Investor lending dominates borrowings: CommSec's Savanth Sebastian

GUEST OBSERVER

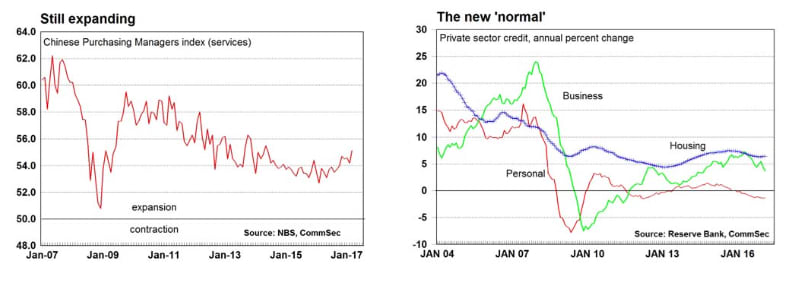

Private sector credit rose by 0.3 percent in February after a 0.2 percent gain in January. Annual credit growth of 5.0 percent is near 3-year lows.

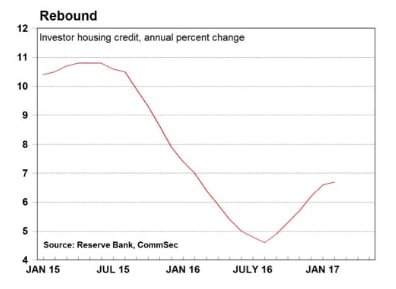

Investor housing: Investor housing finance lifted by 0.6 per cent in February to stand 6.7 per cent higher over the year – the fastest growth in 12 months.

China data: The National Bureau of Statistics manufacturing purchasing managers’ index rose from 51.6 to 51.8 in March while the services gauge rose from 54.2 to 55.1 – a near 3-year high.

What does it all mean?

The latest lending (private sector credit) figures suggest a subdued borrowing environment. But it is important to point out that lending recorded the biggest lift in 15 months in December and only partially gave back some of that out-sized growth over January and February. The subdued February reading was largely due to a modest slide in business credit which would be expected given the out-sized gain in December. The key will be how business borrowing performs in coming months.

Interestingly home lending continues to lift, dominated by investor credit growth. In fact annual growth in investor finance is now at a 12-month high. The measures taken over the last couple of year by regulators to curb investment lending had a temporary impact that has faded. And as such it is no surprise that the regulators have today looked at other avenues to tighten lending standards.

The measures announced by APRA today are designed to keep modest pressure on the brakes of investor home lending rather than represent a slamming on the brakes. Annual growth of investor lending still remains comfortably below the 10 per cent annual growth limit although new lending has been lifting in recent months. Anecdotally the lift in interest rates on investor housing loans is already acting to slow interest in home buying.

The stronger Chinese manufacturing and services data bodes well for the broader global economy. And given the strong trade links between Australia and China, policymakers would be encouraged by a strengthening Chinese economy.

No doubt policymakers will continue to discuss key issues like housing affordability, but overall the central bank seems upbeat on the medium-term outlook for the Australian economy. CommSec expects no change to interest rates over the rest of 2017.

What do the figures show?

Private sector credit

Private sector credit (lending) rose by 0.3 per cent in February after a 0.2 per cent gain in January. Annual credit growth eased from 5.4 per cent to a near 3-year low of 5.0 per cent.

Housing credit grew by 0.6 per cent in February to be up 6.4 per cent on a year ago – annual growth is lifting of the lowest levels in 30 months.

Owner occupier housing credit rose by 0.5 per cent in February to stand 6.2 per cent higher than a year ago – the slowest growth in 17 months. Investor housing finance lifted 0.6 per cent in February to stand 6.7 per cent higher over the year – the fastest growth in 12 months.

Personal credit fell by 0.1 per cent in February to be down 1.3 per cent over the year – just up from the 1.4 per cent annual decline in January, which was the biggest annual decline in 41⁄2 years.

Business credit fell by 0.1 per cent in February after a 0.4 per cent fall in January and 1.1 per cent rise in December. Business credit is 3.7 per cent higher than a year ago – slowest growth in 21⁄2 years. What is the importance of the economic data?

Private sector credit figures are released by the Reserve Bank on the last working day of the month. Credit is separated into three categories – housing, other personal and business. Private sector credit is effectively the amount of loans outstanding in the economy. If growth in lending is strong then it suggests that credit from financial institutions is freely available, underlying demand for assets such as cars and houses is firm and that the price of credit (interest rates) is attractive.

What are the implications for interest rates and investors?

The Chinese economic data remains encouraging, showing that the transition from the industrial sector to household sector remains on track. The manufacturing sector is expanding, while the services sector is clearly the driver taking up any slack.

Interest rates are super-low but credit growth is slowing rather than rising. Excluding investor housing, demand for loans is modest. Consumers and businesses are still keen to pay down debt rather than take up new credit.

Interest rates will remain on hold over the rest of 2017.

Savanth Sebastian is an economist for CommSec