The three p’s of property are now political, paralysis and persuasion: Robert Simeon

Up until now it’s very clear that federal and state politicians do not want a debate on property markets as they well know that a major overhaul is what’s required – consumers would be much better off and government revenues would be significantly reduced.

This would explain why the last significant taxation review in Australia, happened back in 2000, with the introduction of the goods and services tax (GST).

In 2008, the then Rudd Government commissioned the Henry Tax Review which was then published in 2010 – this was supposed to be Australia’s tax system reforms for the next ten to twenty years. Sadly, this review was binned and never saw the light of day as it threatened the longevity of a politician’s career. More recently, Ken Henry had another attempt to shed light on Australia’s housing affordability woes – the recommendations were immediately muted.

In December 2016, the Turnbull government completed its 20-month inquiry into home ownership in Australia. The conclusion was that Australia had no structural problem with housing affordability! This would have to be the most embarrassing finding over the last decade of Australian politics.

Australia urgently needs a property inquiry that does not include politicians or banks – this must be independent with the findings released six months before the next federal election. Then constituents can decide who they will vote for based on these findings, and the logical person to head this is Ken Henry, although our elected politicians would cringe at such a thought.

The Turnbull Government sixteen months ago agreed to implement many of the findings from the Murray recommendations relating to bank competition – to this day the legislation has been ignored despite publicly agreeing to act. Much like the Turnbull Government announcing that the Productivity Commission would formally investigate an inquiry into bank competition- this too, has mysteriously disappeared.

Treasurer Scott Morrison indicated this week that the government was working on a housing affordability package in the May federal budget although he has effectively ruled out most of the solutions available that must be included.

Australia’s big banks testified at a parliamentary inquiry into banking this week and all found to much amazement that Australia’s property prices aren’t over-inflated. Of course, they are going to say that because if they said they hold grave fears (which they all do) then there would be a huge sell-off of their respective shares. Like just what are these inquiries supposed to achieve? Maybe a lie detector would be an intelligent start – where this graph has the banks not remotely concerned.

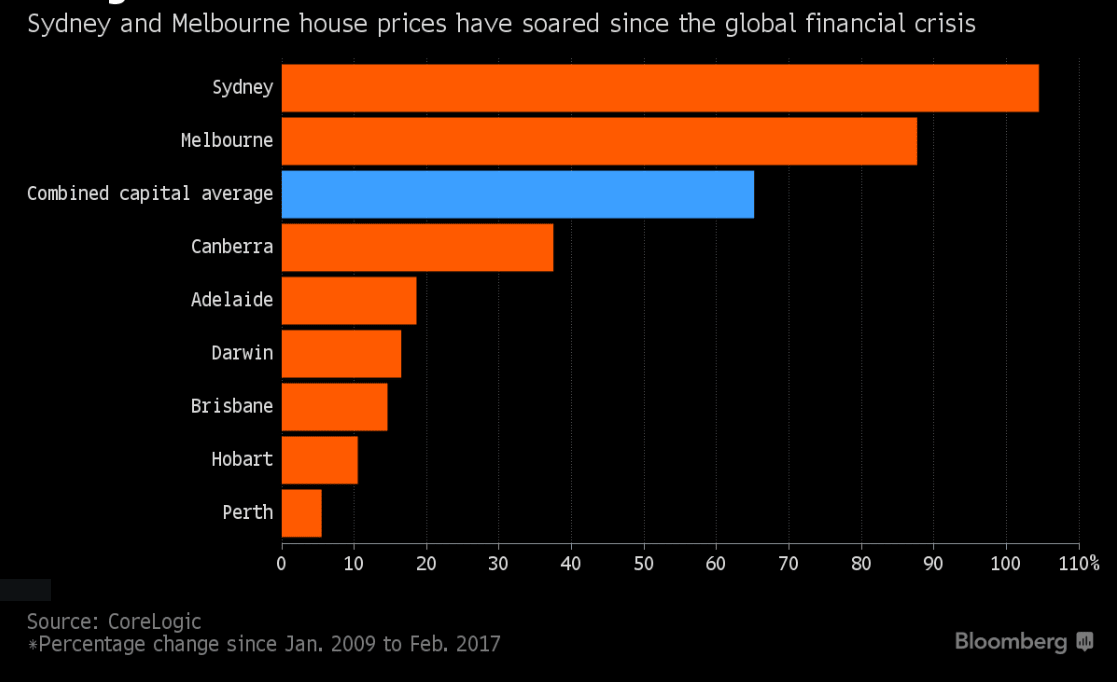

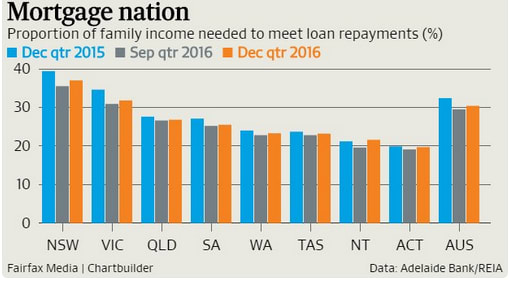

Again the Reserve Bank of Australia (RBA) left the cash rate at 1.50 per cent which takes me to a topic that I have written about – why does Australia have a one fit cash rate that fits all property markets? SGS Economics principal Terry Rawnsley announced that they found if interest rates were presently set for each state and territory that there would be massive variations across Australia. Sydney would currently be at 3.75 per cent, Melbourne would be 3.50 per cent, Adelaide, Brisbane and Hobart at 0.25 per cent and Perth at 0.5 per cent. Why is the RBA not looking at these models? For example, if Sydney was at 3.75 per cent then the variable rate would be at 7.05 per cent – but we all know that this would not be good for the economy and the government’s economic standing in the global economy. I can tell you one thing, if Sydney had a variable rate of 7.05 per cent clearance rates would be half of where they sit today.

These are just a few of the discussions we should be having today, although a fair and true representation can only occur when vested and conflicted parties are not involved in the debate. Rather make the findings, and then have the much-overdue debate.

Although Canberra would rather let you know that they are steering Australia to absolute greatness. In less than a month, April 1 (and this is not an April Fool’s joke) Australia will lay claim and become the titleholder for the longest economic expansion ever recorded before once it posts our 104th quarter of economic growth.

Yep – there is a valid argument why Australia must not have any economic reform and this would explain why economic paralysis has spread so fast and wide in Canberra. They will also tell you this planning and research has enabled Sydney to post the strongest annual growth in house prices since 2003.

My-bad, I am obviously barking up the wrong tree.

ROBERT SIMEON is a director of Richardson Wrench Mosman and Neutral Bay and has been selling residential real estate in Sydney since 1985.

He has also been writing real estate blog Virtual Realty News since 2000.