Leading Index eases back a little: Bill Evans

GUEST OBSERVER

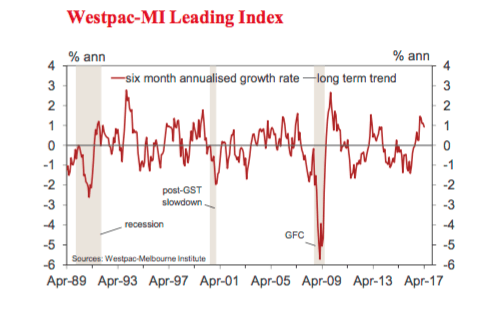

The six month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, fell from 1.11 percent in March to 0.92 percent in April.

This marks the ninth consecutive month where the growth rate in the Index is at or above trend. That followed a period of seventeen consecutive months where the growth rate had been below trend. That sustained period of below trend growth in the series had been pointing to the weakness we saw in the economy in the September quarter (although no lead indicator could have prepared us for a negative growth print).

The resumption of positive growth in the Index in August last year gave us some comfort that the bounce back in growth in the December quarter to 1.1% could have been anticipated.

While the strong bounce back in the December quarter was partly statistical in response to the negative quarter in September the ongoing positive signal from the Index is consistent with solid growth through most of 2017.

In his statement following the Reserve Bank Board meeting on May 2 the Governor noted: “Growth is expected to increase gradually over the next couple of years to a little above 3 percent”.

Recall that it is generally accepted by the market and in official circles that trend growth in the Australian economy is around 2.75 percent so a confident prediction of “a little above 3 percent” would be consistent with the Index remaining clearly positive for an extended period.

The Bank’s current spot forecasts for growth are: 3 percent in 2017; 3.25 percent in 2018 and 2019 (to June).

Westpac concurs with the Bank’s forecast of 3 percent growth through 2017. That is above trend and consistent with the positive leads from the Index over the last nine months.

However we do have concerns for growth beyond 2017. Prospects for 2018 look discouraging. Housing construction is likely to be contracting through 2018 while export growth will slow and the terms of trade are likely to be falling, slowing nominal income growth.

Prospects for an offsetting boost from household spending and business investment are not encouraging given the ongoing negative feedback loop from weak labour incomes to consumption and sales.

The Leading Index growth rate has lifted over the last six months from 0.25 percent in November to 0.92 percent in April. Until recently the key drivers of that improvement had been global factors: rising commodity prices and the steepening of the yield curve.

In April both of these components slowed with the change in the 6 month contribution being -0.19 percentage points for commodity prices and -0.05 percentage points for the yield curve (which has recently been flattening).

However, other international factors are still supportive of the Index – US industrial production has contributed 0.33 percentage points to the increase in the Index while ASX200 has contributed 0.29 percentage points.

On the domestic front dwelling approvals have contributed 0.19 percentage points; the Westpac-MI Unemployment Expectations Index 0.11 percentage points; and Westpac-MI Consumer Sentiment Expectations Index 0.06 percentage points.

The only ‘domestic’ component dragging on the Index is “aggregate monthly hours worked” which reduced the index growth rate by 0.08 percentage points between November and April.

The Reserve Bank Board next meets on June 6. Policy is firmly on hold as the Bank assesses developments particularly in housing and labour markets.

As discussed, the Governor expects a period of sustained above trend growth over the course of 2018 and 2019.

“That view would be broadly consistent with markets which continue to expect the Reserve Bank to be raising rates next year (although the strength of this conviction does vary over time). Consistent with the Leading Index we do concur with the Bank’s forecast for 3 percent growth in 2017 but expect a slowdown next year.

Such a development would eliminate any ‘pressure’ to raise rates next year – we continue to expect rates to be on hold in 2018.

BILL EVANS is chief economist of Westpac.