Property prices rose in Elizabeth, SA despite impending Holden shutdown

Holden will finally end its Australia manufacturing chapter in October 2017, leading to job losses numbering a least 1,000.

It first announced its decision to shut making cars in Australia in late 2013. Much was said back then about the impact on the economy.

Real estate being a being part of the Australian economy, Property Observer looked up for change in property prices in Elizabeth, site of Holden's plant, from around the time the decision was first announced and found there was no major impact on values. In fact, both house and unit prices have grown in value from 2013 to October 2016, according to CoreLogic RP Data.

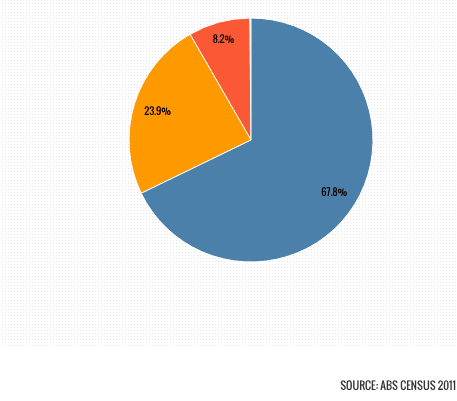

The population in the area was 18,672 people, according to ABS Census 2011 data. The dwelling composition in the suburb was 67.8 percent houses, 8.2 percent units/apartments, while the rest comprised semi-detached homes or townhouses.

The median house price in Elizabeth (postcode 5112) in October 2016 was $226,000 with an annual average growth of 5.07 percent and three-year growth of 10.24 percent, according to CoreLogic data as at October 2016. There were 19 properties sold, data shows.

The weekly median rent was $250 per week, with a gross rental yield of 5.75 percent, data shows.

For units, corresponding data was not available. However, according to the suburb profile on www.realestate.com.au, the median unit rent was $201 per week.

Median house prices rose from about $200,000 in 2013, when Holden first announced its closure decision, to about $226,000 (CoreLogic, October 2016).