The outlook for non-mining business investment

GUEST OBSERVER

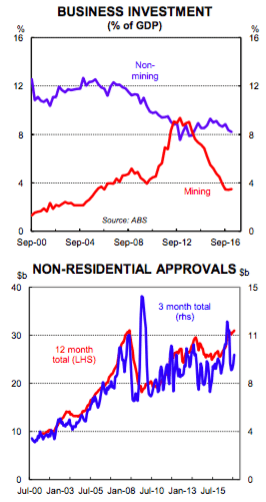

After showing some tentative signs of lifting, non-mining business investment has dropped back again as a share of GDP.

The capex survey and non-residential approvals data signal only a modest lift non-mining investment this year.

However there are some more positive signs for business investment.

These include high levels of business conditions and confidence, rising capacity utilisation and a lift in company profits.

The strong pipeline of infrastructure spending and the revival in the manufacturing sector are also supportive of stronger investment.

Non-mining business investment remains the missing ingredient in the successful transition from mining to non-mining led growth. A pick up in non-mining business investment would be a welcome driver of growth in the short-term. It also boosts productivity in the medium to long-term, which is essential for maintaining growth in the face of an ageing population and a potentially slower population growth rate.

Mining sector investment seems to have stabilised for now. However non-mining business investment is yet to show a meaningful lift. In fact, as a share of GDP, 8 non-mining business investment has fallen back close to the recent lows in late 2013. This is despite record low interest rates and a relatively stable, and lower, Australian dollar.

In the past we have discussed some of the reasons for weak non- mining business investment (see here). These included unrealistic hurdle rates and slower growth in consumer spending which has dampened business’ expectations of future demand. Many of these factors are still relevant.

In this note, we take a fresh look at what the forward indicators of business investment are telling us. We find that the “hard” data such as non-residential approvals and capex spending intentions point to only a very modest increase in business investment in the year ahead. However the background conditions for business investment have improved. In particular there has been a strong lift in business conditions and confidence and a lift in capacity utilisation. Other positives for business investment include the revival in the manufacturing sector.

And also 208 the big lift in public infrastructure spending underway. The note concludes with our outlook for non-mining business investment in the years ahead.

Non-residential building approvals: Non-residential building is one component of business investment. The approvals data tells us the amount of building activity that is likely to enter the pipeline. This data suggests that there should be some pick-up in non-residential building activity this year due to a large spike in approvals in September 2016.

The lift in approvals was in the retail, entertainment, recreation & accommodation, and office sectors. However since the spike, approvals have been running broadly in line with their average of recent years. So we need to see a further pick up in the approvals data in order to see this component of business investment lift meaningfully.

Capex survey: The ABS capital expenditure survey includes business’ estimates of new capital expenditure. And the results are not encouraging. Early estimates for spending plans can vary significantly from actual spending. However at this stage, based on the historical relationship between estimates and actual spending, it looks as if non-mining capex spending for the 2017/18 financial year will be similar to 2016/17 (see here).

However it is possible that these estimates could be revised sharply upwards (or downwards) if the economic landscape changes. Another caveat is that the capex survey also excludes some sectors including health, education and agriculture. Investment in health and education tends to be structural rather than cyclical and demographic factors suggest that it should remain firm.

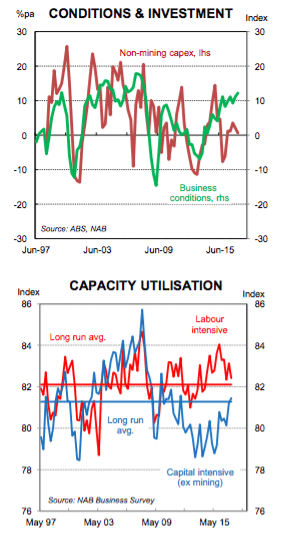

Business conditions and confidence: Survey measures of business conditions and confidence have generally been on an upward trend for several years now. Business conditions are at their highest level since the GFC. Business confidence is the highest since 2010. Both are well above long run averages

Business conditions are buoyant for most industries, with the exception of retail and more recently construction. Conditions are have improved in most States. The exception is the mining State of WA where conditions remain very weak.

Capacity utilisation: Capacity utilisation is rising. However it is important to consider in which industries it is rising as some businesses are more capital intensive than others. Research from the RBA finds that goods-related industries plus transport tend to be more capital intensive than services-related industries. So high levels of capital utilisation in the goods plus transport industries are more likely to result in additions to capital stock. Whereas for services industries, high capacity utilisation more often prompts additional labour hire.

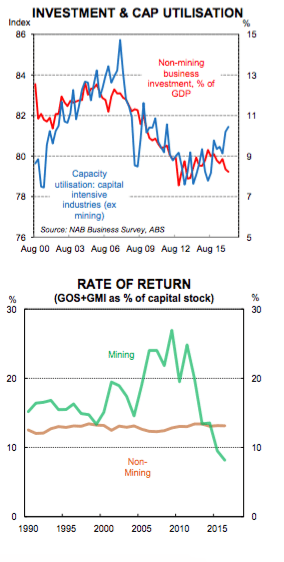

Capacity utilisation has trended higher in recent years for these more capital intensive industries and is now around its long run average. This has historically been consistent with a higher level of non-mining business investment than is the case now.

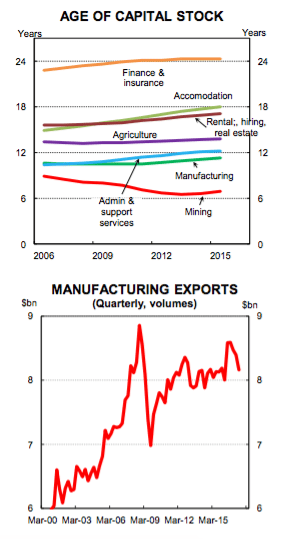

The capital stock has also aged which provides further impetus for new investment. However while business hurdle rates are still high we may need to see capacity utilisation rise to high levels before businesses are willing to investment in more capital.

Return on investment/Tobin’s Q: In addition to demand conditions, the expected rate of return on investment is also an important determinant for business investment. On that score there appears to be plenty of scope to increase non-mining business investment.

The rate of return on the non-mining capital stock is running around 12% and well above most business borrowing rates. However unrealistic hurdle rates are preventing businesses from undertaking some profitable investments.

Also, according to Tobin’s Q theory of investment, growth in non-mining business investment should also be higher than current rates. Tobin’s Q measures the market value of capital relative to its book value. A ratio greater than one suggests that companies should invest more in capital because it is valued more than its replacement cost. Tobin’s Q is hard to measure in practice. But our proxy shows the Q ratio has been on an upward trend since early 2009 and is now well above one.

Revival in the manufacturing sector: There is somewhat of a revival going on in the manufacturing sector (see here). Employment in manufacturing has picked up. Exports have risen too and are not too far below their pre-GFC levels.

A lower and relatively stable Australian dollar in recent years has helped. RBA research shows that a 10% depreciation in the real exchange rate will boost manufacturing exports by more than 15% three years later. The lift in infrastructure spending has also contributed, lifting demand for building materials, metals and transport equipment.

These stronger conditions have seen manufacturing capital expenditure lift 12% over the two quarters to Q1 2017. Although according to the capex survey estimates of future capex spending are still subdued. They imply roughly a 5% fall in capex spending for 2017/18 compared to 2016/17. But given the lift in conditions in the manufacturing sector we may see an upgrade to intentions as the year goes on.

Positive rural conditions are also pulling out more agricultural capital expenditure. Farm capex spending has picked up with annual growth running at around 13%.

Consumer spending: Current household spending patterns and the outlook for future spending are also important factors to consider when thinking about future business investment. Firms in the RBA’s liaison program have indicated that they are reluctant to commit to a substantial increase in investment until they see a sustained pick up in sales.

Consumer spending growth has been slower on average than before the financial crisis. However spending growth has run ahead of income growth as households have cut their savings ratio. Household debt levels are elevated which means household may be reluctant to cut savings further. We think that we will need to see further improvement in the labour market, particularly a fall in the unemployment and underemployment rates, or a lift in wages growth, to lift growth in spending.

Public infrastructure spending: Increased public infrastructure spending can “crowd in” private business investment. For example, new transport infrastructure can make previously undesirable land, more desirable. This attracts new spending on dwelling construction, which in turn attracts businesses to set up in the these new areas. Private sector businesses also provide inputs into the building of infrastructure so stronger demand can enable these businesses to expand.

Australia is about to go through an infrastructure boom. The State governments have ramped up infrastructure spending. In particular there are many large transport infrastructure projects underway in NSW and Victoria. The Federal government is also planning on a large infrastructure spend. The latest Budget includes $75 billion in transport spending over the next ten years.

Studies by the IMF find that an increase in public infrastructure spending in advanced economies increases private business investment in both the short and long term.1 They find the effects are largest when spending occurs in periods of economic slack and easy monetary policy, when it is invested efficiently, that is where public spending is allocated to projects with high rates of return, and when spending in financed by debt rather than tax increases.

You could argue that Australia meets these conditions. Firstly, interest rates are at record lows and are likely to stay there for some time yet. There is also a degree of economic slack in the economy.

Over the year to Q1 the economy grew at just 1.7%, below our estimates of potential growth of around 23⁄4%. While we expect growth to lift to above potential in 2018, a decent share is coming from net exports due to the ramp up in commodity exports following the earlier surge in mining investment. Gross national expenditure, which excludes net exports, doesn’t look quite as strong.

Secondly, in the 2017/18 Budget the Federal government has committed to provide funding for four of the seven projects considered to be “high priority” by Infrastructure Australia. A further three projects on the “priority” list will also receive some funding. And thirdly, these projects will be funded by debt with the Budget not expected to return to surplus until 2020/21.

Sources of funding: Business lending remains soft. Commercial lending growth is in negative territory. Business credit growth is showing a similar lacklustre picture, with soft monthly growth rates since early 2016. Over the year business credit is up just 3.1%. Weak lending is consistent with lacklustre investment.

Another way companies can fund new capital expenditure is by using profits. After five years of lacklustre growth, non-mining profits have begun to lift and are around 17% higher over the year to the March quarter. The lift in profits has been broad based with seven out of nine non-mining categories posting an increase in profits over the year. Mining sector profits have also surged which has positive flow-on effects for industries that service the mining sector.

So what’s the outlook for non-mining business investment?

At this stage we are expecting only a very modest lift in non-mining business investment over the remainder of 2017. This is consistent with the capex survey of business’ intentions and relatively subdued non-residential approvals data. Weak business lending data also points to subdued investment ahead.

However the background conditions for investment are improving. Business conditions and confidence are high and business balance sheets have improved due to stronger profits. Capacity utilisation has lifted and the capital stock has aged.

Other positives for business investment are improving conditions in the manufacturing sector. The strong pipeline of infrastructure spending may also work to “crowd in” business investment. One significant hand brake on stronger capex spending is the fact that business hurdle rates are high given the low interest rate/low yield environment we are in. As a result we have a moderate pick up in non-mining investment in 2018 in our forecasts.

Kristina Clifton is economist and financial market analyst for CBA and can be contacted here.