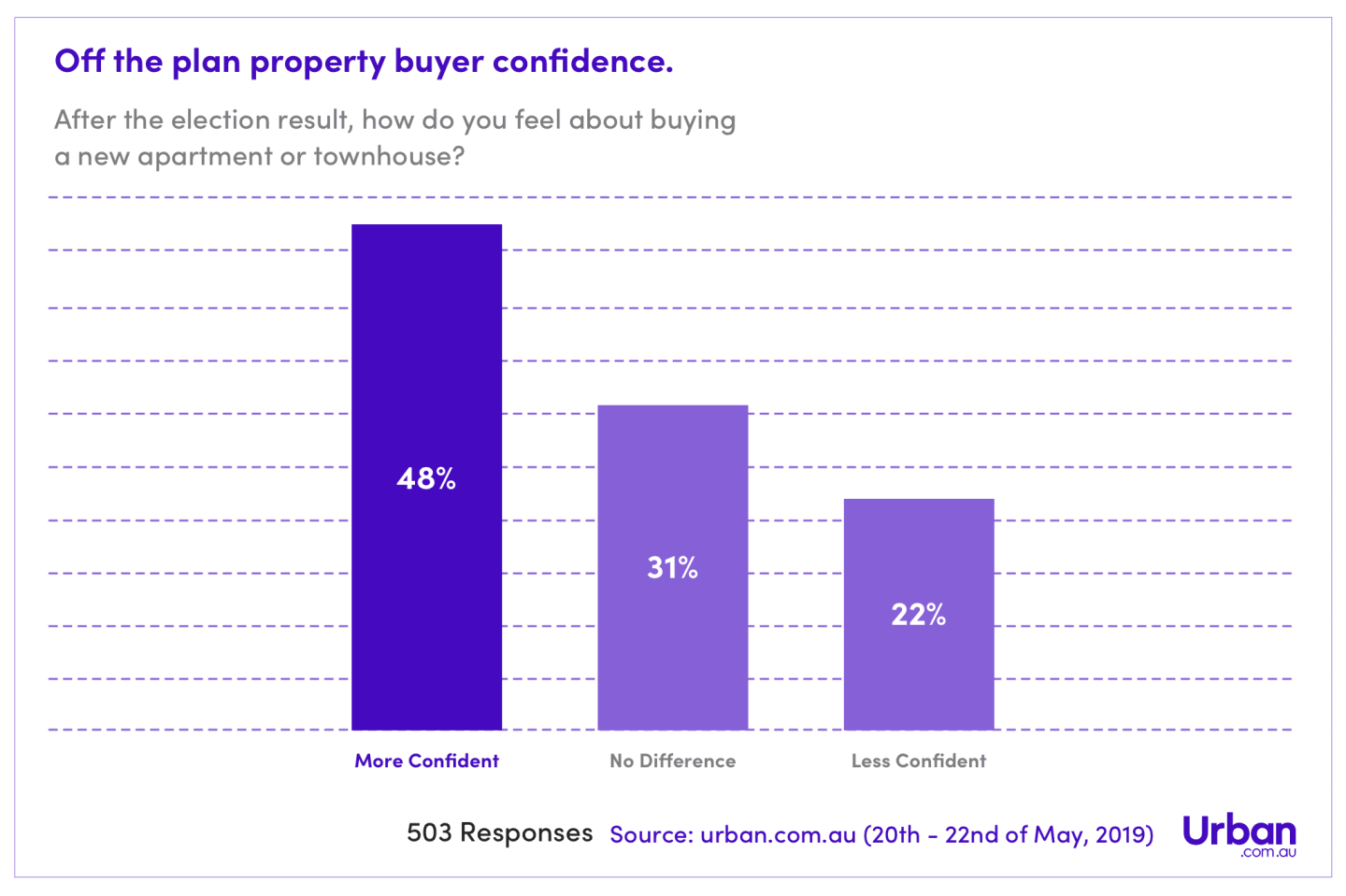

On Monday 20th May, off-the-plan property marketplace Urban.com.au asked home-buyers how they felt about buying a new apartment or town-home under the current policies. Within a week over 500 responses were recorded, with results showing 48% felt more confident, 31% felt no difference and 22% felt less confident.

"We saw an almost immediate uplift in enquiries across our off-the-plan project database in the days after the election and this week there has been a renewed confidence from our developer partners. By the time Spring comes back around, I am confident we will see prices surge across the market."

Mike Bird, Urban.com.au Executive Director

At the beginning of 2019, Colliers Residential Managing Director Peter Chittenden identified ‘lack of confidence’ among buyers as being one of the biggest threats to the housing market. In a recent comment:

“There was a list of factors eroding confidence, one was the Federal Election and now post-election I suggest that market activity will start to accelerate again, and yesterday’s rebound in the share market reinforces this view. However, how fast the breaks come off the housing market will again, very-much depend upon confidence.”

Peter Chittenden, Colliers Managing Director Residential

With this sentiment in mind, we explored some of the ways national policy could reinstate confidence in off-the-plan home buyers.

WILL THIS HAVE A POSITIVE IMPACT ON THE PROPERTY MARKET?

APRA loosens lending constraints

The Australian Prudential Regulation Authority (APRA) has just announced they will be lowering the minimum interest rate serviceability buffer, providing home-buyers with the opportunity to enter the off-the-plan property market again with a smaller deposit.

CoreLogic's senior analyst Cameron Kusher explained that APRA's policy change could mitigate the future house pricing fall, and hasten the market turn-around, with a positive outlook expected from mid-2020 – to as early as the end of 2019.

Chittenden also identifies that the desire for home ownership in Australia is still prevalent, so with more financial support, the goal of first home buyers acquiring their first home could become more attainable.

“The results also proved to my thinking that the ‘Australian Dream’ of homeownership is still very much alive in 2019, and that Australians have not given up on the idea, just the opposite.”

CBRE’s Managing Director of Residential Projects Victoria, Andrew Leoncelli also attributes loan constraints to the decline of the off-the-plan market.

“The fundamentals of the Victorian and wider Australian Economy are good but confidence and momentum had been lost due to the banking royal commission and all of the exogenous bank and APRA attempts to cool the market.”

Negative gearing to remain

Labor’s mission to halve capital gains tax could have had a significant impact on the investor market, making ownership of investment properties less desirable. Concerns suggested that the removal of negative gearing could result in rental increases to accommodate the loss of ROI, however with negative gearing still intact, it is anticipated that a greater sense of confidence could be instilled in investors as the property market regains a stronger sense of stability.

Marshall White Projects Director Leonard Teplin identifies the rise in empty nesters entering the property market,

“One of the mindsets most of us crave is certainty, and since the real estate market opened for business in 2019, the most basic of desires for most Victorians to own property had once more prevailed and buyers (particularly the popular empty nester) are continuing to re-enter the property market in numbers.”

However from 2018 Q2 – 2019 Q2, Urban.com.au recorded that the significant rise of next home buyers has been notably overtaken by first home buyers, as well as a strong decline in investor market interest.

As the off-the-plan market begins to stabilise following the election result, it will be interesting to see whether investors re-enter the market with greater confidence.

“A confident Morrison majority and time after the royal commission with banks back lending and APRA relaxing the credit controls and interest rate cuts about to come we can see this as the return of confidence for the local investor to start buying again.”

Andrew Leoncelli, CBRE Managing Director, Residential Projects Victoria

Will the election result build a fair playing-field for First Home Buyers and investors alike?

With the introduction of the new 5% deposit rate for first home buyers, as opposed to the original 20%, buying a first home in Australia could become more attainable to more Australians looking to acquire property.

The introduction of this policy could potentially see a surge in demand, which could in-turn boost property prices, causing a reverse effect. Another consideration is that mortgages will take longer to service, which is great for the bank, but not for the property owner.

For investors, the fact that no changes will be made to negative gearing or the capital gains tax is good for business.

Marshall White’s Leonard Teplin explains that due to the fact that the current government had already introduced restrictive changes to planning laws, tightening of construction funds, tax on foreign buyers etc. – more fears of potential change posed by Labor could essentially, “fuel the fire of uncertainty for an aspirational purchaser.”

Three Sixty° Property Group's Founder and Managing Director John Meagher held a similar view, commenting that the overall outcome would essentially result in a healthier property market.

A positive Election result for the property industry with no changes to capital gains tax, no changes to negative gearing, a new stimulus for first home buyers through a deposit assist scheme all means no disruption to our industry. A likely interest rate drop later in the year coupled with record low vacancy rates all points to a heather property market.

Whether the future of homeownership in Australia proves to be advantageous is currently unknown, but what we do know for sure is that the majority of our off-the-plan buyers have regained confidence in the market.

As for property developers – as CBRE’s Andrew Leoncelli succinctly states, “Get your projects ready for a strong September and October spring season!”

Thanks to Peter Chittenden, Andrew Leoncelli, Leonard Teplin and John Meagher for sharing your opinions.

[1] Sources: AFR, news.com.au, Smart Property Investment